Amphenol Corporation Reports Record Earnings with 9.1% Increase in Revenue and 7.0% Increase in Net Income for FY2022

February 2, 2023

Earnings report

Amphenol Corporation ($NYSE:APH) is a leading global provider of interconnect and sensor solutions for a variety of industries, including aerospace, consumer electronics, industrial, and automotive. The company, which is publicly traded on the New York Stock Exchange (NYSE: APH), reported their earnings results for the fourth quarter of FY2022, ending on December 31 2022, on January 25 2023. The results were impressive, with total revenue reaching USD 507.5 million, a 9.1% increase from the year before. This was driven by strong demand for Amphenol’s innovative solutions across each of its key markets. Net income also rose by 7.0% to USD 3239.2 million compared to the year before. Some of the key factors contributing to Amphenol’s strong performance included increased demand for their products in the automotive sector, as well as growth in their industrial and aerospace markets.

Additionally, Amphenol’s focus on expanding its portfolio of innovative products and services enabled it to capture additional market share. Amphenol also benefited from cost-cutting measures implemented throughout the year which allowed them to increase their margins. These record earnings results demonstrate Amphenol Corporation’s strong business model and ability to capitalize on market opportunities. Going forward, Amphenol will continue to focus on expanding its portfolio of products and services, as well as increasing its presence in key markets around the world.

Market Price

On Wednesday, Amphenol Corporation reported record earnings with a 9.1% increase in revenue and 7.0% increase in net income for the fiscal year 2022. The stock opened at $74.9 and closed at $79.4, down by 0.1% from prior closing price of 79.4. Amphenol Corporation is a global leader in the design, manufacture and supply of electronic, electrical and fiber optic connectivity solutions for a wide range of industries including industrial, automotive, broadband, data communication, and consumer electronics. Amphenol’s products are used in a wide range of applications, from aircraft engines to medical devices to industrial automation systems. The company posted record financial results for FY2022 with a 9.1% increase in revenues compared to the prior year, driven by strong performance in its core markets, as well as its strategic investments and acquisitions.

Net income for the period rose 7.0%, driven by higher revenue, improved cost efficiency and disciplined capital allocation. The company continues to make strategic investments to increase its customer base and expand its product portfolio. Overall, Amphenol Corporation’s positive financial results demonstrate the strength of its business model and further indicate its long-term potential for growth. With an expanding customer base and strong market presence, Amphenol is well-positioned to continue to generate record earnings in the years ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amphenol Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 12.62k | 1.9k | 15.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amphenol Corporation. More…

| Operations | Investing | Financing |

| 2.17k | -731.1 | -1.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amphenol Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.33k | 8.23k | 11.04 |

Key Ratios Snapshot

Some of the financial key ratios for Amphenol Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 16.6% | 20.6% |

| FCF Margin | ROE | ROA |

| 14.2% | 23.9% | 10.6% |

VI Analysis

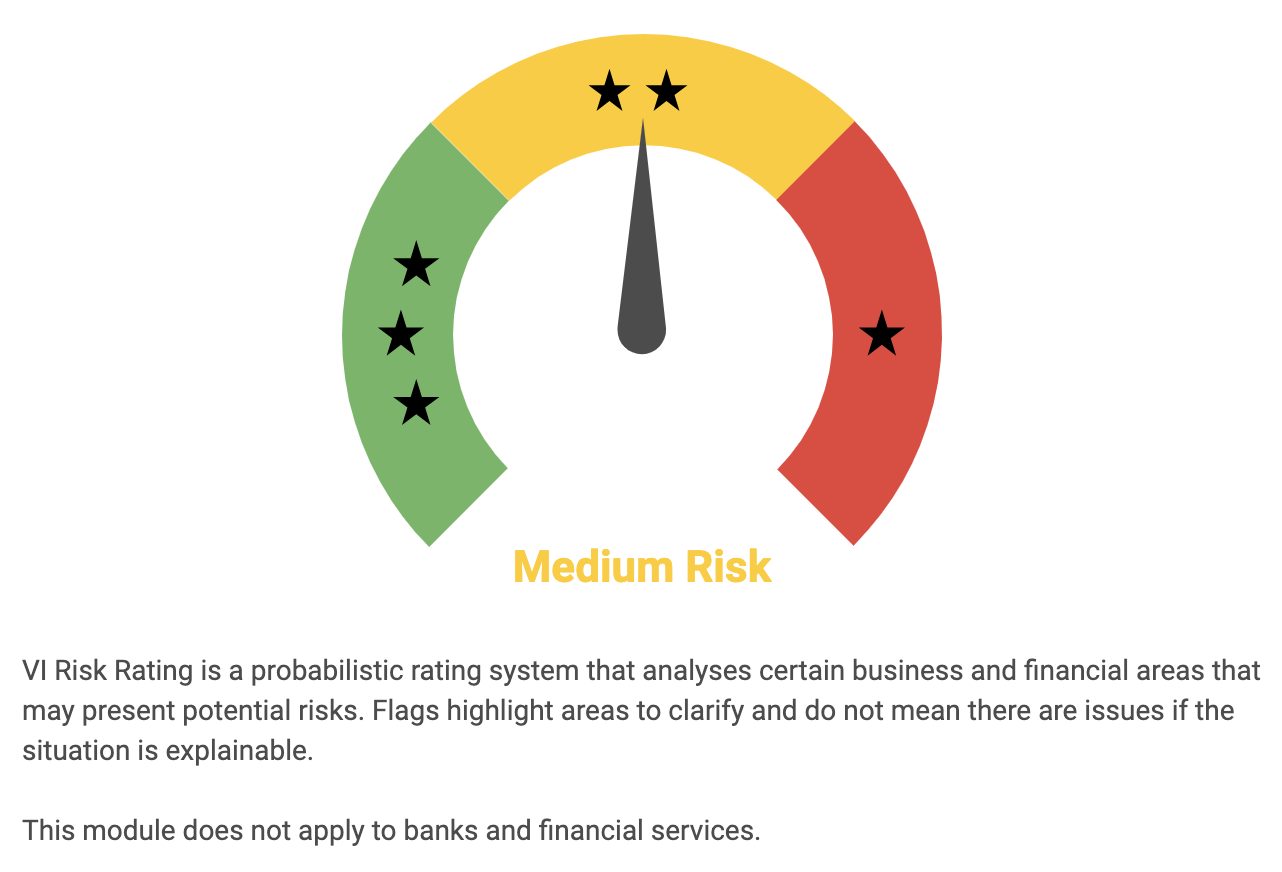

According to the VI Risk Rating, the company has a medium risk rating in terms of financial and business aspects. This means that investors should carefully consider the risks associated with investing in the company. The app also provides an overview of the company’s non-financial risks. Among these, there is at least one warning that should be taken into account. To get a comprehensive view of AMPHENOL CORPORATION‘s risks and potential, investors should register on the VI App and explore the details. The app offers numerous features to help investors assess the company’s fundamentals. These include cash flow analysis, debt-to-equity ratio, current ratio, return on equity and other metrics that can be used to evaluate a company’s financial health.

Additionally, the app allows users to compare AMPHENOL CORPORATION to other companies in the same industry, so they can make more informed decisions. Overall, the VI App simplifies the evaluation of AMPHENOL CORPORATION’s fundamentals and allows investors to make smarter investing decisions. With its comprehensive overview of the company’s financial and non-financial risks, investors can assess their risk tolerance and take informed decisions about investing in the company. By registering on the app, investors can gain access to a wealth of information about AMPHENOL CORPORATION and make better decisions about their investments.

Peers

Amphenol Corp is a leading manufacturer of electronic and fiber optic connectors, cables and interconnect systems. The company has a strong competitive position against its competitors CviLux Corp, Harada Industry Co Ltd, and Hirose Electric Co Ltd.

– CviLux Corp ($TWSE:8103)

CviLux Corp is a technology company that designs, manufactures, and sells electronic products. The company has a market cap of 2.34B as of 2022 and a return on equity of 12.83%. CviLux Corp’s products include electronic components, semiconductors, and integrated circuits. The company was founded in 2003 and is headquartered in Taipei, Taiwan.

– Harada Industry Co Ltd ($TSE:6904)

Harada Industry Co Ltd is a Japanese company that manufactures and sells automotive parts and components. The company has a market cap of 17.05 billion as of 2022 and a return on equity of -5.2%. Harada Industry Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Hirose Electric Co Ltd ($TSE:6806)

Hirose Electric Co Ltd has a market cap of 687.03B as of 2022, a Return on Equity of 8.91%. The company designs, manufactures and sells electronic and electrical components and products, including connectors, cables, modules and boards. It also provides engineering services. The company operates in Japan, North America, Europe and Asia.

Summary

Investing in Amphenol Corporation can be a rewarding decision for investors. The company recently reported strong fourth quarter financial results for FY2022, with total revenue increasing by 9.1% year-over-year to USD 507.5 million and net income increasing by 7.0% to USD 3239.2 million. This performance is indicative of the company’s good management and financial stability. The company has consistently exhibited growth in both revenue and profits, which indicates that they are well-positioned to continue this trend in the future.

Additionally, the company is well-diversified across a number of industries, including automotive, aerospace and defense, industrial, and telecommunications. This diversification reduces risk and provides investors with a wide range of potential opportunities for growth. As such, investing in Amphenol Corporation may be an attractive option for investors looking for an established, reliable company that offers a variety of growth opportunities.

Recent Posts