ASE TECHNOLOGY HOLDING Reports Q4 FY2022 Financial Results on February 9 2023.

February 24, 2023

Earnings Overview

On February 9, 2023, ASE TECHNOLOGY HOLDING ($TWSE:3711) reported its financial results for the fourth quarter of FY2022, which ended December 31, 2022. Revenue totaled TWD 15.7 billion, a year-over-year decrease of 49.1%. In contrast, net income was TWD 177.4 billion, representing a 2.6% rise over the prior year.

Market Price

On Thursday, February 9, 2023, ASE TECHNOLOGY HOLDING announced their fourth quarter financials for the fiscal year 2022. The company reported Continued Revenue Growth, Strong Profitability Improvements, and Healthy Cash Flow levels. This growth was attributed to both revenue growth and cost containment measures which led to the company achieving higher operational efficiency. This increase is due in part to the company paying down debt over the course of the year while also increasing cash flow from its operations.

Overall, ASE TECHNOLOGY HOLDING reported solid financial results for its fourth quarter of 2022 and is continuing to demonstrate financial strength through organic growth and improved profitability measures. This strong performance is expected to continue in the coming year and beyond as the company continues its growth trajectory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ase Technology Holding. More…

| Total Revenues | Net Income | Net Margin |

| 670.87k | 62.09k | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ase Technology Holding. More…

| Operations | Investing | Financing |

| 110.98k | -73.95k | -62.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ase Technology Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 707.07k | 387.14k | 70.22 |

Key Ratios Snapshot

Some of the financial key ratios for Ase Technology Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.5% | 48.3% | 12.7% |

| FCF Margin | ROE | ROA |

| 5.8% | 18.0% | 7.5% |

Analysis

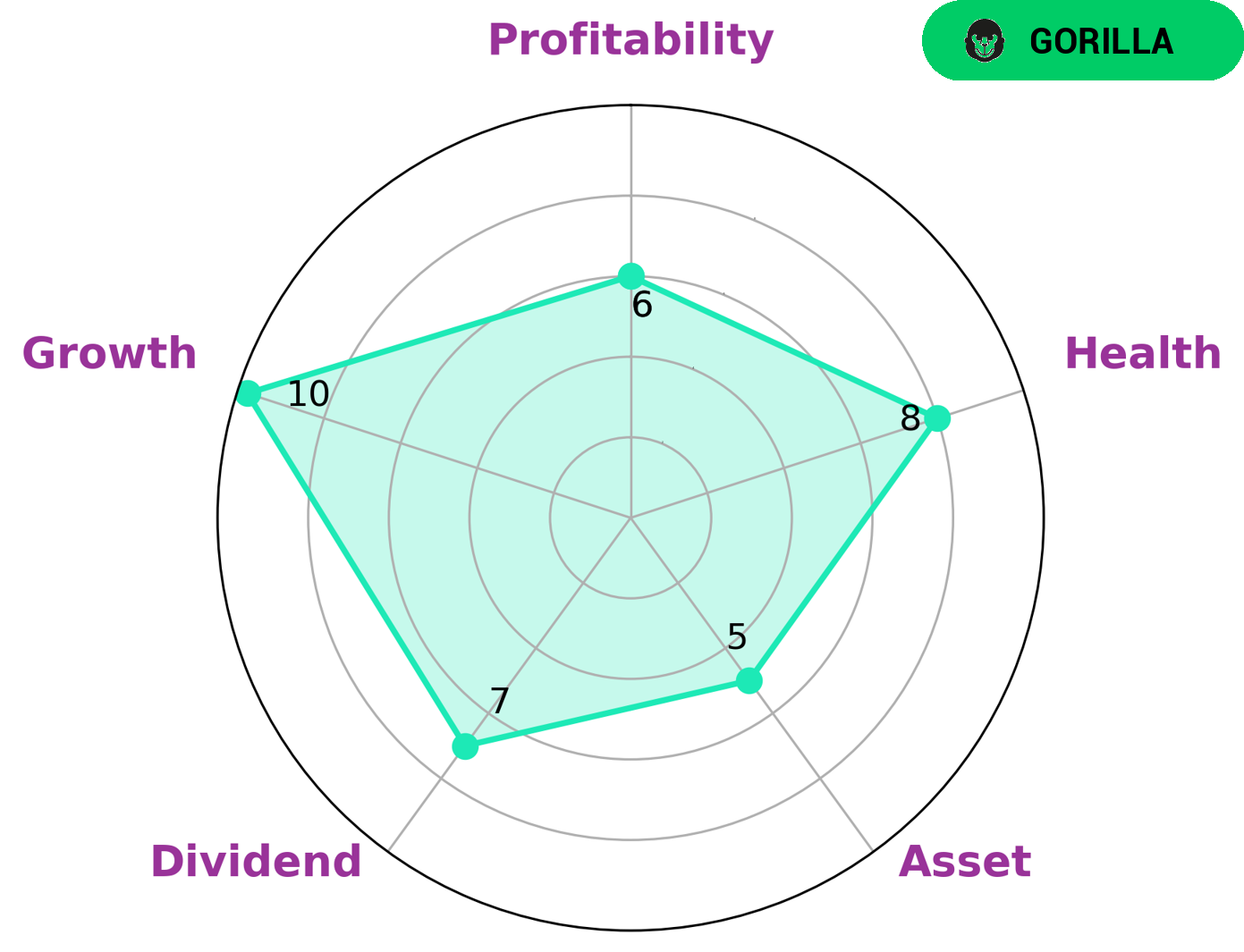

At GoodWhale, we conducted a thorough analysis on ASE TECHNOLOGY HOLDING’s fundamentals and categorized the company as a ‘gorilla’. Such companies typically have strong competitive advantages that allow them to consistently achieve stable and high revenue or earnings growth. From our analysis, ASE TECHNOLOGY HOLDING is strong in dividend, growth, and medium in asset and profitability, making them an attractive investment option for a wide range of investors. We also found that ASE TECHNOLOGY HOLDING has an excellent health score of 8/10 with regard to cashflows and debt, indicating that the company is in good financial health and will be able to sustain future operations in times of crisis. More…

Peers

Its major competitors include Forehope Electronic (Ningbo) Co Ltd, Micro Silicon Electronics Co Ltd, and Amkor Technology Inc. All four companies specialize in providing sophisticated semiconductor assembly and test services to the semiconductor industry, making them formidable competitors in the market.

– Forehope Electronic (Ningbo) Co Ltd ($SHSE:688362)

Forehope Electronic (Ningbo) Co Ltd is a Chinese electronics manufacturer that produces and sells products such as printed circuit boards, connectors, antennas, and more. The company has a market cap of 10.23B as of 2023, making it one of the larger players in its industry. Additionally, the company’s return on equity (ROE) of 17.74% indicates that it is able to generate a healthy return from its investments. This is an indication of the company’s financial health and its ability to generate value for its shareholders.

– Micro Silicon Electronics Co Ltd ($TPEX:8162)

Micro Silicon Electronics Co Ltd is a technology company that specializes in semiconductor and integrated circuit (IC) production. As of 2023, the company has a market capitalization of 2.3 billion and a Return on Equity of 18.35%, indicating that it has a strong financial performance. The company’s market capitalization is a measure of its overall value and can be used to compare it to other companies in the industry. The high ROE shows that the company is able to generate more profits from its shareholders’ invested capital. This suggests that the company has good management and a strong competitive advantage.

– Amkor Technology Inc ($NASDAQ:AMKR)

Amkor Technology Inc is a leading global provider of advanced semiconductor packaging and test services. The company has a market capitalization of 6.76 billion dollars as of 2023 and a Return on Equity of 17.69%. This indicates that the company has been doing well and has been able to increase its shareholders’ equity over time. Amkor is known for its advanced packaging solutions, which help its customers develop and produce high-performance, cost-effective semiconductor solutions. The company also offers various testing solutions and services to help ensure the quality and reliability of its customers’ products.

Summary

ASE Technology Holding showed a decrease in total revenue of 49.1% compared to the same period in the previous year. Despite this, reported net income saw a year-over-year increase of 2.6%, suggesting that the company is on track for a profitable future. Analysts suggest investing in ASE Technology Holding as it has shown signs of long-term growth, with a strong focus on profitability. Investors should keep an eye out for any further updates from the company, as strong financial performance in the future could be beneficial.

Recent Posts