908 DEVICES Reports Record-Breaking Q4 Earnings for FY2022 on December 31, 2022

March 21, 2023

Earnings Overview

908 ($NASDAQ:MASS): For the fourth quarter of FY2022 ending December 31, 2022, DEVICES reported total revenue of -9.8 million USD, a decrease of 182.9% from the same period in the previous year. Net income for this quarter was 11.6 million USD, a drop of 26.5% compared to the same period in the prior year.

Transcripts Simplified

Operator Instructions As a reminder, this conference is being recorded. I would now like to turn the conference over to your host, Brad Farrell, Chief Executive Officer of 908 Devices. Please go ahead sir. Brad Farrell – Chief Executive Officer Thank you. On the call with me today are our Chief Financial Officer, Peter Stuart and our Chief Commercial Officer, Richlynn Best. Let me start off by saying that our results this quarter demonstrate the strength of our platform and the effectiveness of our strategy for growth. We achieved increased revenue and gross margin expansion while also successfully managing our operating expenses. As a result of these factors, we also reported a third consecutive quarter of positive non-GAAP operating income. We believe we can continue to drive these margin improvements as we scale our operations and our customer base around the world. Turning to our product portfolio; our QTRAP system continues to be a mainstay for customers looking to detect extremely low levels of hazardous materials. We are seeing strong demand for our consumables and reagents with both existing customers and those new to 908 Devices’ technologies. Our M908 device continues to be our fastest-growing platform, driven by demand for rapid, on-the-go testing of a broad range of substances, from explosives to illicit drugs. Finally, in the second quarter, we achieved a major milestone: the receipt of FDA clearance for our CENSATM Device, which is now available for purchase by US customers. This clearance was the result of 3 years of hard work and dedication by many people at 908 Devices and we are excited to see it finally come to fruition.

In summary, we had a very productive second quarter and we look forward to building on this momentum going forward. I will now turn the call over to Peter Stuart to provide more detail on our second quarter financials. Peter? Peter Stuart – Chief Financial Officer Thanks, Brad. The record revenue in the second quarter was driven by strong demand for both our devices and consumables across all geographies and end markets. This improvement in gross margin was due primarily to increased economies of scale associated with increased product sales, as well as improved product mix. Our operating expenses were better than expected due to successful cost management initiatives undertaken during the quarter. This marks our third consecutive quarter of positive non-GAAP operating income. In summary, we are very pleased with our performance in the second quarter as we drove significant improvements in both revenue growth and profitability during the period. With that I’ll turn it back over to Brad for closing remarks. Brad Farrell – Chief Executive Officer Thank you, Peter. We continued to invest in sales and marketing capabilities while driving significant improvements in both revenue growth and profitability during the period. Thank you again for joining us today and I look forward to updating you on 908 Devices’ progress in the quarters ahead.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 908 Devices. More…

| Total Revenues | Net Income | Net Margin |

| 46.85 | -33.56 | -71.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 908 Devices. More…

| Operations | Investing | Financing |

| -25.03 | -0.74 | 94.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 908 Devices. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 242.59 | 51.99 | 6.21 |

Key Ratios Snapshot

Some of the financial key ratios for 908 Devices are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.6% | – | -75.5% |

| FCF Margin | ROE | ROA |

| -56.6% | -11.3% | -9.1% |

Share Price

On Tuesday, December 31, 2022, 908 DEVICES reported record-breaking fourth quarter earnings for the fiscal year 2022. 908 DEVICES stock opened at $8.8 and closed at $9.2, representing a 2.9% increase from the prior closing price of $9.0. The impressive quarterly earnings results have been attributed to the company’s strategic investments in R&D and marketing initiatives, as well as strong demand for their innovative products and services. 908 DEVICES has managed to buck the trend and post impressive results despite the difficult economic climate. The company’s impressive financials are also a testament to their commitment to delivering quality products and services that are designed to meet the needs of their customers.

The record-breaking quarter is yet another milestone for the company and a sign of continued future growth. 908 DEVICES is well-positioned to capitalize on the increasing demand for their products and services, both domestically and internationally. With their strong financials and innovative solutions, 908 DEVICES is poised to make even greater strides in the coming years. Live Quote…

Analysis

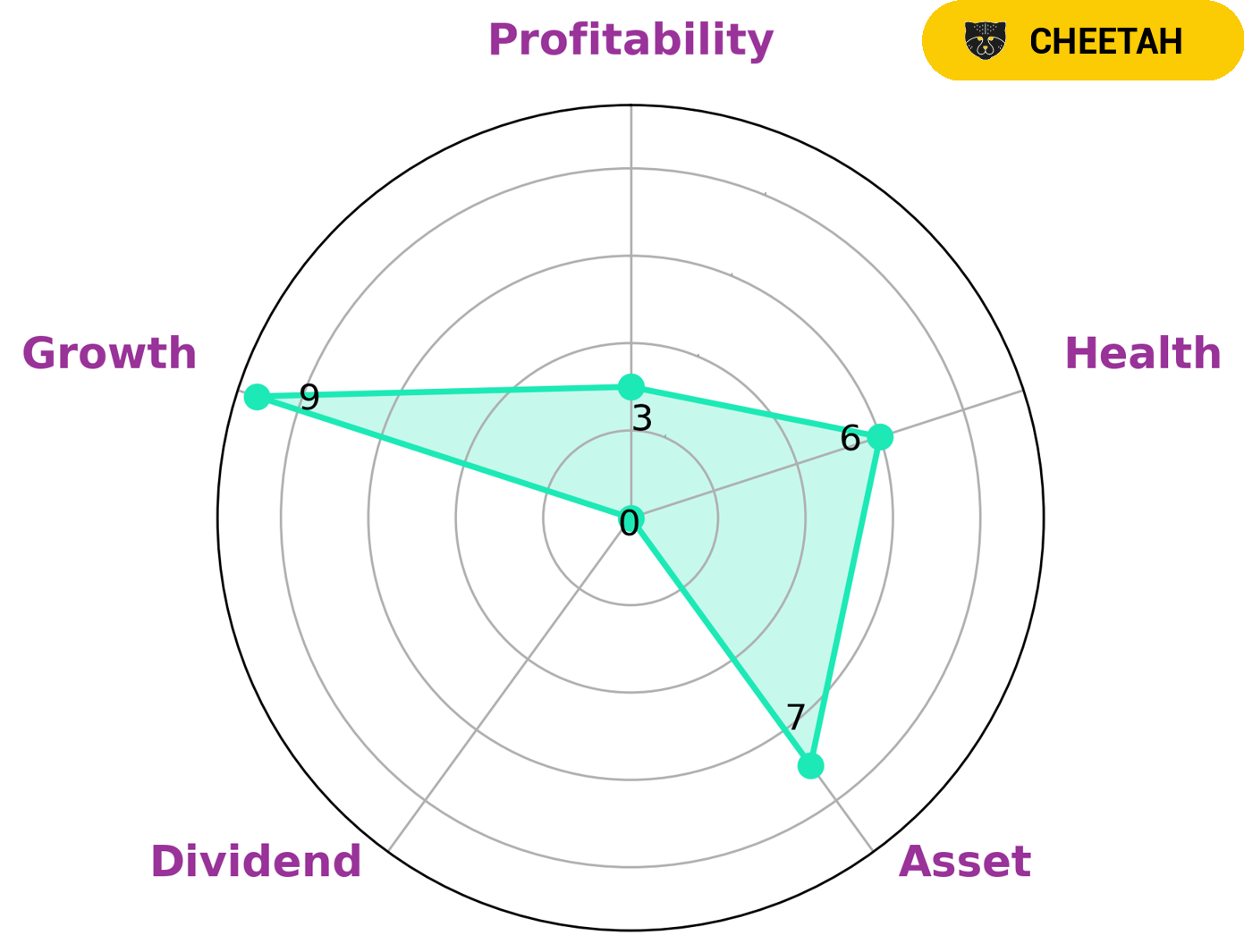

After conducting an analysis of 908 DEVICES‘s wellbeing, GoodWhale has identified 908 DEVICES as a ‘cheetah’ company. This categorization comes from the Star Chart, which classifies companies that have achieved high revenues and earnings growth but are considered less stable due to lower profitability. From our analysis, we can see that 908 DEVICES is strong in assets and growth, and weak in dividend and profitability. Despite its weaknesses, 908 DEVICES still has an intermediate health score of 6/10 when it comes to its cashflows and debt, which means it should be able to sustain future operations in times of crisis. This makes 908 DEVICES an attractive investment option for various types of investors. Growth investors will be interested in the company’s potential for future earnings growth. Value investors may look at 908 DEVICES’s assets, while risk-averse investors may be attracted to the company’s intermediate health score. All these factors combine to make 908 DEVICES a desirable option for a wide range of investor types. More…

Peers

The company’s products are used in a variety of industries, including healthcare, pharmaceuticals, food and beverage, environmental testing, and forensics. 908 Devices Inc’s main competitors are Cell Kinetics Ltd, Belluscura PLC, and Armm Inc.

– Cell Kinetics Ltd ($OTCPK:CKNTF)

Lumicell Inc is a medical device company that develops and commercializes proprietary technologies for the treatment of cancer. The company’s products are based on its proprietary Selective Photothermolysis System, which enables the delivery of energy selectively to cancer cells while sparing healthy tissue. Lumicell’s products are designed to improve patient outcomes and reduce treatment costs.

– Belluscura PLC ($LSE:BELL)

Belluscura PLC is a medical technology company that develops, manufactures, and markets medical devices for the treatment of respiratory disorders and other conditions. The company has a market cap of 77.01M as of 2022 and a Return on Equity of -18.87%. Belluscura PLC is headquartered in London, United Kingdom.

Summary

Investors in 908 DEVICES may be disappointed by the company’s fourth quarter earnings results, as total revenue decreased by 182.9%, while net income decreased by 26.5%. This is a substantial decrease year-over-year and suggests that investors should take caution when considering investing in 908 DEVICES. However, depending on the company’s future performance, there may be potential for long-term growth. It is important for investors to do their own due diligence and research the company thoroughly before making an investment decision.

Recent Posts