Abm Industries Intrinsic Value – Zacks Research Predicts Positive Q2 2023 Earnings for ABM Industries Incorporated

March 29, 2023

Trending News ☀️

Zacks Research has recently issued an estimated earnings forecast for ABM ($NYSE:ABM) Industries Incorporated for the second quarter of 2023. The prediction is a positive one; the research firm believes that the company’s second-quarter earnings will be higher than the same period in 2022. This positive news comes as a welcome boost for ABM Industries, whose revenues have been increasing steadily over the last several years. The company has a strong presence in a variety of industries, including energy, facilities services, and government services, and its diverse portfolio of services has allowed it to weather economic downturns more effectively than many of its competitors. ABM Industries’ success has been aided by its investments in new technology, which have enabled it to stay ahead of the competition and offer its customers innovative and cost-effective solutions.

In addition, its commitment to providing quality service and customer satisfaction has helped it to maintain its strong reputation in the industry. Overall, this positive prediction from Zacks Research is a testament to ABM Industries’ sound management and successful business strategies. With its impressive financial performance, the company is well-positioned to continue its strong performance in the second quarter of 2023 and beyond.

Stock Price

Recent news around ABM Industries Incorporated has been mostly mixed, but on Monday its stock opened at $44.0 and closed at $44.0, up by 1.3% from the previous closing price of 43.4. This prediction comes as welcome news to shareholders and investors, and may bode well for the company’s future prospects. Those interested in learning more about the company’s future plans should keep an eye out for upcoming reports and statements from ABM Industries Incorporated. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Abm Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.86k | 192.9 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Abm Industries. More…

| Operations | Investing | Financing |

| 43.1 | -241.6 | 241.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Abm Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.92k | 3.18k | 26.27 |

Key Ratios Snapshot

Some of the financial key ratios for Abm Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 10.2% | 4.0% |

| FCF Margin | ROE | ROA |

| -0.2% | 11.5% | 4.0% |

Analysis – Abm Industries Intrinsic Value

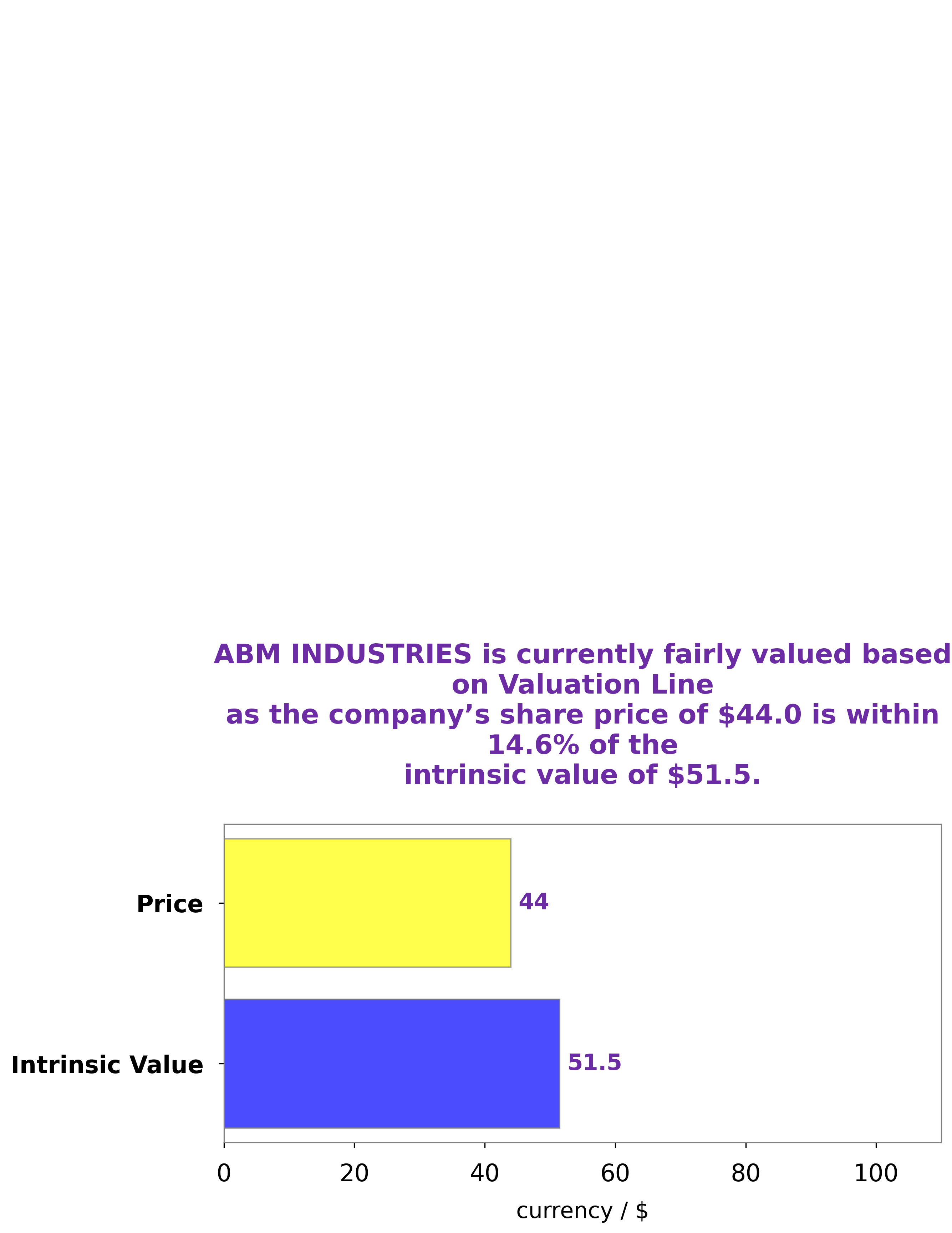

Our analysis of the fundamentals of ABM INDUSTRIES reveals a fair value of $51.5 for its stock, according to our proprietary Valuation Line. Currently, ABM INDUSTRIES’ stock is trading at $44.0, representing an undervaluation of 14.6%. This means that investors can take advantage of the relative discount and purchase the stock at a lower price than its fair value. Thus, we believe that investors should consider buying ABM INDUSTRIES’ shares at these levels as a potential good long-term investment. More…

Peers

As the competition heats up, ABM Industries Inc will have to make sure that their services remain the best in the industry in order to stay ahead of their competitors.

– Mader Group Ltd ($ASX:MAD)

Mader Group Ltd is a leading global provider of construction services, specializing in the mining and energy sectors. With a market cap of 714M as of 2022, the company is well positioned to continue to grow and expand its business. Mader Group Ltd has a very impressive Return on Equity (ROE) of 33.68%, which is significantly higher than the industry average of 14%. This indicates that the company is making effective use of its equity to generate excellent returns for its shareholders. Mader Group Ltd is well-positioned to capitalize on growth opportunities in the global construction and energy sectors.

– Teleperformance SE ($OTCPK:TLPFF)

Teleperformance SE is a global leader in customer experience management and business process outsourcing. Founded in 1978, the company specializes in providing customer care, technical support, and digital integrated services across multiple channels. As of 2022, Teleperformance SE has a market capitalization of 13.34B. Its return on equity (ROE) is 16.41%, which indicates a high return on the invested capital relative to its competitors. This strong ROE is testament to the company’s ability to generate value for its shareholders by efficiently using its resources.

– Dexterra Group Inc ($TSX:DXT)

Dexterra Group Inc is a Canadian company that specializes in providing enterprise mobility solutions and services to its clients. The company has a market cap of 335.95M as of 2022, which represents its current market value. Its Return on Equity (ROE) is 4.62%, which refers to the amount of net income earned compared to the company’s total equity. The company’s current ROE is lower than the industry average, indicating that it is creating less value for its shareholders than its peers. Overall, Dexterra Group Inc is a reliable provider of enterprise mobility solutions and services and its market cap and ROE can be taken as indicators of its stability and potential for growth.

Summary

ABM Industries Incorporated is a diversified facility management services provider based in the United States. According to a recent research report from Zacks, the company is expected to report strong earnings in the second quarter of 2023. The report cited its diverse offerings and strong cost management as key factors driving the projected growth. ABM Industries has been able to leverage its expertise in energy and automation, engineering, and construction management.

Additionally, the company has seen an increase in its client base, with both existing and new customers utilizing its services. With a strong balance sheet and a positive outlook for the future, ABM Industries is poised to continue to grow and outperform its peers in the facility management industry. Investor confidence appears to be high, as ABM Industries’ share price has been steadily increasing in recent months.

Recent Posts