Wedge Capital Management L L P NC Increases Ironwood Pharmaceuticals, Position by 38.0%

June 27, 2023

☀️Trending News

Ironwood Pharmaceuticals ($NASDAQ:IRWD), Inc., is a biopharmaceutical company focused on developing and commercializing treatments for gastrointestinal diseases. The company has a portfolio of approved and pipeline therapies for the treatment of irritable bowel syndrome with diarrhea (IBS-D) and other gastrointestinal diseases. This increase in Wedge Capital’s investment in Ironwood Pharmaceuticals can be attributed to the company’s successful launch of Linzess, an approved therapy that is the only FDA-approved once-daily IBS-D treatment. The company expects to file for FDA approval later this year, further boosting investor confidence and driving Wedge Capital Management’s decision to increase its position in Ironwood.

Analysis

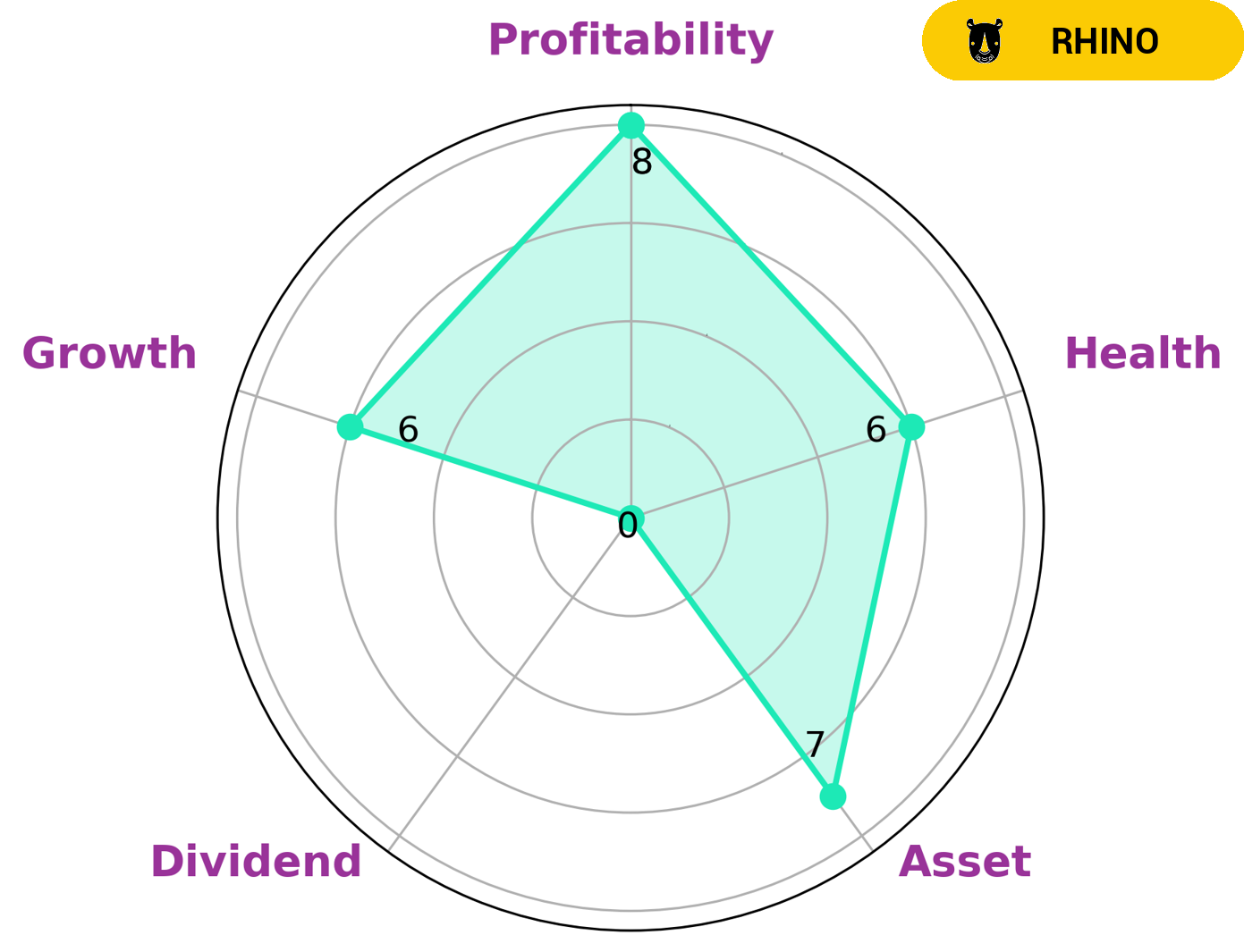

Our analysis of Ironwood Pharmaceuticals‘ wellbeing has revealed that it is an ‘elephant’ company, signifying that it is rich in assets once liabilities have been taken away. In terms of the Star Chart, Ironwood Pharmaceuticals is strong in asset, profitability, and medium in growth, but weak in dividend. This company is likely to be of great interest to value investors. Investors who focus on asset and profitability metrics are more likely to be drawn to Ironwood Pharmaceuticals than those who value growth and dividends. Furthermore, Ironwood Pharmaceuticals has a high health score of 8/10 with regard to its cashflows and debt, making it more than capable of sustaining future operations even in times of crisis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ironwood Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 417.13 | 181.98 | 43.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ironwood Pharmaceuticals. More…

| Operations | Investing | Financing |

| 273.76 | -0.14 | -237.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ironwood Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.16k | 448.43 | 4.2 |

Key Ratios Snapshot

Some of the financial key ratios for Ironwood Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | 20.6% | 64.5% |

| FCF Margin | ROE | ROA |

| 65.6% | 25.8% | 14.6% |

Peers

Its competitors are Sun Pharma Advanced Research Co Ltd, Strides Pharma Science Ltd, Glenmark Pharmaceuticals Ltd.

– Sun Pharma Advanced Research Co Ltd ($BSE:532872)

Sun Pharma Advanced Research Co Ltd has a market cap of 70.81B as of 2022. The company’s Return on Equity is -429.91%. Sun Pharma Advanced Research Co Ltd is a pharmaceutical company that specializes in the research and development of new drugs and therapies. The company’s products are sold in over 100 countries worldwide.

– Strides Pharma Science Ltd ($BSE:532531)

Strides Pharma Science Ltd is a pharmaceutical company with a market cap of 29.66B as of 2022. The company has a Return on Equity of -10.94%. The company’s main products are generic drugs and active pharmaceutical ingredients. The company operates in over 50 countries and has over 10,000 employees.

– Glenmark Pharmaceuticals Ltd ($BSE:532296)

Glenmark Pharmaceuticals is a pharmaceutical company headquartered in Mumbai, India. The company was founded in 1977 by Gracias Saldanha as a generic drug manufacturer. The company has over 8,000 employees and operates in over 40 countries. The company’s product portfolio includes drugs in the areas of cardiology, dermatology, diabetes, oncology, respiratory, and urology.

Summary

Ironwood Pharmaceuticals, Inc., is a biopharmaceutical company that focuses on developing and commercializing innovative medicines. Wedge Capital Management L L P NC recently increased its position in Ironwood Pharmaceuticals, Inc. by 38%. This indicates a positive outlook regarding the company’s potential for long-term growth. Analysis of Ironwood Pharmaceuticals, Inc. reveals that the company has consistently seen healthy sales growth over the years, while their operating margins have also remained strong.

Additionally, Ironwood has made significant investments in R&D, aiming to expand the depth and breadth of their product portfolio. This should help the company continue to remain competitive in the future. Overall, the analysis of Ironwood Pharmaceuticals, Inc. reveals a strong company with potential for further growth.

Recent Posts