Adobe Inc Reports Q3 Earnings for FY2023 on September 14th

September 27, 2023

🌥️Earnings Overview

On September 14, 2023, ADOBE INC ($NASDAQ:ADBE) announced their financial results for their fiscal year 2023 third quarter, ending August 31, 2023. Total revenue increased by 10.4% from the previous year to USD 4.9 billion, while net income grew 22.8% year over year to USD 1.4 billion.

Stock Price

On Thursday, September 14th, ADOBE INC reported its earnings for the third quarter of fiscal 2023. The company’s stock opened at $551.1 and closed at $552.2, which was slightly down from its prior closing price of 553.6. This was mainly driven by higher subscription revenue and increased demand for its cloud-based products and services.

Overall, investors reacted positively to ADOBE INC’s third quarter earnings report as the company continues to show strong growth in its core businesses. The company’s stock price edged slightly lower on the day of the report, however it remained well above its pre-earnings price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adobe Inc. More…

| Total Revenues | Net Income | Net Margin |

| 18.89k | 5.12k | 27.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adobe Inc. More…

| Operations | Investing | Financing |

| 8.03k | 554 | -5.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adobe Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.09k | 13.31k | 34.61 |

Key Ratios Snapshot

Some of the financial key ratios for Adobe Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.9% | 17.1% | 35.1% |

| FCF Margin | ROE | ROA |

| 40.4% | 27.0% | 14.2% |

Analysis

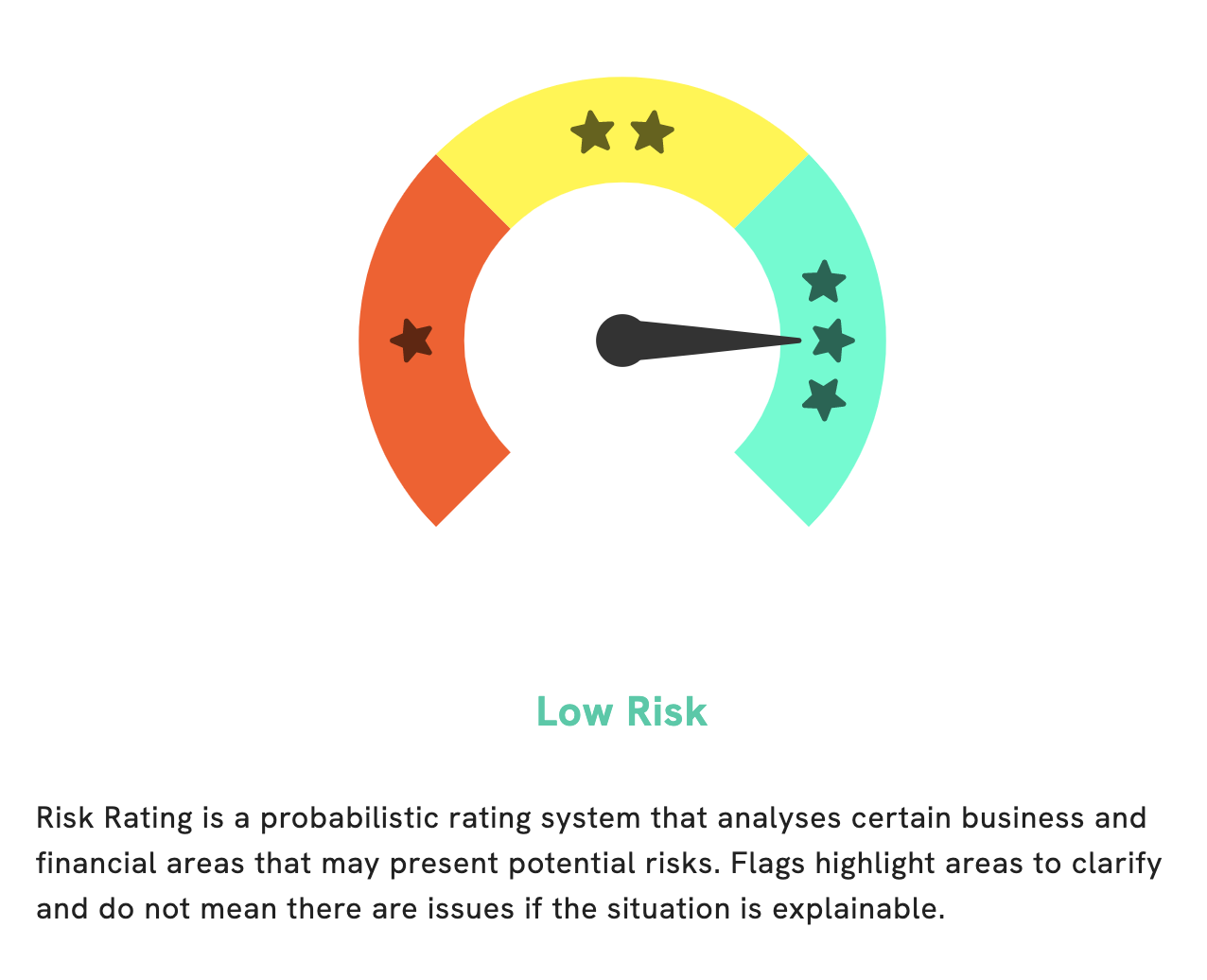

GoodWhale has conducted an analysis of ADOBE INC‘s fundamentals and determined that it is a low risk investment in terms of financial and business aspects. Our Risk Rating system takes into consideration both historical performance and current trends to determine the level of risk associated with each company. However, our analysis has revealed one potential risk warning in the company’s balance sheet. This warning may indicate that ADOBE INC may not be as financially sound as previously thought. To find out more about this risk warning, register on goodwhale.com and delve deep into the fundamentals of the company. More…

Peers

Adobe Inc is a leading software company that offers a range of products, including Creative Cloud, Photoshop, and Acrobat. Its main competitors are Crowd Media Holdings Ltd, Creative Realities Inc, and PT Solusi Sinergi Digital Tbk.

– Crowd Media Holdings Ltd ($ASX:CM8)

Crowd Media Holdings Ltd is a social media and technology company. The company has a market cap of 15.12M as of 2022 and a Return on Equity of -36.63%. The company enables brands and celebrities to connect with their fans and followers through social media. The company also provides technology solutions for social media marketing and management.

– Creative Realities Inc ($NASDAQ:CREX)

Creative Realities, Inc. is a digital customer engagement company that designs, develops, and sells customer engagement solutions in the retail, hospitality, and museums and exhibitions markets worldwide. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services. The company was formerly known as Creative Realities, LLC and changed its name to Creative Realities, Inc. in July 2015. Creative Realities, Inc. was founded in 2010 and is headquartered in New York, New York.

Creative Realities Inc has a market cap of 12.84M as of 2022 and a Return on Equity of 9.18%. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services.

– PT Solusi Sinergi Digital Tbk ($IDX:WIFI)

In 2022, PT Solusi Sinergi Digital Tbk had a market capitalization of 410.06 billion Indonesian rupiah and a return on equity of 23.38%. The company provides digital printing, document management, and other related services in Indonesia.

Summary

Adobe Inc. reported strong financial results for the 3rd quarter of fiscal year 2023, with total revenue increasing 10.4% year-over-year to USD 4.9 billion and net income growing 22.8% to USD 1.4 billion. This impressive performance was driven by strong demand for Adobe’s creative software and cloud services, such as Adobe Creative Cloud, Adobe Document Cloud, and Adobe Experience Cloud. Investors should take notice of these results, as they demonstrate the company’s ability to innovate and generate strong revenue growth. With a promising product pipeline and expanding customer base, Adobe looks well-positioned for continued success in the future.

Recent Posts