American Tower Co. Q1 2023 Earnings Estimate Released by Zacks Research

December 29, 2022

Trending News 🌥️

American Tower ($NYSE:AMT) Co. is a real estate investment trust (REIT) that owns, operates and develops communications sites, such as antenna towers, which are leased to wireless carriers, radio and television broadcasters, municipalities and other tenants. Recently, Zacks Research released its estimate for American Tower Co’s Q1 2023 earnings. Zacks Research is an independent research provider that provides detailed stock analysis and ratings for investors. The report cited strong demand from wireless carriers as one of the main drivers of the positive earnings outlook. The report also noted that American Tower Co’s Q1 2023 earnings will benefit from the company’s strategic investments in infrastructure such as 5G technology. The company has also been diversifying its tenant base by signing new contracts with cable and satellite operators.

This diversification should help American Tower Co. to mitigate risk from any potential downturns in the wireless market. American Tower Co. has also been taking steps to reduce its debt. This debt reduction should further improve the company’s financial position and enable it to make additional investments in infrastructure and acquisitions. The company’s strategic investments, diversification of its tenant base, and debt reduction should all be positive factors that contribute to the company’s performance. Investors should keep an eye on American Tower Co.’s Q1 2023 earnings results when they are released.

Share Price

On Tuesday, American Tower Co. saw their stock open at $211.0 and close at $210.9, down 0.7% from the previous closing price of 212.4. This estimate was based on the company’s performance in the first quarter of 2023 and the subsequent outlook for the rest of the year. This suggests that American Tower Co. is continuing to perform well in terms of its financial performance, despite the pandemic.

The Q1 2023 earnings estimate was welcomed by investors as it provides an insight into the company’s performance and outlook for the rest of the year. Overall, the release of the Q1 2023 earnings estimate by Zacks Research provides insight into the financial performance and outlook of American Tower Co. Despite the stock closing lower on Tuesday, it remains up since the start of the year, suggesting that investors remain confident in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Tower. More…

| Total Revenues | Net Income | Net Margin |

| 10.45k | 2.9k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Tower. More…

| Operations | Investing | Financing |

| 3.19k | -11.67k | 7.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Tower. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.51k | 54.19k | 13.49 |

Key Ratios Snapshot

Some of the financial key ratios for American Tower are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 28.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

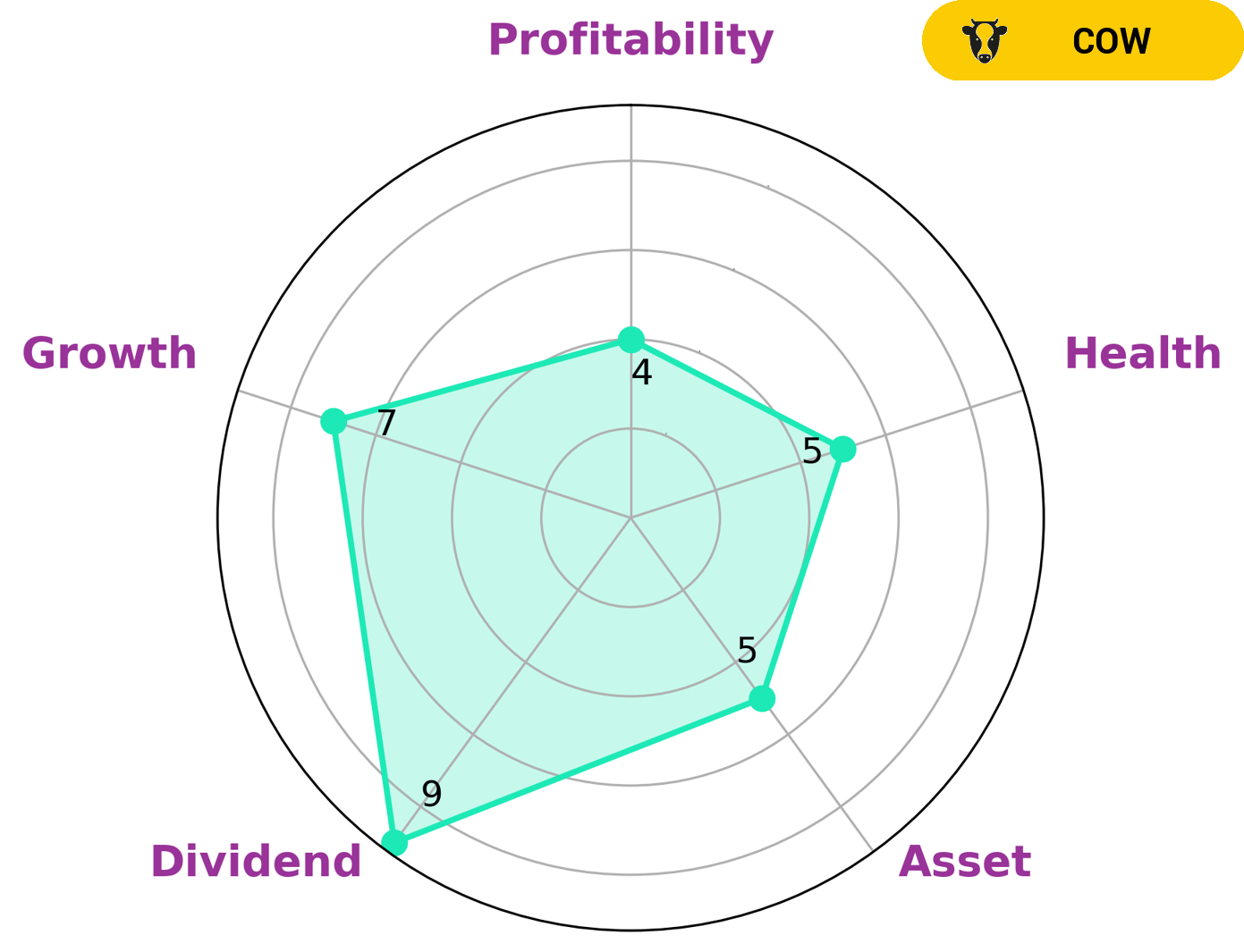

American Tower Corporation (AMERICAN TOWER) is a sound long-term investment choice for those looking for a reliable dividend-paying stock. According to the VI app, AMERICAN TOWER has an intermediate health score of 5/10 with regard to its cashflows and debt, making it likely to sustain operations in times of crisis. This company is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. For investors seeking growth potential, AMERICAN TOWER is strong in dividend and growth and medium in asset and profitability. Through analysis of the company’s fundamentals, it can be seen that AMERICAN TOWER has strong financials, with attractive returns on equity and assets, as well as a good balance sheet. Furthermore, the stock’s current price-to-earnings ratio is lower than its five-year average, indicating that it may be undervalued. In conclusion, AMERICAN TOWER is an attractive investment option for those looking for a reliable dividend-paying stock with growth potential. Its fundamentals reflect its long-term potential, and the stock appears to be undervalued. Investors looking for a sound, long-term investment should consider AMERICAN TOWER. More…

VI Peers

The company owns and operates more than 40,000 wireless communication sites across the country. American Tower Corp’s main competitors are SBA Communications Corp, CyrusOne Inc, and Equinix Inc.

– SBA Communications Corp ($NASDAQ:SBAC)

SBA Communications Corporation is a holding company that operates as a real estate investment trust (REIT), which is engaged in the ownership and leasing of wireless communications infrastructure, including antenna sites, towers, other structures, and supporting assets.

As of December 31, 2020, the Company owned or operated approximately 40,000 communication sites in the United States, Brazil, Canada, Chile, Colombia, Germany, Guatemala, India, Mexico, Peru, South Africa, and Spain.

– CyrusOne Inc ($NASDAQ:EQIX)

Equinix is a company that provides data center and interconnection services to a variety of customers. Its market cap as of 2022 is 47.86B. The company has a variety of products and services that it offers to its customers, which include data center services, interconnection services, and a variety of other services.

Summary

American Tower Corporation (AMT) is an industry leader in the ownership, operation and development of wireless and broadcast communications real estate. Investors should consider the financial health of the company, as well as its competitive advantages and market positioning, when making an investment decision. American Tower has a strong balance sheet with a low debt to equity ratio and has seen consistent growth in its core business over the past few years. The company is well-positioned to benefit from the continued growth of 5G networks, as well as the demand for mobile data services.

Recent Posts