AMERICAN STATES WATER Reports Fourth Quarter Earnings for FY2022 Ending March 1, 2023.

March 5, 2023

Earnings report

On December 31, 2022, AMERICAN STATES WATER ($NYSE:AWR) reported their earnings results for the fourth quarter of FY2022 ending March 1, 2023. Total revenue was USD 18.6 million, a decrease of 8.5% compared to the same quarter of the previous year. Despite the slight decrease in revenue, net income was USD 125.4 million, an increase of 7.5% from the same quarter in the previous year. This increase in net income is a positive sign for AMERICAN STATES WATER as it shows that the company remains profitable even during times of economic struggle and uncertainties.

Overall, these results show the resilience and strength of AMERICAN STATES WATER’s business model in adapting to the changing landscape of the water industry. Management is confident that these strong quarterly results will help guide the company toward continued growth and success in the future.

Market Price

On Wednesday, their stock opened at $88.5 and closed at $86.9, resulting in a 2.7% decrease in their closing price compared to the previous day’s closing price of 89.3. This decrease in share prices came despite higher estimates in the quarter. Despite the overall financial performance being strong, the company’s stock price dropped as a result of investor anxiety over the company’s dividend payout ratio and anticipated climate risk due to recent events. The company believes it can deliver long-term value for shareholders amidst this climate of uncertainty and will continue to focus on providing high-quality services to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWR. More…

| Total Revenues | Net Income | Net Margin |

| 491.53 | 78.4 | 15.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWR. More…

| Operations | Investing | Financing |

| 123.59 | -145.09 | -2.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.03k | 878.28 | 19.09 |

Key Ratios Snapshot

Some of the financial key ratios for AWR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | -0.1% | 26.3% |

| FCF Margin | ROE | ROA |

| -7.4% | 11.4% | 4.0% |

Analysis

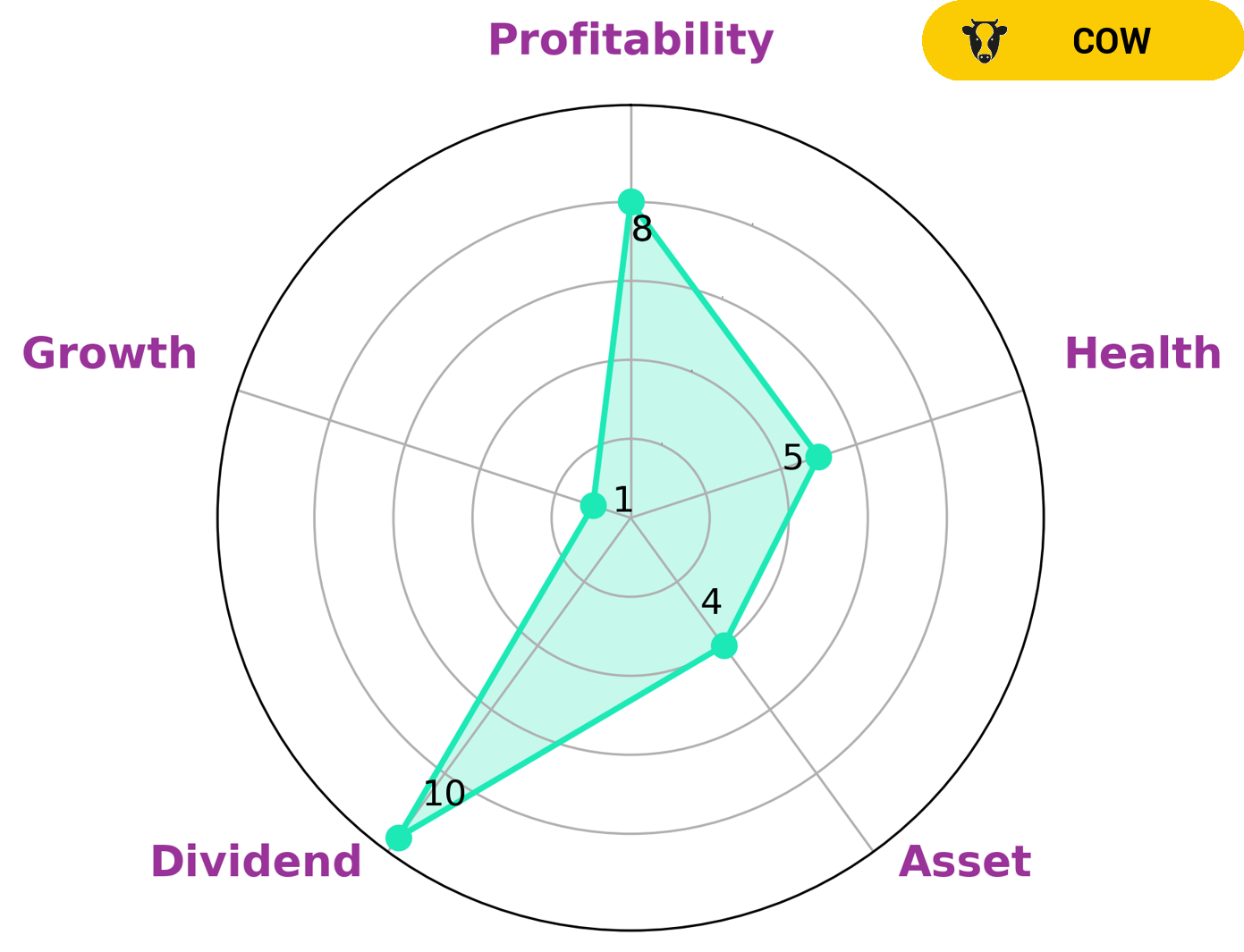

At GoodWhale, we performed an analysis of AMERICAN STATES WATER’s wellbeing. Based on our Star Chart, the company’s performance is strong in dividend and profitability, and medium in asset. Moreover, in terms of growth, AMERICAN STATES WATER is weak, having a health score of 5/10 considering its cashflows and debt. This indicates that it might be able to pay off debt and fund future operations. Besides that, AMERICAN STATES WATER is classified as ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. Investors who prefer stability and steady returns may thus be interested in this company. More…

Peers

The Company operates through two segments: Water and Electric. American States Water Company provides water and wastewater services to residential, commercial, industrial, and governmental customers in the states of California and Arizona. The Company is the largest shareholder-owned water utility in California. American States Water Company’s subsidiaries include Golden State Water Company and Arizona Water Company. SJW Group is a publicly traded water and wastewater utility company headquartered in San Jose, California. The Company operates through three segments: Water Utility Services, Real Estate Services, and Corporate and Other. SJW Group provides water and wastewater services to residential, commercial, industrial, and governmental customers in the states of California, Texas, Connecticut, and Massachusetts. American Water Works Co Inc is a publicly traded water and wastewater utility company headquartered in Voorhees, New Jersey. The Company operates through three segments: Regulated Businesses, Market-Based Operations, and Homeowner Services. American Water Works Company Inc provides water and wastewater services to residential, commercial, industrial, and governmental customers in the states of Illinois, New Jersey, Pennsylvania, Virginia, West Virginia, Kentucky, Ohio, Michigan, Indiana, North Carolina, South Carolina, Maryland, Delaware, Florida, Louisiana, Georgia, Colorado, Nevada, New Mexico, Oklahoma, Texas, and Wyoming. Global Water Resources Inc is a publicly traded water and wastewater utility company headquartered in Scottsdale, Arizona. The Company operates through two segments: Regulated Operations and Non-Regulated Operations. Global Water Resources Inc provides water and wastewater services to residential, commercial, industrial, and governmental customers in the state of Arizona.

– SJW Group ($NYSE:SJW)

SJW Group is a publicly traded water and wastewater utility company headquartered in San Jose, California. It is the holding company for San Jose Water Company, SJWTX, Inc., and SJW Land Company. As of 2019, SJW Group served more than one million people in San Jose, California; Austin, Texas; and Connecticut.

The company has a market cap of 1.88B as of 2022 and a Return on Equity of 7.1%. SJW Group’s market cap is the fourth highest of all water and wastewater utilities in the United States. The company’s ROE is above the average for all water and wastewater utilities in the United States.

– American Water Works Co Inc ($NYSE:AWK)

The American Water Works Company, Inc. is the largest publicly traded U.S. water and wastewater utility company. It provides water and wastewater services to an estimated 15 million people in 47 states and Ontario, Canada. The company operates through six segments: Regulated Businesses, Market-Based Businesses, Homeowner Services, Contracted Services, Other, and Corporate & Other. The company was founded in 1886 and is headquartered in Voorhees, New Jersey.

– Global Water Resources Inc ($NASDAQ:GWRS)

As of 2022, Global Water Resources Inc has a market cap of 277.81M and a ROE of 30.2%. The company is involved in the development, ownership, and operation of water and wastewater utilities in the United States.

Summary

A m e r i c a n S t a t e s W a t e r ( A W R ) r e p o r t e d t h i r d – q u a r t e r f i n a n c i a l r e s u l t s w i t h t o t a l r e v e n u e a t U S D 1 8 . 5 % c o m p a r e d t o t h e s a m e q u a r t e r o f t h e p r e v i o u s y e a r . N e t i n c o m e w a s U S D 1 2 5 . 5 % y e a r o v e r y e a r . T h i s w a s a s i g n i f i c a n t i n c r e a s e f r o m t h e p r e v i o u s y e a r , i n d i c a t i n g t h e c o m p a n y i s w e l l – p o s i t i o n e d f o r g r o w t h i n t h e c o m i n g y e a r .

T h e c o m p a n y c o n t i n u e s t o i n v e s t i n i t s i n f r a s t r u c t u r e , w h i c h i s h e l p i n g t o d r i v e g r o w t h . O t h e r f a c t o r s c o n t r i b u t i n g t o t h e i n c r e a s e i n c l u d e a s t r o n g w a t e r s u p p l y s y s t e m , c o s t – c o n t a i n m e n t s t r a t e g i e s , a n d c o s t – r e d u c t i o n i n i t i a t i v e s . L o o k i n g a h e a d , A W R i s c o m m i t t e d t o i n v e s t i n g i n i t s i n f r a s t r u c t u r e a n d t a k i n g a l o n g – t e r m v i e w o f o p e r a t i o n s.

Recent Posts