ARROW ELECTRONICS Reports Q2 Earnings of USD 8514.5 Million, Year-over-Year Decrease of 10.0%

August 18, 2023

🌥️Earnings Overview

ARROW ELECTRONICS ($NYSE:ARW)’ FY2023 Q2 earnings results, reported as of June 30 2023, demonstrated total revenue of USD 8514.5 million, a decrease of 10.0% year-on-year. Net income for the quarter was USD 236.6 million, a decrease of 36.1% compared to the prior year.

Analysis

GoodWhale has conducted an analysis of ARROW ELECTRONICS and their fundamentals. After completing the evaluation, GoodWhale has determined that ARROW ELECTRONICS is a high risk investment in terms of financial and business aspects. GoodWhale has identified 3 risk warnings associated with ARROW ELECTRONICS’ income sheet, cashflow statement, and non financial aspects. To gain a comprehensive understanding of ARROW ELECTRONICS’ risk profile, it is highly recommended for prospective investors to become a registered user with GoodWhale so they can review all the risk warnings in detail. By doing so, investors can make an informed decision about whether ARROW ELECTRONICS is the right investment for them. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arrow Electronics. More…

| Total Revenues | Net Income | Net Margin |

| 35.84k | 1.2k | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arrow Electronics. More…

| Operations | Investing | Financing |

| 346.75 | -68.15 | -335.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arrow Electronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.54k | 14.88k | 100.36 |

Key Ratios Snapshot

Some of the financial key ratios for Arrow Electronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | 31.6% | 5.2% |

| FCF Margin | ROE | ROA |

| 0.7% | 20.9% | 5.7% |

Peers

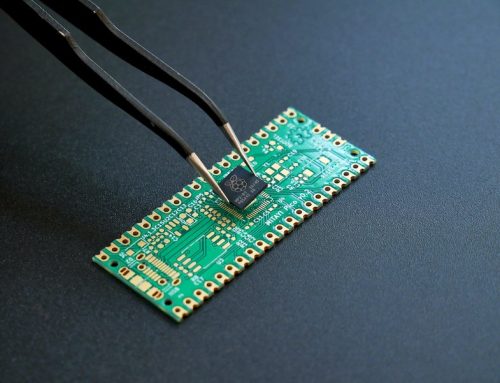

Arrow Electronics Inc is one of the leading global distributors of electronic components and enterprise computing solutions. Its main competitors are Avnet Inc, Samsung Electro-Mechanics Co Ltd, and WPG Holding Co Ltd.

– Avnet Inc ($NASDAQ:AVT)

Avnet Inc is an American technology company headquartered in Phoenix, Arizona. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

As of 2021, Avnet has a market capitalization of $4.14 billion and a return on equity of 16.09%. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

– Samsung Electro-Mechanics Co Ltd ($KOSE:009150)

Samsung Electro-Mechanics Co Ltd is a South Korean electronics company that specializes in the manufacture of electronic components and devices. The company has a market capitalization of 10.31 trillion as of 2022 and a return on equity of 14.53%. Samsung Electro-Mechanics is a subsidiary of the Samsung Group and its products are used in a wide range of electronic devices, including mobile phones, televisions, computers and digital cameras.

– WPG Holding Co Ltd ($TWSE:3702)

WPG Holding Co Ltd is a leading electronics manufacturer and distributor in Greater China. The company has a market cap of $78.92 billion as of 2022 and a return on equity of 14.11%. WPG Holding Co Ltd is a vertically integrated company with a strong presence in the upstream and downstream segments of the electronics manufacturing value chain. The company has a diversified product portfolio that includes semiconductors, passive components, displays, and assembly and test services. WPG Holding Co Ltd is a major supplier to global electronics brands such as Apple, Huawei, and Xiaomi.

Summary

ARROW ELECTRONICS reported their FY2023 Q2 earnings results on June 30 2023, revealing total revenue of USD 8514.5 million, a 10.0% decrease compared to the prior year. Net income for the quarter was USD 236.6 million, a 36.1% decrease from the previous year. This news caused the stock price to drop on the same day, indicating that investors may be cautious about ARROW ELECTRONICS’ outlook in the near future.

Analysts suggest that investors should watch for any signs of improvement, as any positive news could lead to a rebound in the stock price. Furthermore, investors should be aware of any potential risks or challenges facing the company, as these could further impact the stock price.

Recent Posts