American Water Works Q4 Earnings Soar, 2023 Guidance Affirmed

February 17, 2023

Trending News 🌥️

American Water Works ($NYSE:AWK) (AWW) reported exceptional Q4 earnings that surpassed analyst expectations, sending investors into a tizzy. The company reported a GAAP EPS of $0.81, and beat estimates by $0.01. Revenue was also impressive and exceeded expectations by $7.26M, amounting to a total of $931M.

These phenomenal results provide reassurance that AWW is in good financial standing, and to top it all off, the company affirmed its 2023 earnings per share guidance range of $4.72 to $4.82, giving investors more confidence for the future. This news has investors feeling bullish about AWW, and the market is responding positively.

Stock Price

On Wednesday, American Water Works (AWW) reported its fourth quarter earnings, which soared higher than expected. As a result, the company’s stock opened at $148.6 and closed at $149.2. This rise came in spite of the current uncertain economic climate.

Additionally, the company reaffirmed its 2023 guidance with confidence. This news is promising for investors and shareholders alike as it shows that AWW is in a strong financial position moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWK. More…

| Total Revenues | Net Income | Net Margin |

| 3.81k | 1.32k | 19.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWK. More…

| Operations | Investing | Financing |

| 1.18k | -1.54k | 373 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.13k | 19.37k | 42.67 |

Key Ratios Snapshot

Some of the financial key ratios for AWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 1.3% | 56.2% |

| FCF Margin | ROE | ROA |

| -29.0% | 17.5% | 4.9% |

Analysis

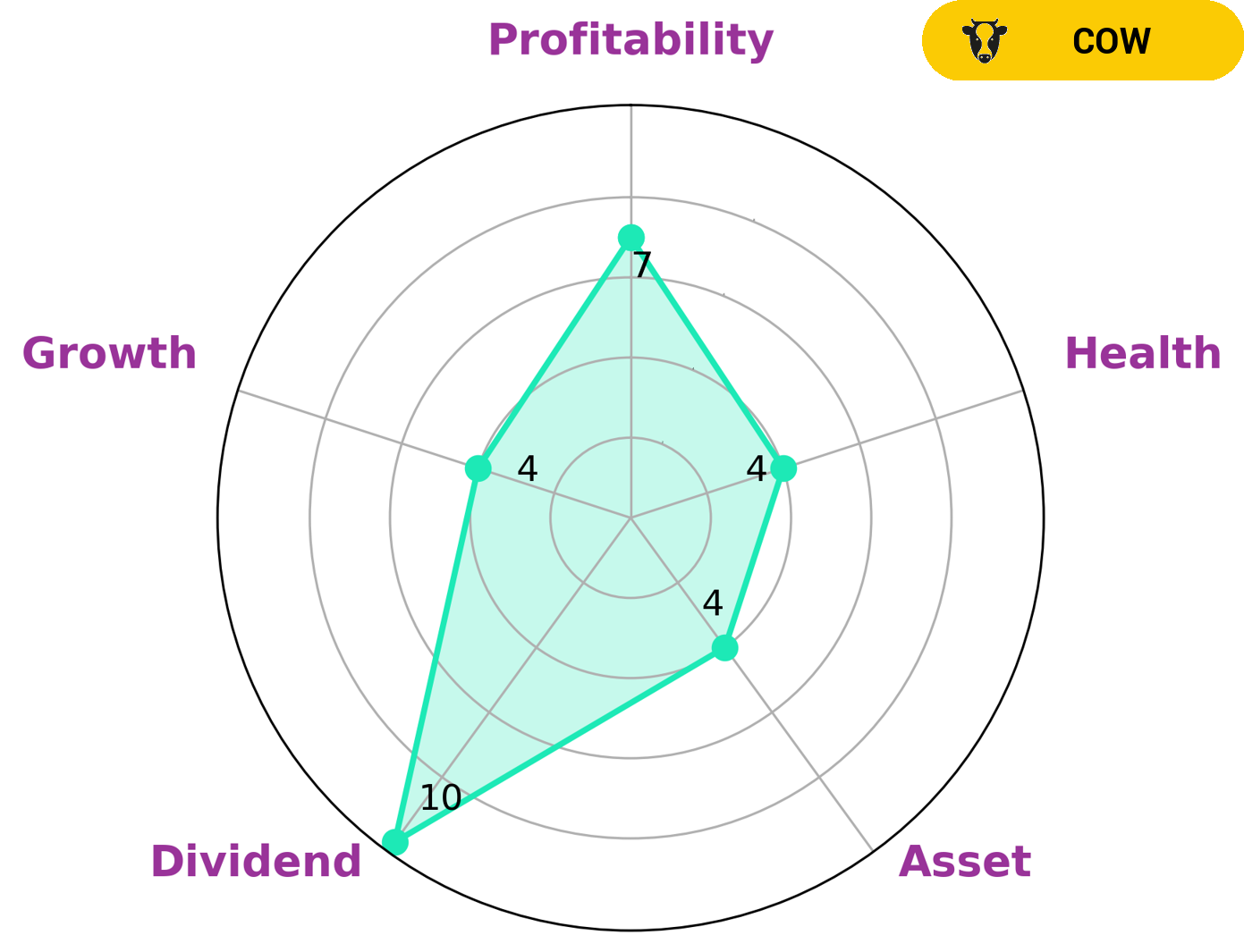

At GoodWhale, we have conducted an analysis of the fundamentals of AMERICAN WATER WORKS. On our Star Chart, AMERICAN WATER WORKS is classified as a ‘cow’, a company that has a track record of reliably paying out consistent and sustainable dividends. This makes it an attractive investment for income-seeking investors, such as retirees looking to supplement their income. Looking into AMERICAN WATER WORKS’ financial health, it is given an intermediate score of 4/10; while it may have sufficient cashflows and debt to sustain its future operations during times of crisis, there are other areas of financial health that may need improvement. Specifically, AMERICAN WATER WORKS is strong in dividends and profitability and only medium in asset and growth. More…

Peers

American Water Works Co Inc, American States Water Co, Global Water Resources Inc, and Artesian Resources Corp are all water utilities companies. They are all in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– American States Water Co ($NYSE:AWR)

American States Water Co is a water and wastewater utility company that serves nearly million people in the United States. The company has a market cap of 3.22B as of 2022 and a ROE of 12.01%. American States Water Co is the largest water utility company in California and the fourth largest in the United States. The company also provides wastewater services to approximately 700,000 people in Arizona, Illinois, New Mexico, and Texas.

– Global Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources, Inc. is a water resource management company that provides water and wastewater services to residential and commercial customers in the Phoenix metropolitan area. The company has a market cap of $296.66 million and a return on equity of 21.79%. Global Water Resources is headquartered in Scottsdale, Arizona.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the metropolitan area of Wilmington, Delaware. It is the largest provider of water and wastewater services in the state of Delaware, and is the 8th largest provider of water and wastewater services in the United States. The company has a market cap of 496.24M as of 2022 and a Return on Equity of 10.87%.

Summary

Revenue also grew year-over-year, driven mostly by growth in the company’s regulated business as well as higher base rates. The company also maintained its guidance for 2023, expecting mid single-digit growth in operating earnings and an increase in low single-digit rate base growth. Additionally, they highlighted their continued focus on financial discipline, investments in infrastructure and the environmental sustainability of their operations. With these fundamentals, investors should be encouraged by American Water Works’ robust performance and favorable outlook.

Recent Posts