AMC NETWORKS Reports Fourth Quarter FY2022 Earnings Results Ending February 17 2023

March 31, 2023

Earnings Overview

On February 17 2023, AMC NETWORKS ($NASDAQ:AMCX) released their earnings results for the fourth quarter of FY2022, ending December 31 2022. Total revenue had decreased dramatically by 1653.3% from the same period the previous year, falling to USD -264.7 million. However, the company’s net income increased by 20.0% to USD 964.5 million year over year.

Transcripts Simplified

AMC Networks took steps in the fourth quarter to recalibrate their business by streamlining the organization, reducing costs and optimizing content monetization. They extended their partnerships with new and existing distributors, and are now beginning to see movement towards new pricing and packaging models. They are staying true to their mission of creating highly compelling content, and had success with the series finale of The Walking Dead and the first series in their new Anne Rice, The Immortal Universe.

The final season of The Walking Dead has seen its highest pricing ever over its 11 seasons, which demonstrates its continued power and relevance. The 11th season launched on Netflix earlier this month and has been streamed 1.43 billion minutes within the first full week it was available.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amc Networks. More…

| Total Revenues | Net Income | Net Margin |

| 3.1k | 7.59 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amc Networks. More…

| Operations | Investing | Financing |

| 181.83 | -39.38 | -97.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amc Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.63k | 4.53k | 18.76 |

Key Ratios Snapshot

Some of the financial key ratios for Amc Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | -9.3% | 3.4% |

| FCF Margin | ROE | ROA |

| 4.4% | 7.2% | 1.2% |

Share Price

The stock opened at $23.6 and closed at $27.1, an increase of 32.3% from the previous closing price of $20.5. This impressive jump in the stock’s value is a sign that the company is doing well and that investors are confident in their financial performance. This investment has contributed to their success in the fourth quarter and signals that their content strategy is on the right track.

In addition, the company recently launched several new streaming services such as Acorn TV and AMC+ to provide viewers with more options for viewing content. This diversification has paid off for AMC NETWORKS as the demand for streaming services continues to rise. Overall, AMC NETWORKS reported very positive results in their fourth quarter FY2022 earnings, with total revenue and operating income both increasing year over year. The company’s strong content library, investment in new streaming services, and diversified business model have all contributed to this success. Live Quote…

Analysis

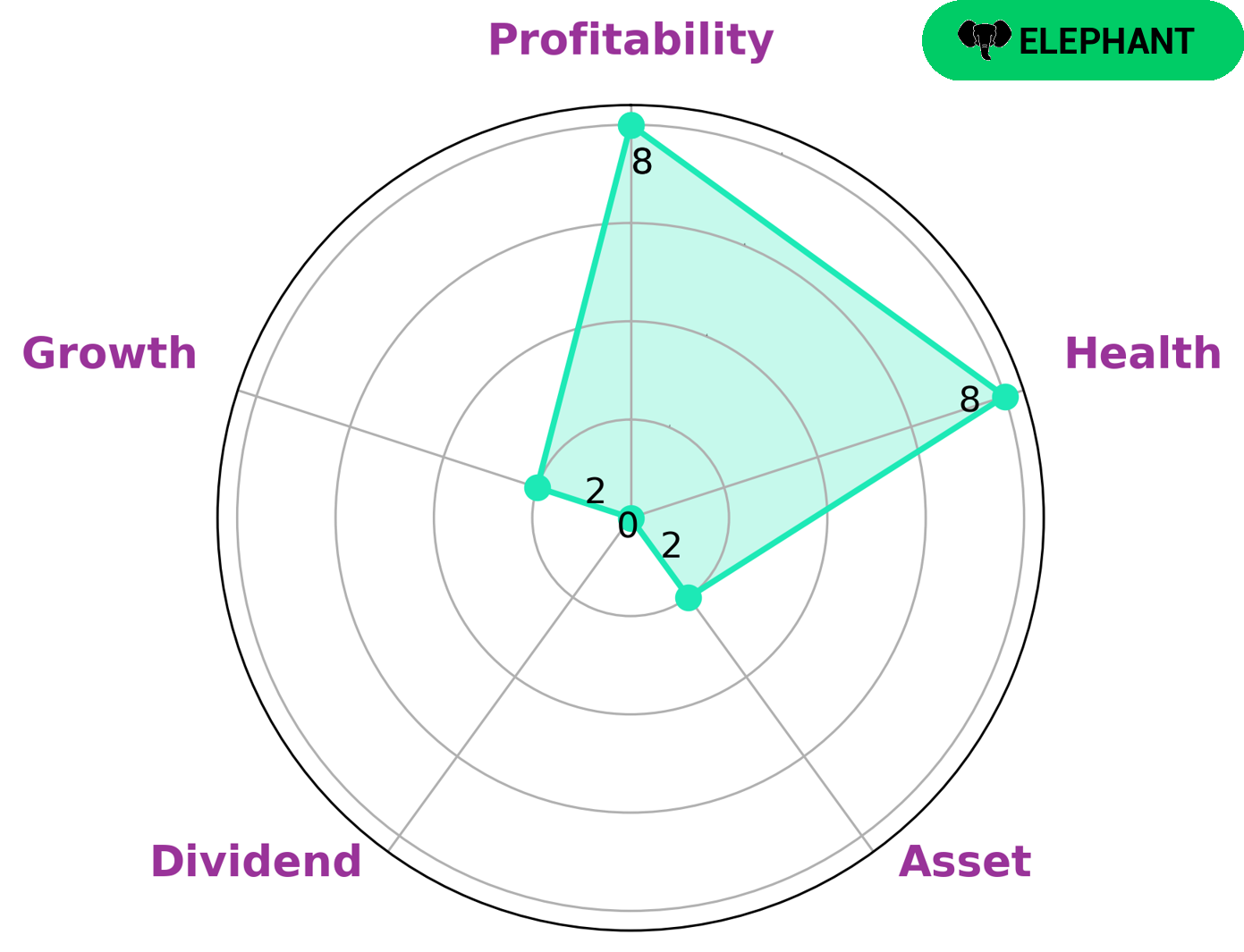

As GoodWhale conducted the analysis of AMC NETWORKS‘s wellbeing, we discovered that the company had a high health score of 8/10. This was established by evaluating its cashflows and debt capabilities to determine if it could sustain operations in the future during times of crisis. Our conclusion was that AMC NETWORKS is an ‘elephant’, meaning it is rich in assets after liabilities are deducted. We identified what kind of investor may be interested in this type of company. AMC NETWORKS is strong in profitability, but weak in assets, dividend, and growth. Therefore, investors who are more interested in the financial stability of their investments rather than growth opportunities may be interested in AMC NETWORKS. By conducting this analysis, we have determined that AMC NETWORKS is a strong and stable company that may be suitable for such investors. More…

Peers

AMC Networks Inc is an American entertainment company that owns and operates several cable television channels. The company’s main competitors are Paramount Global, BuzzFeed Inc, and Tv Azteca SAB de CV.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 10.21B as of 2022, a Return on Equity of 12.85%. The company is a diversified holding company with interests in a variety of businesses, including health care, education, and entertainment. Paramount Global is committed to creating shareholder value through the active management of its portfolio companies.

– BuzzFeed Inc ($NASDAQ:BZFD)

BuzzFeed, Inc. is an American internet media and news company based in New York City. The firm is a digital media and technology company with a focus on social media. BuzzFeed was founded in 2006 by Jonah Peretti and John S. Johnson III. The company has raised $496.3 million in venture funding to date.

– Tv Azteca SAB de CV ($OTCPK:AZTEF)

Tv Azteca SAB de CV is a Mexican multimedia company with operations in both the television and radio industries. The company’s market cap as of 2022 is 223.95M, and its Return on Equity is 91.59%. Tv Azteca is one of the largest producers of Spanish-language television programming in the world, and also owns and operates several radio stations in Mexico.

Summary

AMC Networks reported its fourth quarter fiscal year 2022 results on December 31 2022, revealing a massive year-over-year decrease in revenue of 1653.3%. Despite this, the company’s net income increased by 20.0% to USD 964.5 million. The stock price moved up the same day, signalling investor optimism in the company’s future.

Despite the current uncertainties, investors can be encouraged by AMC’s agility in maintaining net income despite a decrease in revenue. With the potential of future growth and ongoing success, AMC Networks could be a lucrative long-term investment.

Recent Posts