ASE TECHNOLOGY HOLDING Reports Fourth Quarter FY2022 Earnings Results on December 31 2022

March 20, 2023

Earnings Overview

ASE TECHNOLOGY HOLDING ($TWSE:3711) reported that the total revenue for the quarter ending February 9 2023 was TWD 15.7 billion, a decrease of 49.1% compared to the same quarter of FY2022. Net income for the fourth quarter of FY2022 increased by 2.6% year-over-year to TWD 177.4 billion.

Market Price

On Thursday, December 31 2022, ASE TECHNOLOGY HOLDING reported its fourth quarter FY2022 earnings results. The company opened the day at NT$104.5, up from its closing price the day before. The release of the financial results drove investor confidence in ASE TECHNOLOGY HOLDING and reflected positively on the company’s performance. This was the third consecutive quarter of double-digit growth in both revenue and net income, and was made possible by strong demand for the company’s semiconductor products and services.

Additionally, ASE TECHNOLOGY HOLDING also announced that it plans to expand its international presence by investing up to NT$2 billion over the next three years. The strong fourth quarter results reflect the success of ASE TECHNOLOGY HOLDING’s strategic initiatives, which have allowed the company to remain competitive in a difficult market environment. With its commitment to innovation and expansion, ASE TECHNOLOGY HOLDING is well positioned to continue driving growth and profitability for FY2023 and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ase Technology Holding. More…

| Total Revenues | Net Income | Net Margin |

| 670.87k | 62.09k | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ase Technology Holding. More…

| Operations | Investing | Financing |

| 110.98k | -73.95k | -62.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ase Technology Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 707.07k | 387.14k | 70.22 |

Key Ratios Snapshot

Some of the financial key ratios for Ase Technology Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.5% | 48.3% | 12.7% |

| FCF Margin | ROE | ROA |

| 5.8% | 18.0% | 7.5% |

Analysis

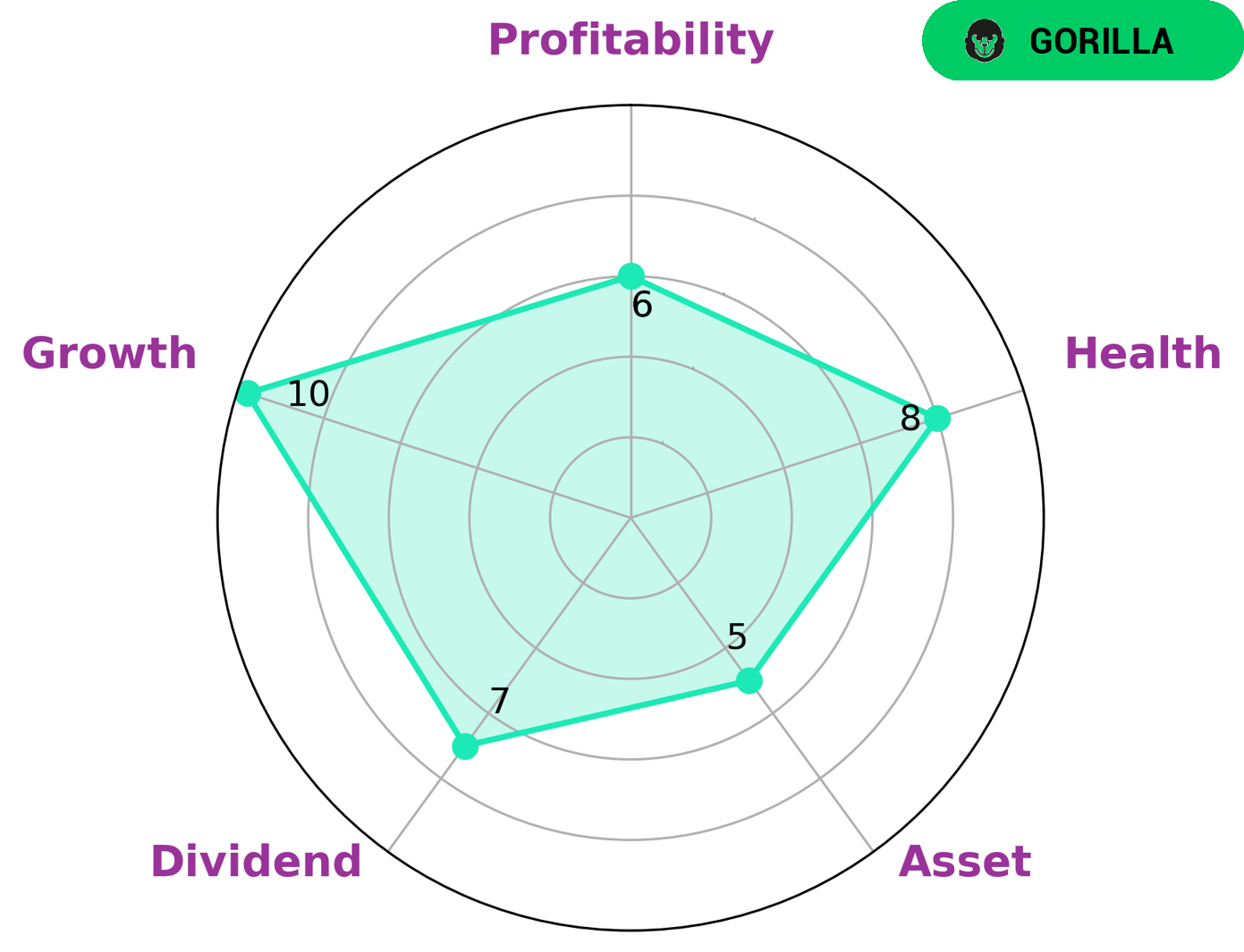

Our Star Chart analysis showed that ASE TECHNOLOGY HOLDING is strong in dividend and growth, and medium in asset and profitability. Moreover, ASE TECHNOLOGY HOLDING has a high health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable of safely riding out any crisis without the risk of bankruptcy. This makes it an attractive investment opportunity for a variety of investors, particularly those interested in long-term growth and stability. More…

Peers

Its major competitors include Forehope Electronic (Ningbo) Co Ltd, Micro Silicon Electronics Co Ltd, and Amkor Technology Inc. All four companies specialize in providing sophisticated semiconductor assembly and test services to the semiconductor industry, making them formidable competitors in the market.

– Forehope Electronic (Ningbo) Co Ltd ($SHSE:688362)

Forehope Electronic (Ningbo) Co Ltd is a Chinese electronics manufacturer that produces and sells products such as printed circuit boards, connectors, antennas, and more. The company has a market cap of 10.23B as of 2023, making it one of the larger players in its industry. Additionally, the company’s return on equity (ROE) of 17.74% indicates that it is able to generate a healthy return from its investments. This is an indication of the company’s financial health and its ability to generate value for its shareholders.

– Micro Silicon Electronics Co Ltd ($TPEX:8162)

Micro Silicon Electronics Co Ltd is a technology company that specializes in semiconductor and integrated circuit (IC) production. As of 2023, the company has a market capitalization of 2.3 billion and a Return on Equity of 18.35%, indicating that it has a strong financial performance. The company’s market capitalization is a measure of its overall value and can be used to compare it to other companies in the industry. The high ROE shows that the company is able to generate more profits from its shareholders’ invested capital. This suggests that the company has good management and a strong competitive advantage.

– Amkor Technology Inc ($NASDAQ:AMKR)

Amkor Technology Inc is a leading global provider of advanced semiconductor packaging and test services. The company has a market capitalization of 6.76 billion dollars as of 2023 and a Return on Equity of 17.69%. This indicates that the company has been doing well and has been able to increase its shareholders’ equity over time. Amkor is known for its advanced packaging solutions, which help its customers develop and produce high-performance, cost-effective semiconductor solutions. The company also offers various testing solutions and services to help ensure the quality and reliability of its customers’ products.

Summary

ASE TECHNOLOGY HOLDING reported their financial results for the fourth quarter of FY2022, ending on February 9 2023. Revenue for the quarter was TWD 15.7 billion, a decrease of 49.1% year over year.

However, net income for the quarter showed an increase of 2.6%, reaching TWD 177.4 billion. This indicates that despite significant revenue losses, the company is still able to manage its costs effectively and generate a positive return on investment. Investors should continue to monitor ASE TECHNOLOGY HOLDING’s financial performance as the company works to recover from the impacts of the pandemic.

Recent Posts