AMERICAN PUBLIC EDUCATION Reports Record Fourth Quarter Results for Fiscal Year 2022-2023

March 18, 2023

Earnings Overview

On March 14 2023, AMERICAN PUBLIC EDUCATION ($NASDAQ:APEI) reported results for their fourth quarter of fiscal year 2022 ending December 31 2022. Total revenue for this quarter was USD -6.5 million, a decrease of 169.7% compared to the previous year. Net income was USD 152.4 million, a slight 1.0% decrease year-over-year.

Transcripts Simplified

1. At this time, all participants are in a listen-only mode. Following today’s presentation, we will conduct a question-and-answer session and instructions will be provided at that time. I would now like to turn the conference over to your host, Mr. Christopher Symanoskie, Vice President of Investor Relations and Corporate Communications. Please go ahead. Christopher Symanoskie: Thank you and good morning everyone. With me today are Dr. Wallace Boston, president and chief executive officer and Dr. Todd Nelson, executive vice president and chief financial officer. Following their prepared remarks, we will open the call up for your questions.

Before I turn the call over to Dr. Boston, I would like to remind you that certain statements we make during this conference call may include forward-looking statements about our future plans and prospects. Actual results may differ materially from those indicated by these forward looking statements as a result of various important factors. Those factors are discussed in our recent Form 10-K, quarterly reports on Form 10-Q and other documents filed with the SEC and are available on our website. We do not undertake any obligation to update our forward-looking statements to reflect new information or future events or developments except as required by law. Dr. Boston, please go ahead. Dr. Wallace Boston: Thank you Chris and good morning everyone.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APEI. More…

| Total Revenues | Net Income | Net Margin |

| 606.33 | -115.04 | -0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APEI. More…

| Operations | Investing | Financing |

| 29.21 | -13.67 | -35.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APEI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 615.06 | 265.33 | 18.51 |

Key Ratios Snapshot

Some of the financial key ratios for APEI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.4% | -19.6% | 1.8% |

| FCF Margin | ROE | ROA |

| 2.1% | 2.0% | 1.1% |

Stock Price

The company opened at $9.5 and closed at $9.3, representing a 0.5% increase from their previous closing price of $9.2. These results demonstrate the continued success of AMERICAN PUBLIC EDUCATION as they continue to provide quality education services to the American public. This includes higher enrollment and increased tuition fees, resulting in increased net income and cash flow for the company. Moreover, the company has been focusing on improving their educational services, with initiatives such as reducing classroom sizes and improving the quality of teachers.

This strong fourth quarter performance shows that AMERICAN PUBLIC EDUCATION is committed to providing quality public education services in the United States. With these record results, the company is well-positioned to continue their success into the next fiscal year and beyond. Live Quote…

Analysis

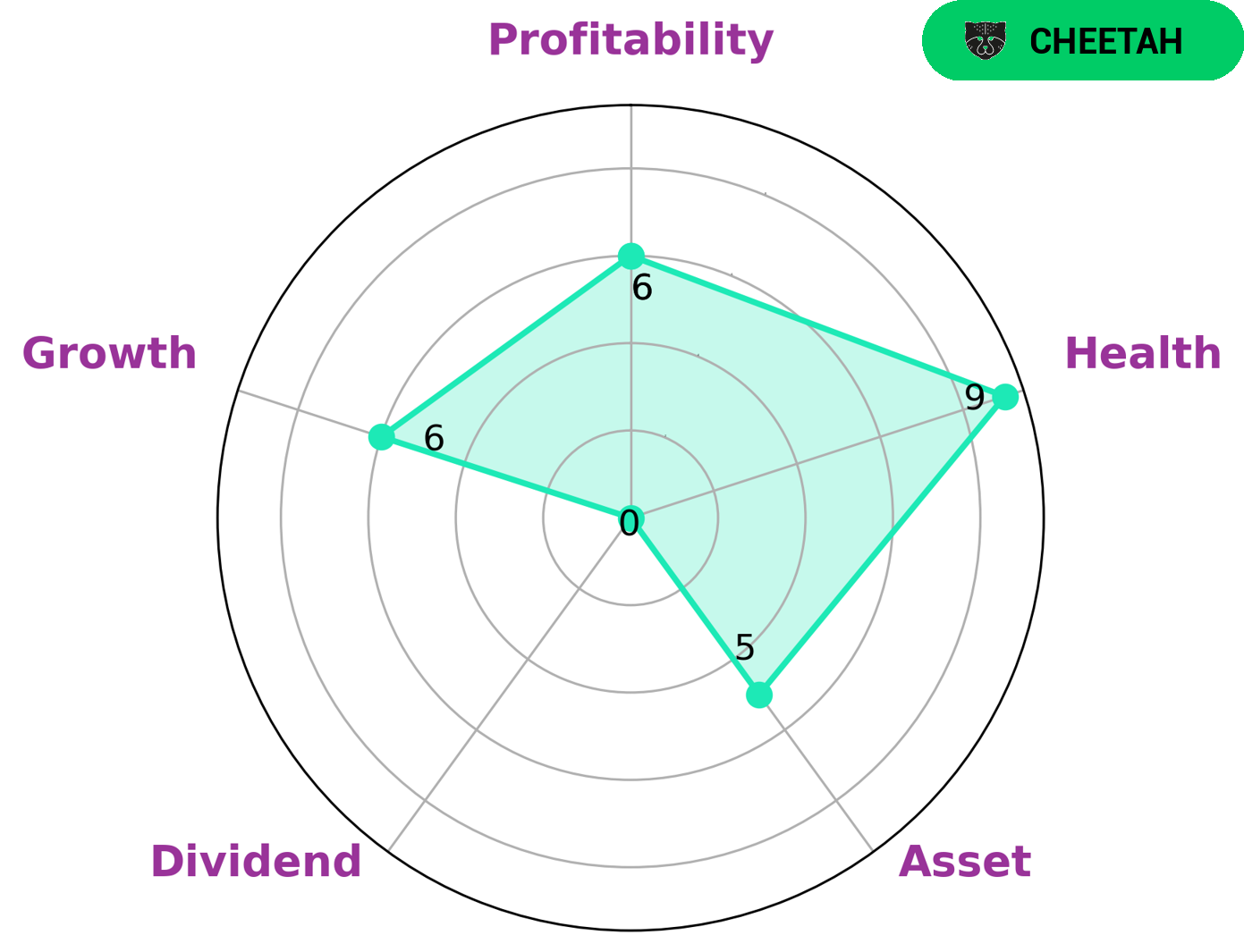

At GoodWhale, we analyze the financials of AMERICAN PUBLIC EDUCATION to identify their strengths and weaknesses. Our star chart analysis classifies AMERICAN PUBLIC EDUCATION as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. As such, AMERICAN PUBLIC EDUCATION is an attractive proposition for investors looking for fast returns, with its high health score of 9/10 with regard to its cashflows and debt meaning it is capable to safely ride out any crisis without the risk of bankruptcy. In terms of specifics, AMERICAN PUBLIC EDUCATION is strong in liquidity, medium in asset, growth, profitability and weak in dividend. This makes AMERICAN PUBLIC EDUCATION a good candidate for investors looking for fast returns, but understanding that there is associated risk with such an investment. More…

Peers

As the for-profit education industry continues to grow in the United States, so does the competition among the companies that provide these services. American Public Education, Inc. (APEI) is one of the largest for-profit education providers in the country and competes with other companies such as Grand Canyon Education, Inc. (GCEI), Koolearn Technology Holding Ltd., and BExcellent Group Holdings Ltd.

– Grand Canyon Education Inc ($NASDAQ:LOPE)

As of 2022, GC Education Inc has a market cap of 2.74B and a ROE of 33.2%. The company provides higher education services, including online programs and on-campus programs in the United States. GC Education Inc is a publicly traded company on the Nasdaq stock exchange.

– Koolearn Technology Holding Ltd ($SEHK:01797)

Koolearn Technology Holding Ltd is a provider of online education services in China. The company offers a range of online courses covering various academic subjects, including mathematics, physics, chemistry, biology, and English. Koolearn Technology Holding Ltd also provides online test preparation services for students preparing for various exams, such as the Chinese College Entrance Examination, or “gaokao.” The company was founded in 2006 and is headquartered in Beijing, China.

– BExcellent Group Holdings Ltd ($SEHK:01775)

BExcellent Group Holdings Ltd is a Hong Kong-based company principally engaged in the provision of educational services. The Company operates its business through four segments. The Language Training segment offers language courses to individuals and corporate clients. The Test Preparation segment offers courses to prepare students for academic tests, such as the Graduate Record Examinations, the Test of English as a Foreign Language and the Scholastic Aptitude Test, among others. The International Education segment provides international education services. The Others segment is engaged in the provision of professional training courses and the operation of kindergartens.

Summary

American Public Education reported a decrease in total revenue for the fourth quarter of fiscal 2022 compared to the same period the year before. Despite the decrease in revenue, net income for the quarter was down only 1%. This suggests that the company is managing to maintain profitability in a difficult economic environment. Investors will be keeping a close eye on the company’s performance over the next year as it looks to turn around its fortunes and return to sustained growth.

Recent Posts