SG Americas Securities LLC Invests in Ironwood Pharmaceuticals, for Promising Healthcare Opportunities

May 19, 2023

Trending News ☀️

Ironwood Pharmaceuticals ($NASDAQ:IRWD), Inc. is an American biotechnology company that specializes in developing new medicines for unmet medical needs, including treatments for gastrointestinal disorders, respiratory and cardiovascular diseases. On May 16, 2023, SG Americas Securities LLC announced that they had acquired a new investment in Ironwood Pharmaceuticals, Inc., citing the company’s promising healthcare opportunities as the primary reason for the investment. The new investment from SG Americas Securities LLC is expected to significantly increase Ironwood Pharmaceuticals’ portfolio of treatments and capabilities, furthering their goal of providing unparalleled healthcare to patients worldwide. With this new partnership, Ironwood Pharmaceuticals will have access to the latest technology, research, and clinical expertise needed to bring new treatments to market faster and more efficiently.

Additionally, the two companies are working collaboratively to develop novel technologies that will help address existing and emerging healthcare needs. This investment marks yet another milestone in Ironwood Pharmaceuticals’ commitment to providing innovative therapies for unmet medical needs. The company has already achieved great success in the healthcare sector with its expanding pipeline of treatments and has established itself as a leader in the biotechnology world. With this new investment from SG Americas Securities LLC, Ironwood Pharmaceuticals is poised to become a major player in the healthcare industry and continue to provide groundbreaking therapies to patients around the world.

Stock Price

On Wednesday, Ironwood Pharmaceuticals stock opened at $10.2 and closed at the same price, up by 1.1% from its previous closing price of 10.1. This promising stock performance is indicative of the potential that Ironwood Pharmaceuticals holds in the healthcare sector. The company’s portfolio of medicines, combined with innovative research programs, makes it an attractive investment opportunity for long-term investors. Ironwood Pharmaceuticals’ commitment to developing new treatments for serious diseases, backed by SG Americas Securities LLC’s investment, ensures that the company will remain competitive and well-positioned for growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ironwood Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 417.13 | 181.98 | 43.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ironwood Pharmaceuticals. More…

| Operations | Investing | Financing |

| 273.76 | -0.14 | -237.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ironwood Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.16k | 448.43 | 4.2 |

Key Ratios Snapshot

Some of the financial key ratios for Ironwood Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | 20.6% | 64.5% |

| FCF Margin | ROE | ROA |

| 65.6% | 25.8% | 14.6% |

Analysis

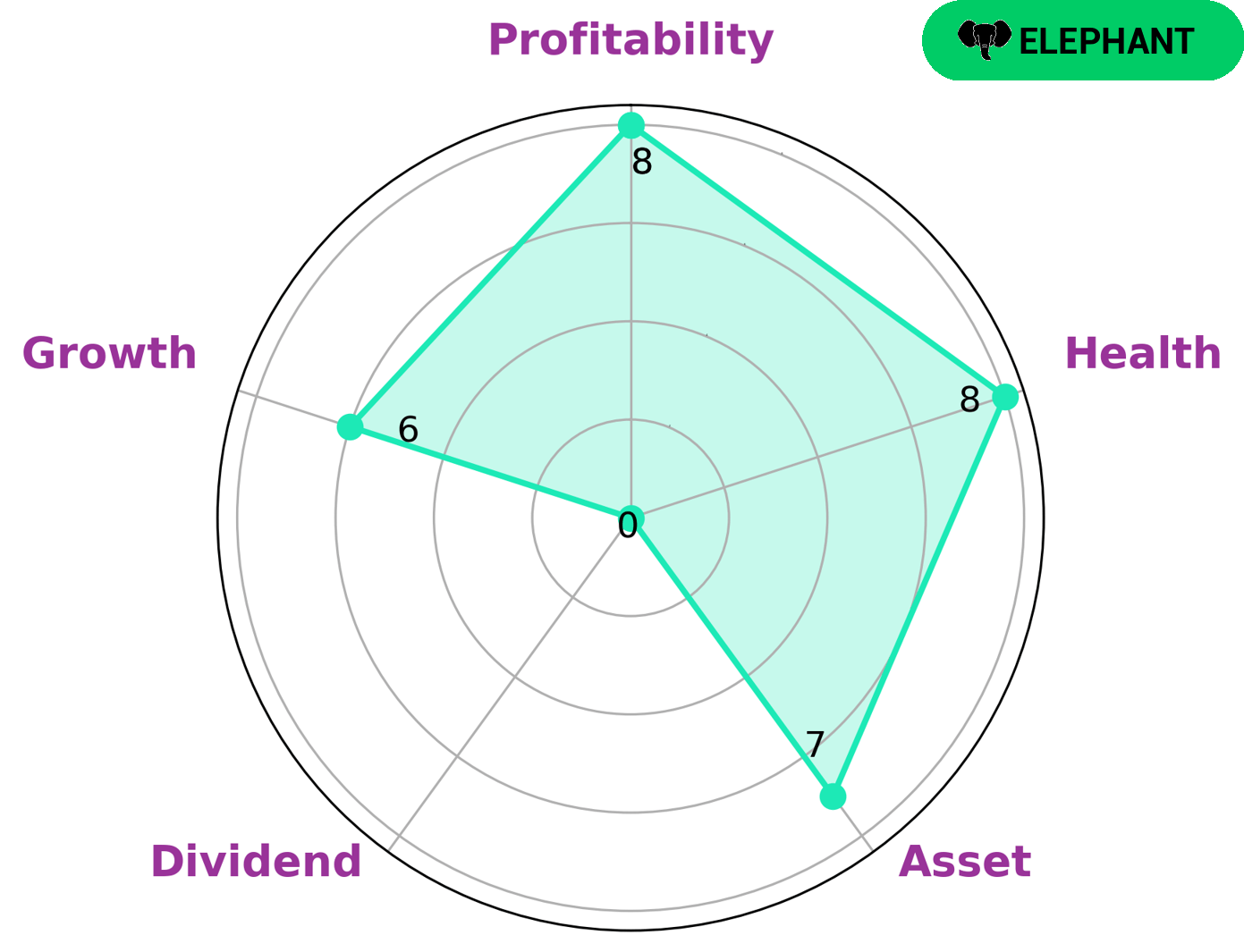

GoodWhale conducted an analysis of IRONWOOD PHARMACEUTICALS‘s wellbeing, and the results of this analysis were displayed in our Star Chart. The chart showed that IRONWOOD PHARMACEUTICALS had strong assets, profitability, and moderate growth, while its dividend score was weaker. Overall, the company had a health score of 8/10, indicating that it is capable of sustaining future operations in times of crisis. Our analysis also classified IRONWOOD PHARMACEUTICALS as an ‘elephant’, a type of company which is very asset-rich after liabilities are deducted. Given their strong asset base, IRONWOOD PHARMACEUTICALS may be of interest to investors looking for long-term stability and security. Additionally, the company’s relatively low dividend score may make them attractive to investors who are seeking returns from growth rather than income. More…

Peers

Its competitors are Sun Pharma Advanced Research Co Ltd, Strides Pharma Science Ltd, Glenmark Pharmaceuticals Ltd.

– Sun Pharma Advanced Research Co Ltd ($BSE:532872)

Sun Pharma Advanced Research Co Ltd has a market cap of 70.81B as of 2022. The company’s Return on Equity is -429.91%. Sun Pharma Advanced Research Co Ltd is a pharmaceutical company that specializes in the research and development of new drugs and therapies. The company’s products are sold in over 100 countries worldwide.

– Strides Pharma Science Ltd ($BSE:532531)

Strides Pharma Science Ltd is a pharmaceutical company with a market cap of 29.66B as of 2022. The company has a Return on Equity of -10.94%. The company’s main products are generic drugs and active pharmaceutical ingredients. The company operates in over 50 countries and has over 10,000 employees.

– Glenmark Pharmaceuticals Ltd ($BSE:532296)

Glenmark Pharmaceuticals is a pharmaceutical company headquartered in Mumbai, India. The company was founded in 1977 by Gracias Saldanha as a generic drug manufacturer. The company has over 8,000 employees and operates in over 40 countries. The company’s product portfolio includes drugs in the areas of cardiology, dermatology, diabetes, oncology, respiratory, and urology.

Summary

Ironwood Pharmaceuticals, Inc. is a promising investment opportunity in the healthcare sector. On May 16, 2023, &SG Americas Securities LLC announced the purchase of a new position in Ironwood Pharmaceuticals, Inc. The company’s potential for growth is very promising, as it has already introduced multiple innovative treatments and medications through its focused therapeutic areas.

Additionally, their financials are strong, with a healthy balance sheet and a low debt-to-equity ratio. The stock price is also trending upwards, making it an attractive investment option. Analysts estimate that the company has the potential to grow significantly as it continues to expand its product portfolio and increase its presence in the global market.

Recent Posts