APOLLO MEDICAL Reports FY2022 Q4 Earnings Results for December 31 2022 on February 23 2023.

March 28, 2023

Earnings Overview

On February 23 2023, APOLLO MEDICAL ($NASDAQ:AMEH) announced its earnings results for the fourth quarter ending December 31 2022. Total revenue decreased by 118.9% year-over-year to -USD 2.6 million, yet net income increased by 51.3% to USD 292.9 million.

Transcripts Simplified

ApolloMed reported a record total revenue of $1.14 billion for 2022, an increase of 48% from $773.9 million in 2021. This increase was primarily driven by increased capitation revenue from organic membership growth at their core IPAs, a more favorable membership mix, and their participation in a value-based Medicare fee-for-service model. Fee-for-service revenue increased 86% to $49.5 million from $26.6 million in the prior year. Total OpEx increased to over $1 billion in 2022, an increase of 54% from $675.7 million in the prior year. Net income attributable to ApolloMed was $49 million compared to $73.9 million for 2021.

Earnings per share on a diluted basis were $1.08 per share compared to $1.63 per share for the prior year. They reported EBITDA of $110.8 million, an increase of 11% from $99.1 million for the year ended December 31, 2021. Adjusted EBITDA increased 5% to $140 million for 2022 from $133.5 million for 2021.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apollo Medical. More…

| Total Revenues | Net Income | Net Margin |

| 1.14k | 49.05 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apollo Medical. More…

| Operations | Investing | Financing |

| 82.13 | -7.11 | -20.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apollo Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 963.9 | 395.21 | 11.87 |

Key Ratios Snapshot

Some of the financial key ratios for Apollo Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.0% | 44.7% | 8.3% |

| FCF Margin | ROE | ROA |

| 5.2% | 11.1% | 6.1% |

Share Price

On February 23 2023, APOLLO MEDICAL announced its financial results for the quarter ending December 31 2022. This marked the fourth quarter results for the FY2022 fiscal year. On the day of the report, APOLLO MEDICAL stock opened at $33.4, but by the close of the market it had dropped to $32.6, a decrease of 1.5% from the prior closing price of 33.2.

Overall, APOLLO MEDICAL’s results were generally in line with expectations and investor sentiment, although there was some concern over the slight drop in net profit compared to the estimated target. Nevertheless, the company’s solid performance and strong financial position bode well for future growth prospects. Live Quote…

Analysis

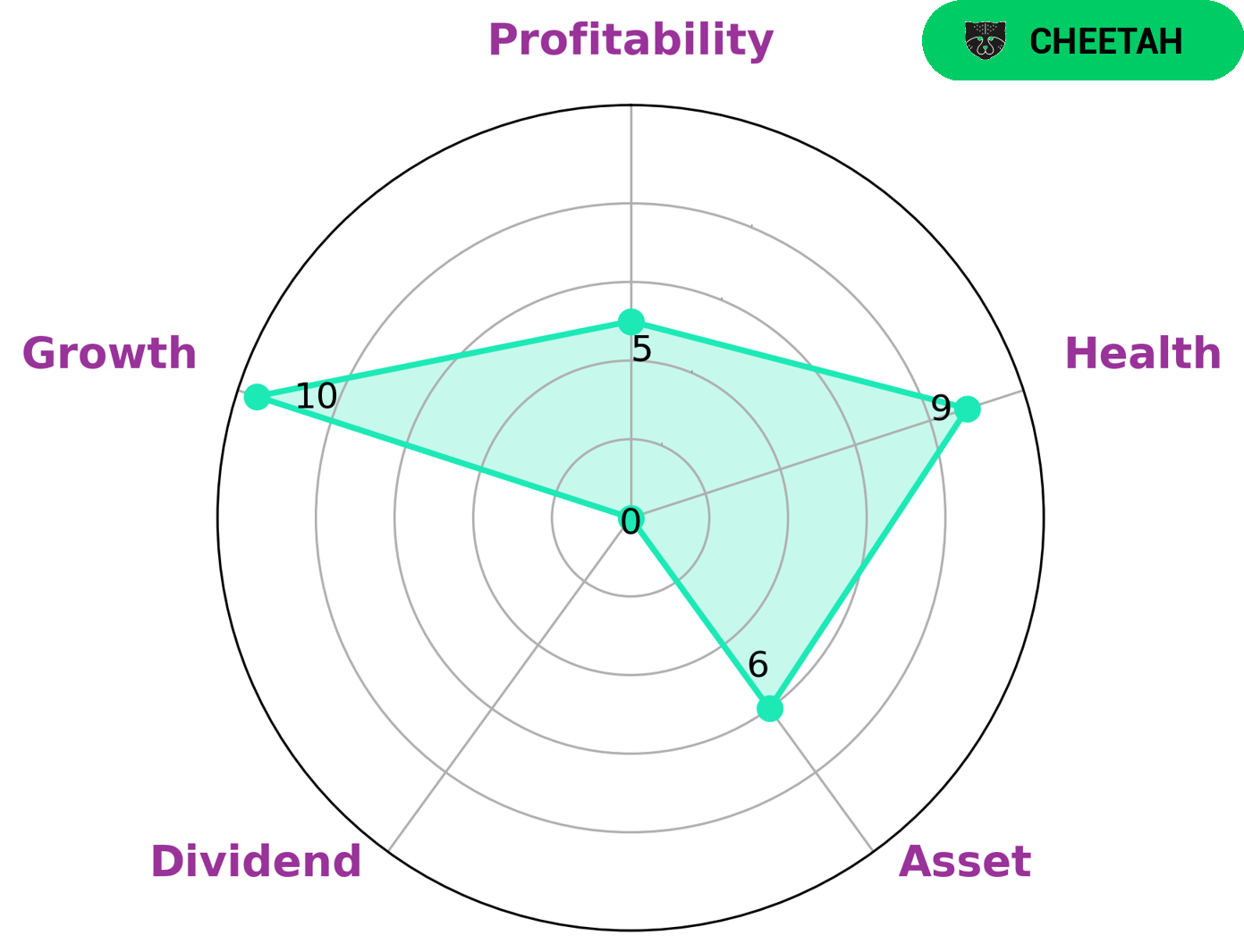

GoodWhale recently conducted an analysis on APOLLO MEDICAL‘s wellbeing. The Star Chart showed that APOLLO MEDICAL had a high health score of 9/10, and is able to safely ride out any crisis without the risk of bankruptcy, considering its cashflows and debt. Additionally, APOLLO MEDICAL is strong in terms of growth, but medium in asset, profitability and dividend. As a result, we classify APOLLO MEDICAL as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors that may be interested in such a company could include those looking for higher growth potential with an associated higher risk. They may be seeking to diversify their portfolio, or to take an opportunity to buy in at an attractive price. Additionally, investors looking for a cheaper option may also be interested in APOLLO MEDICAL’s stock given its current health score. More…

Peers

The healthcare industry is highly competitive, with Apollo Medical Holdings Inc competing against some of the largest companies in the world.

However, Apollo has been able to maintain a strong position in the industry through its innovative products and services. The company has a strong focus on research and development, which has allowed it to bring new and innovative products to market. Additionally, Apollo has a strong marketing and sales force that has helped it to gain market share.

– HealthCare Global Enterprises Ltd ($BSE:539787)

HealthCare Global Enterprises Ltd has a market cap of 41.71B as of 2022, a Return on Equity of 13.62%. The company is a leading provider of healthcare services in India with a network of over 30 hospitals across the country. The company offers a comprehensive range of services including medical and surgical care, diagnostics, and preventive healthcare.

– Cano Health Inc ($NYSE:CANO)

Cano Health Inc is a healthcare services company that operates primary care and specialty care clinics in the United States. The company has a market cap of 828.58M as of 2022 and a Return on Equity of -2.88%. Cano Health Inc provides healthcare services to patients through its network of primary care and specialty care clinics. The company offers a range of services including primary care, specialty care, and behavioral health services. Cano Health Inc also provides pharmacy services and operates a laboratory.

– Dhanvantri Jeevan Rekha Ltd ($BSE:531043)

Dhanvantri Jeevan Rekha Ltd is a publicly traded company with a market cap of 64.14M as of 2022. The company’s Return on Equity is 3.31%. Dhanvantri Jeevan Rekha Ltd is engaged in the business of providing healthcare services in India. The company offers a wide range of services including medical consultation, diagnostics, surgery, and other treatments.

Summary

APOLLO MEDICAL released its FY2022 Q4 earnings results as of December 31 2022, showing a significant decrease in revenue of 118.9%. Despite this, net income increased by a sizeable 51.3%. This is an encouraging sign for investors, indicating that the company is able to remain profitable despite difficult economic conditions.

The results may signal an opportunity to invest in APOLLO MEDICAL, as long-term returns could be bolstered by their ability to remain profitable. Investors should consider diving deeper into the company’s financials and operations to understand the potential risks and benefits associated with investing in the company.

Recent Posts