Andersons Intrinsic Stock Value – ANDERSONS Reports Positive Third Quarter Earnings for FY2023

November 22, 2023

☀️Earnings Overview

For the third quarter of FY2023, ANDERSONS ($NASDAQ:ANDE) reported total revenues of USD 3635.7 million, a 13.8% decrease from the same quarter in the prior year. Moreover, their reported net income was USD 9.7 million, a 73.6% reduction year over year.

Stock Price

On Tuesday, ANDERSONS reported positive third quarter earnings for the fiscal year of 2023. The company’s stock opened at $53.2 and ended the day at $52.1, a slight drop of 2.5% from the previous closing price of 53.4. Despite the slight decline in stock value, the company’s earnings exceeded expectations. The company reported a significant increase in net sales and a considerable reduction in operating expenses, resulting in a robust bottom line. ANDERSONS have attributed their success to their focus on innovation and cost-cutting measures, which have allowed them to offer their customers competitive prices while still delivering a high-quality product.

In addition, the company has invested heavily in its digital marketing efforts, helping to drive customer engagement and boost sales. Overall, ANDERSONS’ positive third quarter earnings have been a positive surprise to investors and are reflective of the company’s commitment to continued growth and success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Andersons. ANDERSONS_Reports_Positive_Third_Quarter_Earnings_for_FY2023″>More…

| Total Revenues | Net Income | Net Margin |

| 16.21k | 59.03 | 0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Andersons. ANDERSONS_Reports_Positive_Third_Quarter_Earnings_for_FY2023″>More…

| Operations | Investing | Financing |

| 1.14k | -173.08 | -686.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Andersons. ANDERSONS_Reports_Positive_Third_Quarter_Earnings_for_FY2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.59k | 2.14k | 36.76 |

Key Ratios Snapshot

Some of the financial key ratios for Andersons are shown below. ANDERSONS_Reports_Positive_Third_Quarter_Earnings_for_FY2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.0% | 210.8% | 1.0% |

| FCF Margin | ROE | ROA |

| 6.1% | 8.2% | 2.8% |

Analysis – Andersons Intrinsic Stock Value

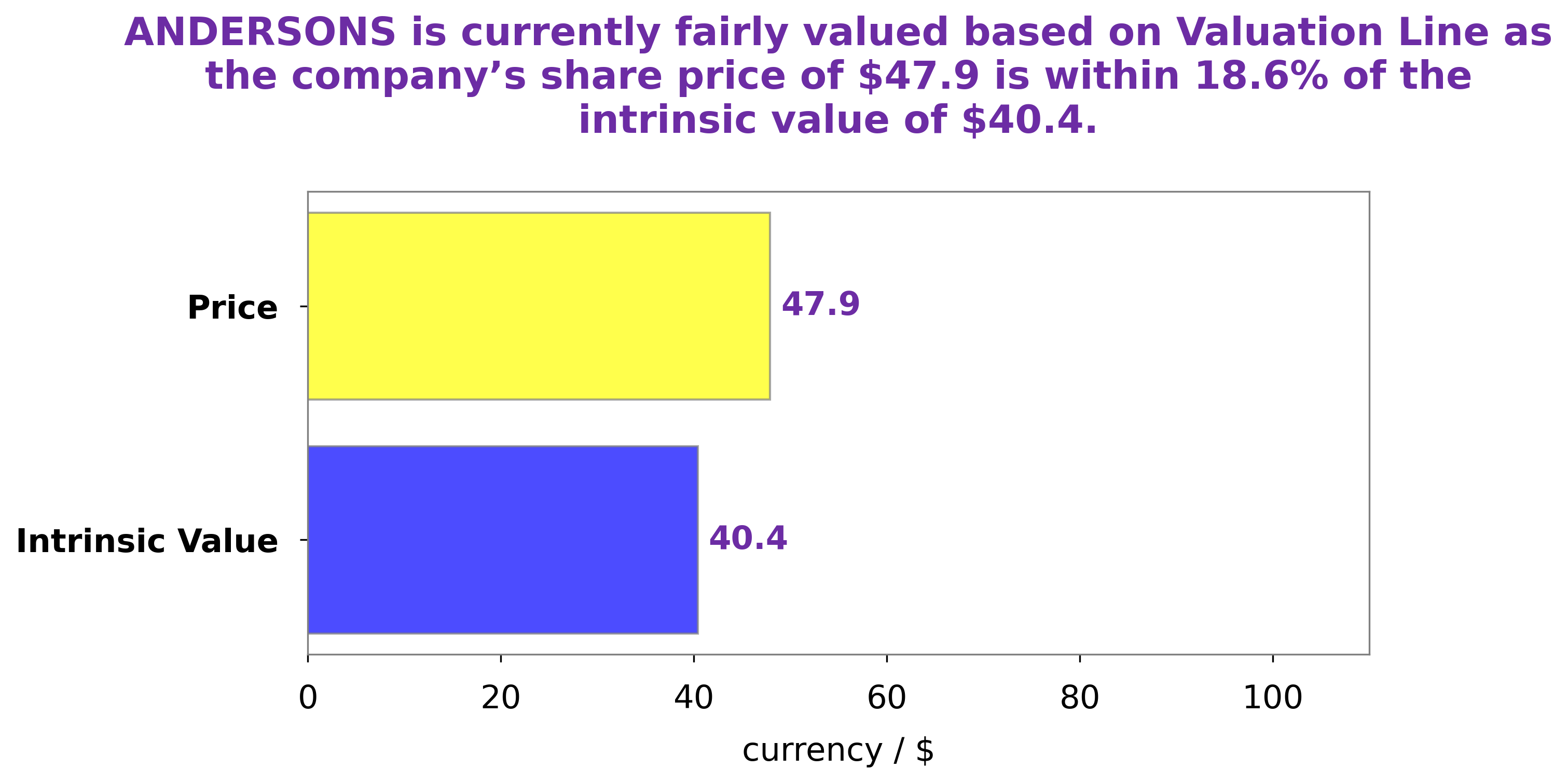

At GoodWhale, we have conducted a thorough analysis of ANDERSONS‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of ANDERSONS share to be around $42.7. However, the stock is currently traded at $52.1, meaning it is overvalued by 22.2%. This offers an opportunity to investors looking to get into the stock. More…

Peers

The supermarket industry is highly competitive, with Andersons Inc. facing tough competition from Atacadao SA, Fix Price Group Ltd, and Rallye SA. All four companies are vying for market share in the highly competitive supermarket industry.

– Atacadao SA ($OTCPK:ATAAY)

Atacadao SA is a Brazilian company that operates as a wholesale distributor of food and non-food products. The company has a market cap of 7.72B as of 2022 and a return on equity of 19.02%. Atacadao SA operates in the food and beverage industry and offers a wide range of products, including groceries, household items, and personal care products. The company has a strong presence in Brazil, with over 1,000 stores in the country.

– Fix Price Group Ltd ($LTS:0K9N)

Rallye SA is a holding company that operates in the retail, distribution, and services sectors in France. The company has a market cap of 137.34M as of 2022 and a Return on Equity of -15.9%. The company’s retail segment operates hypermarkets, supermarkets, and convenience stores. The distribution segment provides logistics and transportation services. The services segment offers customer loyalty programs, insurance, and financing services.

Summary

ANDERSONS has reported a 13.8% decrease in total revenue from the same quarter in the previous year, amounting to USD 3635.7 million. Net income for the third quarter of FY2023 decreased by 73.6% to USD 9.7 million. Investors should consider the impact of this performance on the company’s stock prices before making any decisions.

They should also consider the potential risks and opportunities that may arise from ANDERSONS’ operations, such as changes in industry trends and competitive landscape. Ultimately, investors should determine whether the company’s current financial position and future outlook are suitable for their investment goals.

Recent Posts