Viatris Consumer-Health Assets Attract Potential €3billion Offers from CVC Capital Partners.

February 12, 2023

Trending News ☀️

Viatris Inc ($NASDAQ:VTRS). is a publicly traded healthcare company that is formed through the merger of Mylan and Upjohn, a division of Pfizer. Now, Viatris Inc. has become a potential target of acquisition as CVC Capital Partners is reportedly considering making an offer for Viatris Inc.’s European over-the-counter portfolio, which could be worth €3billion. This news has been revealed by traders, citing a Bloomberg report, and is being evaluated by Advent International’s Zentiva generics business and Bain-backed drugmaker Stada Arzneimittel. The offer is still in the very early stages and it is unclear if it will be accepted or not. If the acquisition goes through, it will be a huge boost to CVC’s portfolio in the consumer-health sector.

In addition, the company has strong relationships with many major healthcare providers around the world. The potential acquisition would be beneficial for both CVC and Viatris Inc., as the former will acquire a portfolio of assets that are already well established, while the latter will get access to €3billion in capital, which it can use to expand its reach and product offering. In addition, it could help Viatris Inc. become more competitive in the global market by giving it additional resources to expand its operations. Overall, the potential acquisition of Viatris Inc.’s European over-the-counter portfolio by CVC Capital Partners is highly significant and could help both companies reach their goals. Even though the offer is currently in the early stages, it could be a turning point in both companies’ histories if it goes through.

Price History

Viatris Inc. has attracted potential €3billion offers from CVC Capital Partners for its consumer-health assets. This news has been received positively by market participants, as the company’s stock opened at $12.0 and closed at $11.7 on Thursday, down by 1.7% from the prior closing price of 11.9. Viatris is the world’s largest provider of generic medicines and its major markets are the United States, Europe and the rest of the world. The potential offer from CVC Capital Partners is seen as an opportunity to unlock value for Viatris Inc shareholders, as it could provide a more focused approach to the consumer health business. The offer is expected to include assets such as over-the-counter products and personal care products. The proposed sale of Viatris Inc’s consumer health assets is seen as a strategic move by the company to focus on its core business of medicines, which is currently its main source of revenue. Analysts believe that this move could provide additional flexibility for Viatris Inc’s future growth plans, as it could help the company focus on its core products instead of having to manage a broad portfolio of products. At this stage, there is no indication of how much CVC Capital Partners may be willing to pay for Viatris Inc’s consumer health assets.

However, it is expected that the offer may be at least €3 billion, considering the size and scope of the company’s consumer health business. Viatris Inc’s management team is said to be considering all options carefully before making a final decision on the sale. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Viatris Inc. More…

| Total Revenues | Net Income | Net Margin |

| 16.73k | 803.6 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Viatris Inc. More…

| Operations | Investing | Financing |

| 3.33k | -483.1 | -2.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Viatris Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.66k | 29.48k | 15.82 |

Key Ratios Snapshot

Some of the financial key ratios for Viatris Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.7% | 46.3% | 10.4% |

| FCF Margin | ROE | ROA |

| 16.9% | 5.6% | 2.2% |

Analysis

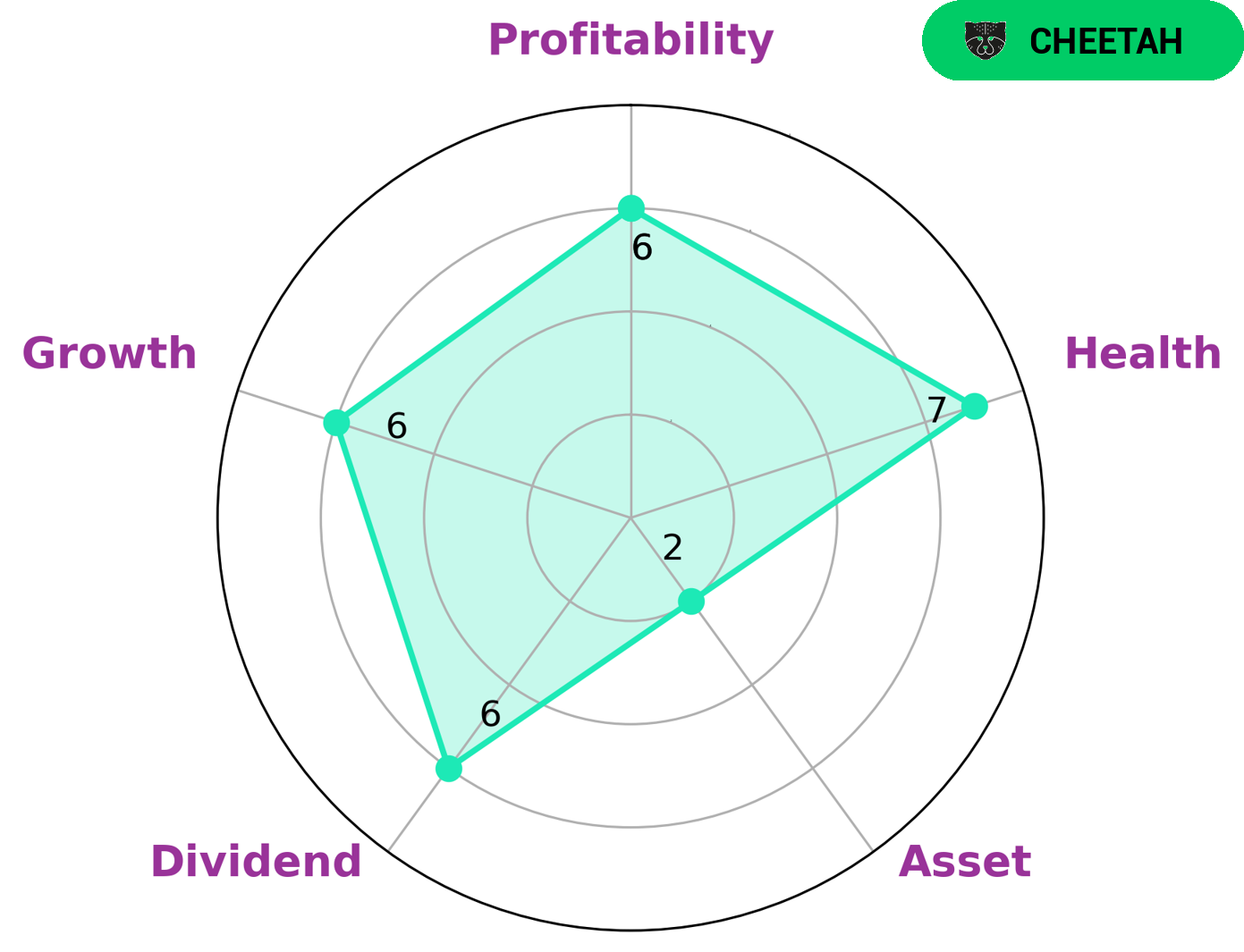

GoodWhale conducted an analysis of VIATRIS INC‘s financials and found that they were classified as a ‘cheetah’ company. This type of company is characterized by high revenue and earnings growth, but lower profitability and stability. For this reason, the company may be attractive to investors looking to invest in a company with high potential for growth but less of a focus on stability and profitability. VIATRIS INC is strong in terms of health score and weak in terms of asset. Its health score of 7/10 is considered to be high, indicating a strong ability to cover debt payments and fund future operations. In terms of dividends, growth, profitability, and assets, the company is considered to be medium. Overall, VIATRIS INC may be attractive to investors looking for a company with high potential for growth, but with less focus on stability and profitability. The company’s health score is high, indicating that it is capable of covering debt payments and funding future operations. In terms of dividends, growth, profitability, and assets, the company is considered to be medium. More…

Peers

The company has a rich history of more than 150 years, dating back to the founding of its predecessor companies, which include some of the world’s most well-known brands. Today, Viatris is a leading provider of essential medicines and solutions, with a presence in more than 150 countries and a workforce of over 30,000 people. The company’s mission is to provide access to high-quality medicines and solutions for patients and customers around the world. Viatris is committed to being a trusted partner for patients, customers, employees, shareholders, and society. The company’s products are available in a wide range of therapeutic areas, including cardiovascular, diabetes, oncology, respiratory, and other conditions. Viatris has a portfolio of more than 1,000 products, including many that are essential medicines. The company also offers a range of services, including manufacturing, distribution, and logistics, to support its customers and patients. Viatris’s competitors include Pfizer Inc, Teva Pharmaceutical Industries Ltd, GSK PLC, and other global pharmaceutical companies.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is an American multinational pharmaceutical corporation. It is one of the world’s largest pharmaceutical companies. The company was founded in 1849 by Charles Pfizer and Charles Erhart in Brooklyn, New York. The company’s headquarters are in New York City. The company’s products include medicines and vaccines for a wide range of medical conditions and diseases.

– Teva Pharmaceutical Industries Ltd ($NYSE:TEVA)

Teva Pharmaceutical Industries Ltd is a pharmaceutical company with a market cap of 9.07B as of 2022 and a Return on Equity of -9.35%. The company focuses on producing generic drugs and active pharmaceutical ingredients. Teva is the world’s largest manufacturer of generic drugs and one of the world’s largest pharmaceutical companies.

– GSK PLC ($LSE:GSK)

GlaxoSmithKline PLC is a British pharmaceutical company with a market capitalization of 58.8 billion pounds as of 2022. The company has a return on equity of 34.04%. GlaxoSmithKline is a global healthcare company that researches, develops, and manufactures pharmaceuticals, vaccines, and consumer healthcare products.

Summary

Recent reports suggest that Viatris Inc. has attracted potential offers from CVC Capital Partners valued at €3 billion for their consumer-health assets. This signals a potential for lucrative returns for investors due to the growing demand for healthcare-related products and services. The investment outlook for Viatris Inc. appears to be positive, supported by the strong industry growth and rise in consumer demand.

Analysts are likely to evaluate the company’s financial performance, competitive position and management capabilities, as well as the potential for further growth before making an investment decision. Investors should also assess the risks associated with investing in Viatris Inc., such as the impact of changing market dynamics and economic conditions.

Recent Posts