AUTOZONE Reports Fourth Quarter Earnings Results for August 31 2023

October 21, 2023

🌥️Earnings Overview

On September 19th 2023, AUTOZONE ($NYSE:AZO) reported its earnings results for the fourth quarter that ended on August 31st 2023. Revenue totaled USD 5690.6 million, showing a 6.4% year-on-year growth. Additionally, net income was USD 864.8 million, which was a 6.8% increase from the same quarter in the previous year.

Price History

The company’s stock opened at $2448.9 and closed at $2475.1, 1.9% lower than its prior closing price of 2522.1. Despite the impressive earnings report, AUTOZONE‘s stock still fell after the announcement as investors were expecting higher profits than what was reported. Going forward, investors will be watching to see if the company can maintain its growth in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Autozone. More…

| Total Revenues | Net Income | Net Margin |

| 17.46k | 2.53k | 14.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Autozone. More…

| Operations | Investing | Financing |

| 3.1k | -648.1 | -3.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Autozone. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.99k | 20.34k | -236.92 |

Key Ratios Snapshot

Some of the financial key ratios for Autozone are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 12.8% | 19.9% |

| FCF Margin | ROE | ROA |

| 13.6% | -50.5% | 13.6% |

Analysis

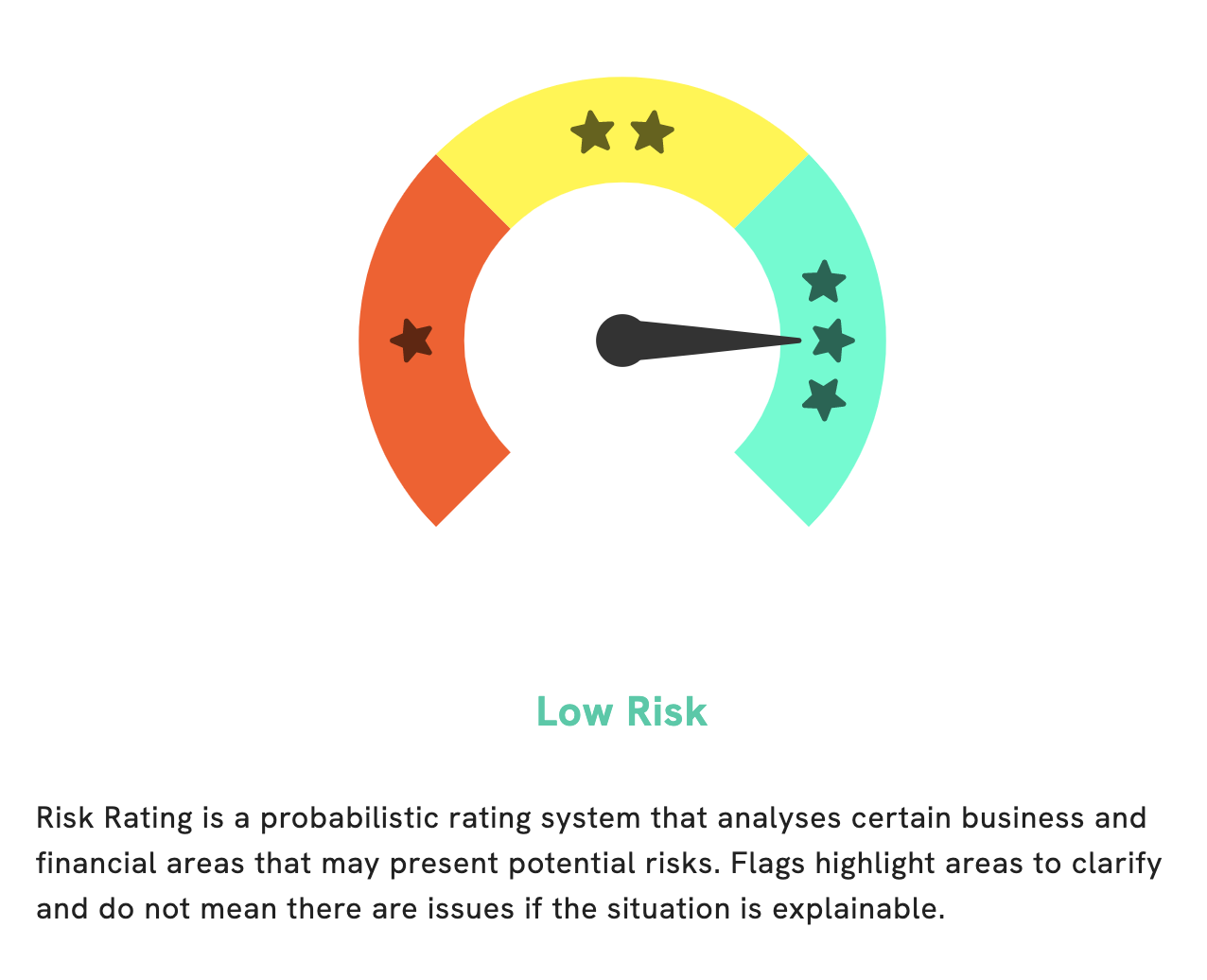

GoodWhale has conducted an analysis of AUTOZONE‘s financials and found it to be a low risk investment in terms of financial and business aspects. This is based on the Risk Rating we provide to all companies in our portfolio. However, we did detect one risk warning in the balance sheet which potential investors should take into consideration when evaluating the company. To gain more insight into this risk warning, feel free to register on goodwhale.com and check out the detailed analysis we provide. More…

Peers

AutoZone Inc. is an American retailer of aftermarket automotive parts and accessories, the largest in the United States. Founded in 1979, AutoZone has over 6,000 stores across the United States, Mexico, and Brazil. The company is based in Memphis, Tennessee.

AutoZone is the leading retailer of aftermarket automotive parts and accessories in the United States. With over 6,000 stores across the United States, Mexico, and Brazil, AutoZone is the go-to destination for all your automotive needs. From oil changes to new tires, AutoZone has everything you need to keep your car running smoothly.

Advance Auto Parts, Inc. is an American automotive aftermarket parts provider that is headquartered in Raleigh, North Carolina. Advance Auto Parts operates in approximately 3,700 stores and 150 Worldpac branches in the United States, Puerto Rico, and the Virgin Islands.

O’Reilly Automotive, Inc. is an American chain of auto parts stores founded in 1957 by the O’Reilly family. It operates more than 5,000 stores in 47 states.

Five Below, Inc. is an American discount store chain selling products that cost up to $5. Among the merchandise sold are toys, games, fashion accessories, bath and body products, candy, snacks, room décor, school supplies, books, and novelty items.

– O’Reilly Automotive Inc ($NASDAQ:ORLY)

O’Reilly Automotive Inc is a publicly traded company with a market cap of 46.99B as of 2022. The company has a Return on Equity of -312.91%. O’Reilly Automotive Inc is a retailer of automotive aftermarket parts, tools, and supplies in the United States. The company operates through four segments: Retail, Commercial, e-Commerce, and Other.

– Five Below Inc ($NASDAQ:FIVE)

Five Below Inc is a publicly traded company with a market capitalization of 7.79 billion as of 2022. The company has a return on equity of 18.02%. Five Below Inc is a specialty retailer that offers a variety of merchandise for teenagers and pre-teens at prices that are “five dollars and below.” The company was founded in 2002 and is headquartered in Philadelphia, Pennsylvania.

– Advance Auto Parts Inc ($NYSE:AAP)

Advance Auto Parts is a leading retailer of automotive parts and accessories in the United States. The company operates over 5,000 stores across the country and employs over 70,000 people. Advance Auto Parts is a publicly traded company on the New York Stock Exchange and has a market capitalization of over $10 billion as of 2021. The company has a strong history of profitability and has a return on equity of over 16%. Advance Auto Parts is a well-run company with a strong balance sheet and a commitment to customer satisfaction. The company is a great choice for investors looking for a stable and profitable business.

Summary

Investors in AUTOZONE can be encouraged by the company’s recently reported earnings results for the fourth quarter of 2023. Total revenue for the quarter increased 6.4% year-over-year, reaching USD 5690.6 million, while net income was up 6.8% from the same period a year ago, with total income of USD 864.8 million. This indicates a strong performance despite challenging economic conditions. With continued investment in new technology and services, AUTOZONE is well positioned to continue delivering positive results and increasing shareholder value.

Recent Posts