ANSYS Reports Fourth Quarter Earnings Results for FY2022 on December 31 2022.

March 5, 2023

Earnings report

On December 31 2022, ANSYS ($NASDAQ:ANSS) reported their FY2022 fourth quarter earnings results. The total revenue for the quarter was USD 257.9 million, representing a 27.0% increase from the same period the year prior.

In addition, reported net income for the quarter was USD 694.1 million, a 5.9% growth compared to the same period the previous year. This increase in revenue and net income demonstrates that ANSYS is continuing to strengthen their financial performance this quarter. The impressive increase in revenue and net income highlights ANSYS’s commitment to providing their customers with the most innovative solutions and services. By continuing to expand their offerings and improving existing products, ANSYS has seen successful growth and profitability in the FY2022 fourth quarter. As they continue to build on their success, it’s clear that ANSYS is set to continue providing their customers with the most industry-leading technology.

Stock Price

On December 31, 2022, ANSYS released their fourth quarter financial results for FY2022. ANSYS stock opened on Wednesday at $267.3 and closed at $266.8, which was an increase of 0.4% from the previous closing price of 265.8. The growth was driven primarily by strong customer demand across its product portfolio as well as solid growth in recurring software subscriptions. Overall, the company reported strong fourth quarter and full-year results, signaling continued strong performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ansys. More…

| Total Revenues | Net Income | Net Margin |

| 2.07k | 523.71 | 25.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ansys. More…

| Operations | Investing | Financing |

| 631 | -411.37 | -245.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ansys. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.69k | 1.82k | 55.96 |

Key Ratios Snapshot

Some of the financial key ratios for Ansys are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | 4.8% | 29.0% |

| FCF Margin | ROE | ROA |

| 29.4% | 7.9% | 5.6% |

Analysis

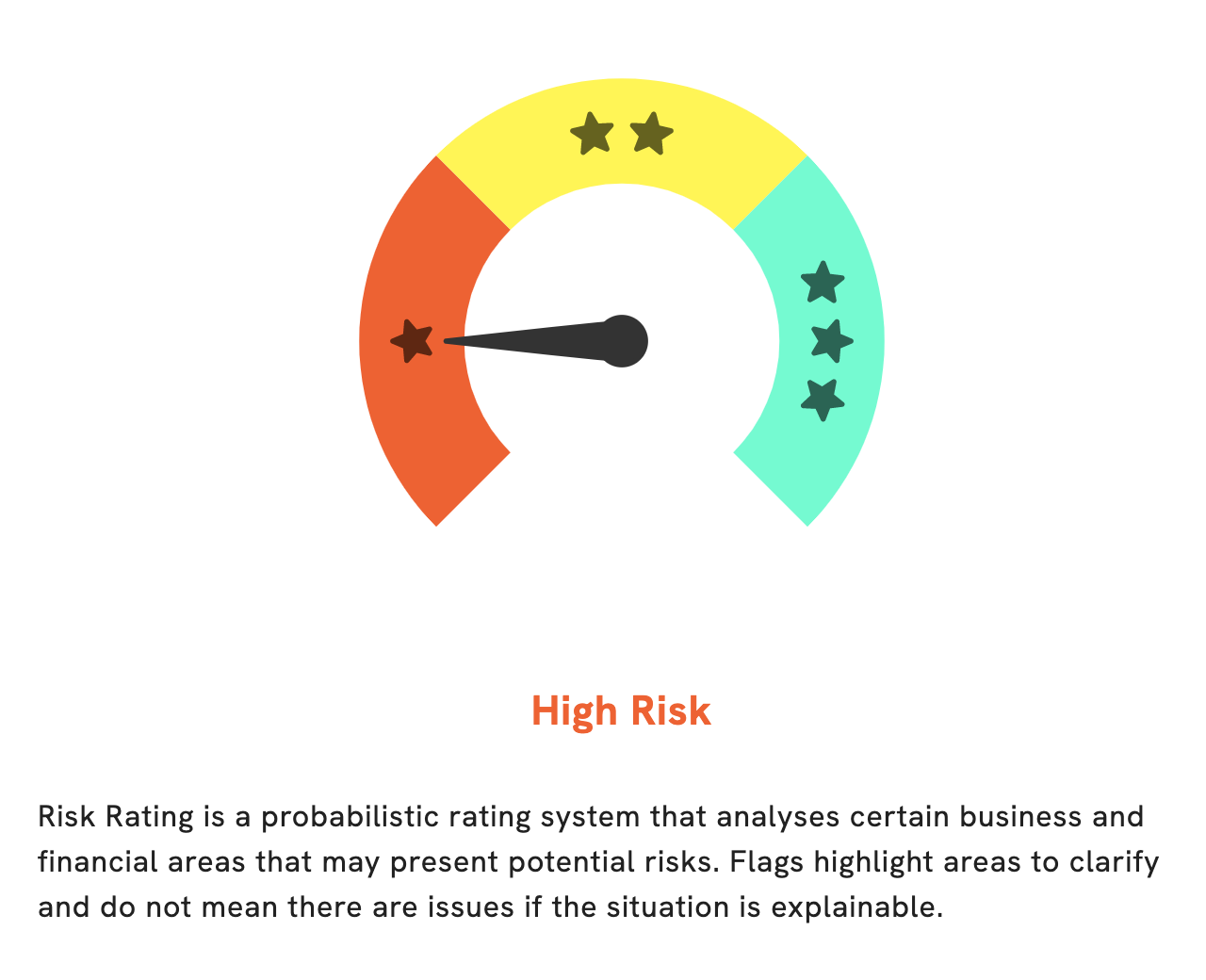

At GoodWhale, we have conducted thorough research into ANSYS‘s fundamentals. After careful analysis, we have determined that ANSYS is a high risk investment from both a financial and business perspective. We have identified three risk warnings in the balance sheet, cashflow statement, and non-financial areas. We take this very seriously and have compiled our findings in a detailed report. To access this report and to become a registered user of GoodWhale, please contact us for more information. Our team is dedicated to helping you make well-informed decisions about your investments and we are committed to providing you with the most accurate analysis of any potential risks associated with ANSYS. More…

Peers

Ansys Inc is a publicly traded company on the Nasdaq Global Select Market under the ticker ANSS. It is headquartered in Canonsburg, Pennsylvania, United States. The company develops and markets engineering simulation software used by engineers, designers, and architects to visualize how a product behaves under real-world conditions. Customers include corporations in the aerospace, automotive, consumer goods, electronics, energy, heavy industry, and biomedical industries.

Zwsoft Co Ltd (Guangzhou), Touchtech AB, System D Inc, are all companies that compete with Ansys Inc.

– Zwsoft Co Ltd (Guangzhou) ($SHSE:688083)

Zwsoft Co Ltd (Guangzhou) has a market cap of 16.94B as of 2022, a Return on Equity of 2.39%. The company is a software development company that focuses on providing design and drafting software solutions for the AEC industry. Its products include ZWCAD, ZW3D, and ZW CAD/CAM.

– Touchtech AB ($LTS:0GIM)

Touchtech AB’s market cap is 3.63M as of 2022. The company has a Return on Equity of -6.31%. Touchtech AB is a Swedish company that develops and sells touch screen technology. The company was founded in 2002 and is headquartered in Stockholm, Sweden.

– System D Inc ($TSE:3804)

System D Inc is a publicly traded company with a market capitalization of $9.15 billion as of 2022. The company’s return on equity is 16.51%. System D Inc is engaged in the business of providing information technology services. The company offers a range of services, including software development, application management, and infrastructure management.

Summary

ANSYS is a global leader in engineering simulation software, offering investors a diverse portfolio of products and services to the manufacturing, science, and technology industries. Its recently reported financial results showed strong revenue and income growth of 27.0% and 5.9%, respectively, over the prior year. Investors are further buoyed by the company’s ability to vertically integrate its services and products into multiple areas of the engineering process, creating a competitive edge in the market. Its strong financial performance, along with its promising outlook, makes ANSYS an attractive investment option.

Recent Posts