AECOM Reports Q4 Earnings Results for FY2023

November 26, 2023

🌥️Earnings Overview

On November 13 2023, AECOM ($NYSE:ACM) reported their FY2023 Q4 earnings results for the period ending September 30 2023. Total revenue for the quarter was USD 3842.4 million, representing a 12.1% increase year-over-year. Meanwhile, net income declined 75.9% to USD 25.5 million compared to the same period the year prior.

Share Price

On Monday, AECOM reported their fourth quarter earnings results for their fiscal year 2023. The stock opened at $80.4 and closed at $80.5, indicating a slight increase of 0.2% from the prior closing price of 80.3. The strong earnings position AECOM in a favorable position for the upcoming fiscal year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aecom. AECOM_Reports_Q4_Earnings_Results_for_FY2023″>More…

| Total Revenues | Net Income | Net Margin |

| 14.38k | 55.33 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aecom. AECOM_Reports_Q4_Earnings_Results_for_FY2023″>More…

| Operations | Investing | Financing |

| 695.98 | -138.18 | -472.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aecom. AECOM_Reports_Q4_Earnings_Results_for_FY2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.14k | 8.53k | 17.85 |

Key Ratios Snapshot

Some of the financial key ratios for Aecom are shown below. AECOM_Reports_Q4_Earnings_Results_for_FY2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.8% | 15.0% | 2.6% |

| FCF Margin | ROE | ROA |

| 4.1% | 9.4% | 2.1% |

Analysis

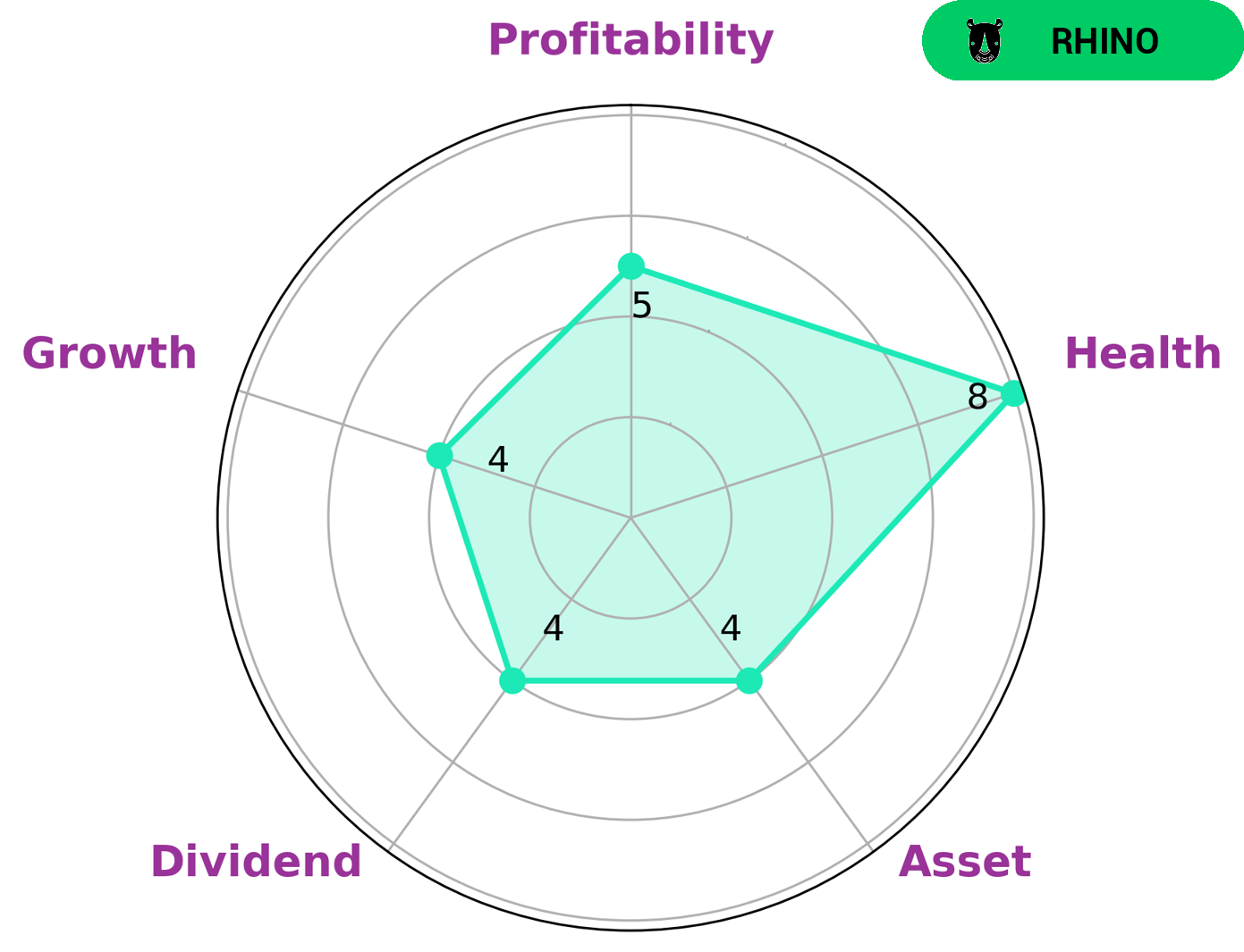

GoodWhale recently examined the fundamentals of AECOM and concluded that it is an attractive investment opportunity. The company has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. According to GoodWhale’s star chart, AECOM is classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. We believe that AECOM is an ideal investment for investors who are seeking stability and moderate growth. The company is strong in liquidity and medium in asset, dividend, profitability, and weak in growth. We recommend that investors consider AECOM as a potential long-term investment, as it is likely to continue to provide consistent returns in the future. More…

Peers

The company’s competitors include Vinci SA, Jacobs Engineering Group Inc, and KEC International Ltd.

– Vinci SA ($LTS:0NQM)

Vinci SA is a French concessions and construction company. The company has a market capitalization of 48.68 billion as of 2022 and a return on equity of 16.12%. The company’s main businesses are in the construction and operation of infrastructure assets, including airports, motorways, railways, and bridges. The company also has concession businesses in the healthcare and energy sectors.

– Jacobs Engineering Group Inc ($NYSE:J)

As of 2022, Jacobs Engineering Group Inc has a market cap of 14.42B and ROE of 8.89%. The company is a leading provider of engineering, technical, and construction services. It has a diversified client base that includes government, commercial, and industrial clients. The company has a strong history of delivering quality projects on time and within budget.

– KEC International Ltd ($BSE:532714)

KEC International Ltd is an infrastructure engineering company. It operates in the following business segments: Power Transmission, Railways, Cables, Transformers, Civil, Water, and Defence. The company has a market cap of 109.13B as of 2022 and a Return on Equity of 12.5%. KEC International Ltd is a leading infrastructure engineering company with a strong presence in India and a growing international footprint. The company’s extensive product and services portfolio includes power transmission, railways, cables, transformers, civil, water, and defence. KEC International Ltd is well-positioned to benefit from the growing demand for infrastructure development in India and across the globe.

Summary

Analysts have been closely watching AECOM‘s performance as the company reported its FY2023 Q4 earnings on November 13, 2023. Total revenue for the quarter ended September 30 reached USD 3842.4 million, a 12.1% increase year-over-year. On the other hand, net income decreased by 75.9% to USD 25.5 million from the same period last year.

Investors may be concerned with the steep decline in profits but should take consolation in the growth in total revenue. Moving forward, investors should pay close attention to AECOM’s progress and closely monitor its financial performance for future developments.

Recent Posts