AUTODESK Reports Fourth Quarter FY2023 Earnings Results on January 31 2023

March 28, 2023

Earnings Overview

AUTODESK ($NASDAQ:ADSK) reported that for the fourth quarter of the fiscal year ending February 23 2023, total revenue was USD 293.0 million, a year-on-year rise of 228.8%. Net income also rose by 8.8% year-on-year to USD 1318.0 million. The results were released on January 31 2023.

Transcripts Simplified

Autodesk‘s fourth quarter and full-year results were strong. Overall, demand in Quarter 4 remained consistent with Quarter 3. The transition from up-front to annual billings for multi-year contracts, and a large renewal cohort, provided a tailwind to billings and free cash flow. Total revenue grew 9% as reported and 12% in constant currency, with subscription revenue growing by 11%. Billings increased 28%, and total deferred revenue grew 21%.

Non-GAAP gross margin remained at 92%, and non-GAAP operating margin increased by 1%. GAAP operating margin increased by 9 percentage points. Autodesk delivered a record free cash flow in the quarter and for the full year of more than $900 million and $2 billion respectively. Autodesk continues to actively manage capital within their framework.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Autodesk. More…

| Total Revenues | Net Income | Net Margin |

| 5k | 823 | 16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Autodesk. More…

| Operations | Investing | Financing |

| 2.07k | -143 | -1.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Autodesk. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.44k | 8.29k | 5.33 |

Key Ratios Snapshot

Some of the financial key ratios for Autodesk are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 42.3% | 20.3% |

| FCF Margin | ROE | ROA |

| 40.5% | 62.0% | 6.7% |

Price History

On Thursday, January 31, 2023, AUTODESK reported its fourth quarter FY2023 earnings results. Its stock opened at $218.1 and closed at $221.2, up 2.1% from its previous closing price of $216.7. The company’s CEO, Andrew Anagnost, commented on the results saying, “We are pleased to report our fourth consecutive quarter of double-digit revenue growth and highest-ever quarterly operating income. The strong financial results from the fourth quarter of FY2023 demonstrate the strength of AUTODESK’s business model and its ability to continue to produce strong financial results despite market volatility. Live Quote…

Analysis

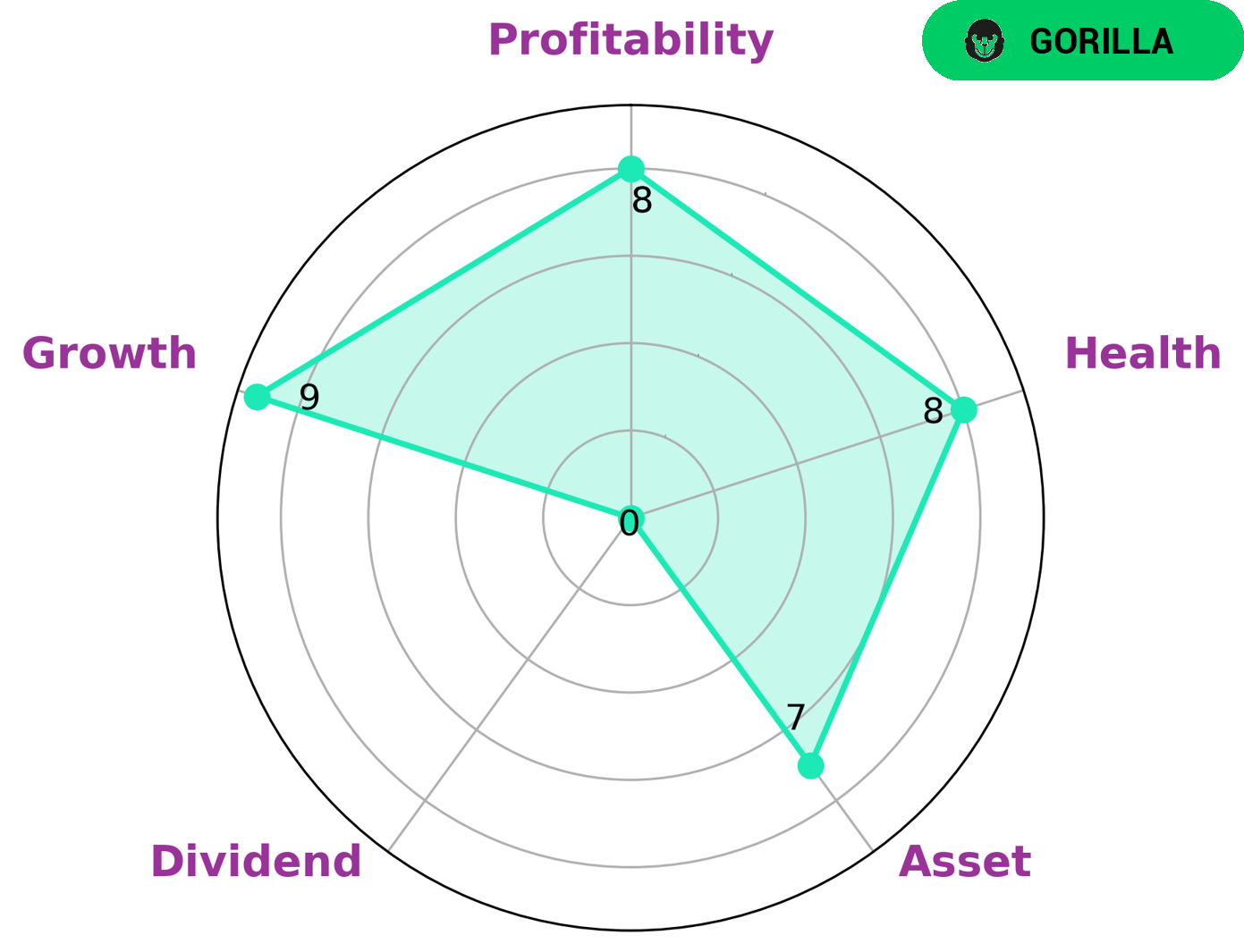

As part of our analysis of AUTODESK’s finances, we created a Star Chart to illustrate how the company is doing in terms of asset, growth, profitability, and dividend. The Star Chart shows that AUTODESK is strong in asset, growth, and profitability, and weak in dividend. We classified AUTODESK as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given its profile, we can assume that AUTODESK would be an attractive option for value investors, who are looking for companies with strong fundamentals and strong pricing power. We can also assume that long-term investors would be interested in AUTODESK because of its strong track record of performance. Furthermore, AUTODESK has a high health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

In the world of architectural and engineering design software, Autodesk Inc. is a giant. Its main competitors are Beijing YJK Building Software Co Ltd, Nemetschek SE, and ZUKEN Inc. All three companies offer similar products and services, but Autodesk Inc. has the lion’s share of the market.

– Beijing YJK Building Software Co Ltd ($SZSE:300935)

Beijing YJK Building Software Co Ltd is a leading provider of enterprise software solutions in China. The company offers a comprehensive suite of products and services that enable organizations to streamline their operations, improve their productivity, and reduce their costs. Beijing YJK Building Software Co Ltd has a market cap of 2.21B as of 2022, a Return on Equity of 2.61%. The company’s products and services are used by a wide range of industries, including manufacturing, construction, healthcare, education, and government. Beijing YJK Building Software Co Ltd has a strong focus on innovation and R&D, and has a number of patents and intellectual property rights. The company’s products are distributed through a network of resellers and distributors in China and around the world.

– Nemetschek SE ($LTS:0FDT)

Nemetschek SE is a holding company for a group of companies that develop software solutions for the AEC industry. The company operates in two segments, Architecture, Engineering, and Construction (AEC) and Media & Entertainment (M&E). The AEC segment provides software solutions for the design, construction, and operation of buildings and infrastructure. The M&E segment provides software solutions for the creation, distribution, and monetization of digital content.

Nemetschek SE has a market cap of 5.53B as of 2022 and a Return on Equity of 22.14%. The company’s strong market position and financial performance are due to its diversified portfolio of software products and solutions, which cater to the needs of the AEC and M&E industries.

– ZUKEN Inc ($TSE:6947)

Mitsubishi UFJ Financial Group, Inc. (MUFG) is one of the largest banks in the world with total assets of over $2.5 trillion. MUFG has a long history dating back to the Meiji period in Japan and is currently one of the leading banks in Asia. The company offers a wide range of financial services including retail banking, corporate banking, investment banking, and asset management. MUFG has a strong presence in Japan with over 3,000 branches and a market share of around 20%. The company also has a significant international presence with operations in over 50 countries.

Summary

AUTODESK had a strong fourth quarter of FY2023, with total revenue up 228.8% year-over-year to USD 293.0 million. Net income also saw a year-over-year increase of 8.8%, reaching USD 1318.0 million. This indicates that AUTODESK is experiencing strong growth and is well-positioned to continue expanding into the future. Investors can benefit from this high-growth stock, as it is poised for further success in the upcoming fiscal year.

Recent Posts