American Lithium Reports Negative Earnings Per Share of C$0.17

June 3, 2023

🌧️Trending News

American Lithium ($NASDAQ:AMLI), a publicly-traded company offering efficient solutions for the lithium-ion battery industry, recently reported a negative earnings per share of C$0.17. This was measured using generally accepted accounting principles (GAAP) and was largely attributed to increased administrative and other costs. The company is in the process of transitioning from a development stage to an operational stage, which has caused the negative EPS. The company’s share prices have also seen a rise in the past few weeks, which can be attributed to investors’ confidence in American Lithium’s potential.

Stock Price

American Lithium recently reported a negative earnings per share of C$0.17 on Friday. This news caused the stock to open and close the same day at $2.0, a decrease of 0.5% from the previous closing price. The market reacted accordingly to the news, causing the stock to remain unchanged on the day. It is unclear how long it will take for the market to recover from the news of negative earnings per share from American Lithium. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Lithium. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -35.67 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Lithium. More…

| Operations | Investing | Financing |

| -24.4 | 3.17 | 12.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Lithium. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 194.28 | 1.89 | 0.9 |

Key Ratios Snapshot

Some of the financial key ratios for American Lithium are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -11.9% | -11.4% |

Analysis

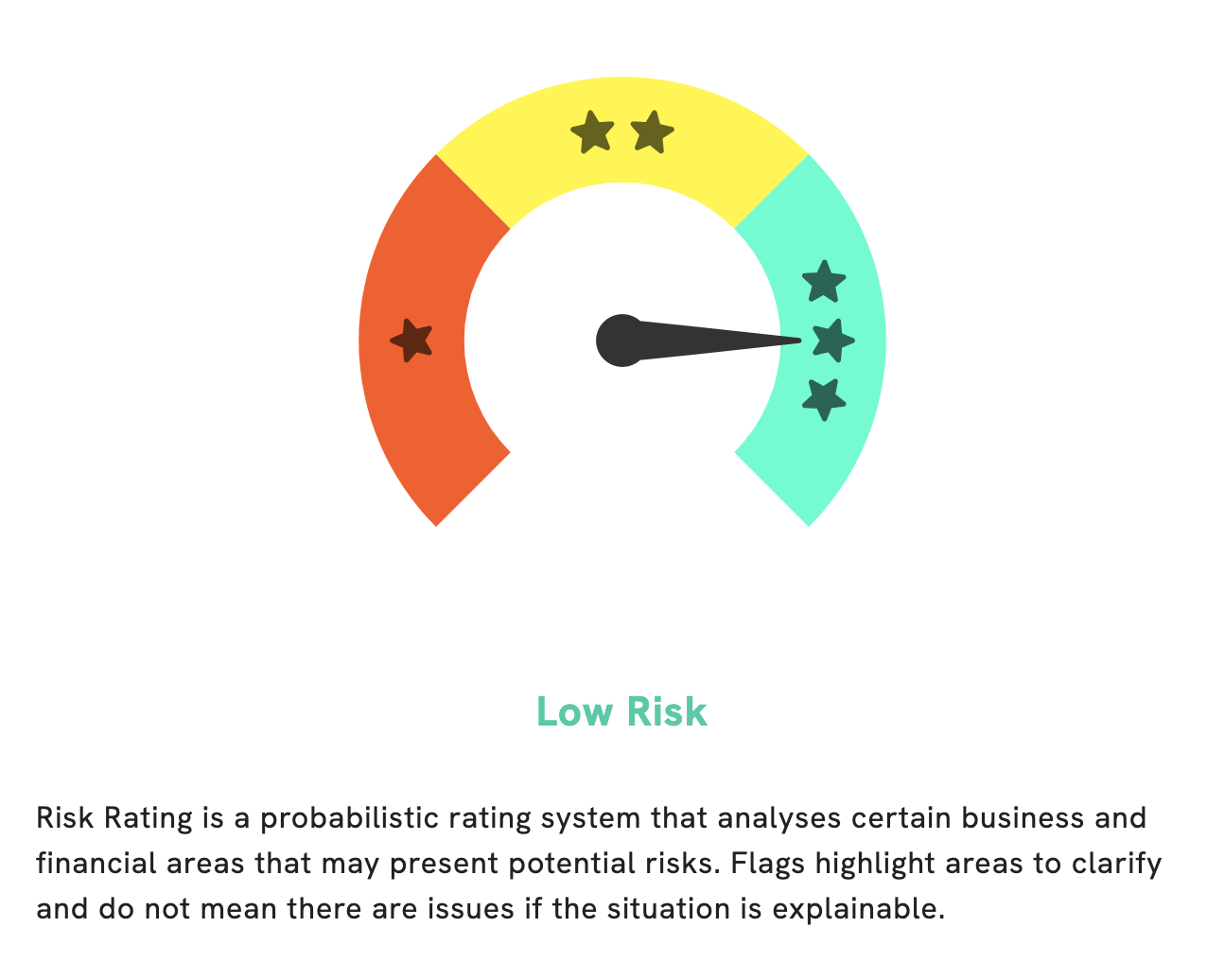

At GoodWhale, we have closely examined AMERICAN LITHIUM‘s financials and have assigned it a Risk Rating of Low. This rating indicates that the company is in good financial and business standing. However, we have detected one risk warning in the income sheet of AMERICAN LITHIUM. To access this warning, users must register for a GoodWhale account. Becoming a registered user gives you access to the full analysis of the company’s financials, including the full details of the risk warning. Register today and get a better understanding of AMERICAN LITHIUM’s financial standing. More…

Summary

Investing in American Lithium offers investors the potential for significant returns, as the company has experienced rapid growth during the last five years. Despite this growth, American Lithium has been unable to consistently turn a profit, with a GAAP EPS of -C$0.17. As such, potential investors should carefully consider the risks associated with investing in this company. American Lithium has a diversified portfolio of lithium mining and production activities, and it has seen rising demand for lithium in recent years. The company’s strategic partnerships and collaborations provide additional potential for growth, though these may be impacted by macroeconomic conditions. Investors will need to assess the company’s financial position, liquidity, and management team before making a final investing decision.

Additionally, investors should consider potential risks such as commodity price volatility and political and economic conditions in the countries where American Lithium operates. Further research and due diligence will be required to determine an appropriate investment strategy.

Recent Posts