Amkor Technology Stock Fair Value – AMKOR TECHNOLOGY Releases Second Quarter Earnings Results for FY2023 on July 31

August 4, 2023

🌥️Earnings Overview

On July 31 2023, AMKOR TECHNOLOGY ($NASDAQ:AMKR) published their earnings results for the second quarter of FY2023, which concluded on June 30 2023. Their total revenue for the quarter was USD 1457.9 million, a 3.1% dip from the same time period in the prior year. Net income reported was USD 64.3 million, a decrease of 48.5% from the previous year.

Stock Price

On Monday, the company’s stock opened at $29.7 and closed at $29.1, a decrease of 1.8% from the prior closing price of 29.6. The release of the second quarter earnings results was critical in gauging the performance of the company in the past three months and allowed investors to make more informed decisions about their investments. Analysts had predicted that AMKOR TECHNOLOGY would have a strong second quarter and that their earnings results would be much higher than the previous years’.

However, the actual results were lower than expected, which caused some investors to sell off their stock. There was a slight drop in the market for AMKOR TECHNOLOGY shares, however, it is expected to recover soon as investors gain more insight into the company’s performance. Overall, AMKOR TECHNOLOGY continues to remain an important player in the technology industry and its second quarter earnings results have not changed its status. Investors are still optimistic about the company’s future prospects and are confident that its products and services will continue to be in demand in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amkor Technology. More…

| Total Revenues | Net Income | Net Margin |

| 6.92k | 580.02 | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amkor Technology. More…

| Operations | Investing | Financing |

| 1.06k | -899.37 | -81.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amkor Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.64k | 2.88k | 15.19 |

Key Ratios Snapshot

Some of the financial key ratios for Amkor Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.7% | 23.7% | 10.3% |

| FCF Margin | ROE | ROA |

| 3.0% | 11.9% | 6.7% |

Analysis – Amkor Technology Stock Fair Value

At GoodWhale, we have conducted an analysis of AMKOR TECHNOLOGY‘s fundamentals in order to evaluate its current stock price. Through our proprietary Valuation Line tool, we have calculated the company’s intrinsic value to be around $24.2. This is notably lower than the current stock price of $29.1, meaning shares are currently overvalued by 20.2%. Investors should take this into consideration when deciding how to proceed with AMKOR TECHNOLOGY stock. More…

Peers

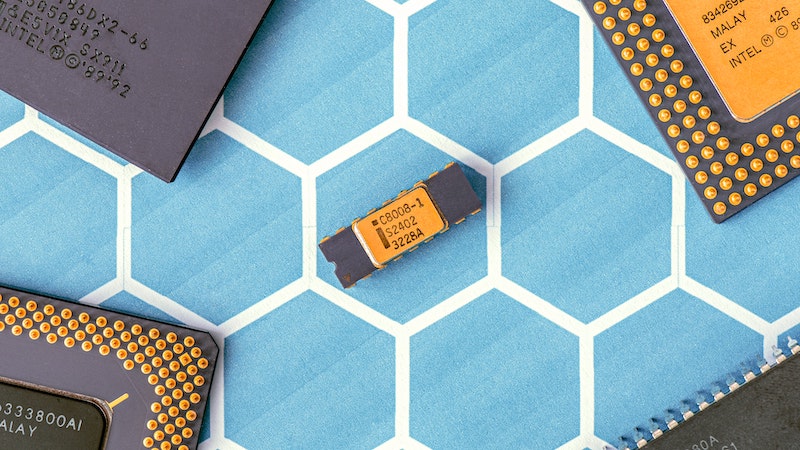

The competition in the semiconductor industry is fierce. Amkor Technology Inc is up against Unisem (M) Bhd, ASE Technology Holding Co Ltd, Vate Technology Corp Ltd, and many other companies. All of these companies are vying for a piece of the pie in an industry that is growing rapidly. The company has a strong market share and is well-positioned to continue its growth.

– Unisem (M) Bhd ($KLSE:5005)

Unisem (M) Bhd is a semiconductor assembly and test company. It has a market cap of 4.21B as of 2022. The company’s ROE is 6.97%. Unisem is involved in the assembly and testing of integrated circuits, semiconductor components, and other electronic devices. The company has operations in Malaysia, the Philippines, China, and the United States.

– ASE Technology Holding Co Ltd ($TWSE:3711)

The company’s market cap is 400.9B as of 2022 and its ROE is 23.11%. The company is engaged in the business of developing, manufacturing and selling semiconductor products.

– Vate Technology Corp Ltd ($TPEX:5344)

Vate Technology Corp Ltd is a publicly traded company with a market capitalization of 1.41 billion as of 2022. The company has a return on equity of 1.79%. Vate Technology Corp Ltd is a leading provider of technology solutions and services. The company offers a wide range of products and services including software development, web development, e-commerce solutions, and IT consulting.

Summary

AMKOR TECHNOLOGY recently reported their financial results for the second quarter of FY2023, with total revenue declining by 3.1% compared to the year prior, and net income decreasing by 48.5%. Investors should take note that despite the decrease in revenue and net income, the company was still able to report positive earnings growth.

Additionally, AMKOR TECHNOLOGY has been successful in cost-cutting and efficiency measures, which have helped to offset some of the loss in revenue. This could be an indication of the company’s potential for future growth. Investors should weigh the current financial performance against future outlook when considering investing in AMKOR TECHNOLOGY.

Recent Posts