Lantheus Holdings Poised to Lead Radiopharmaceuticals Market in 2031 with Key Trend Analysis

June 12, 2023

☀️Trending News

Lantheus Holdings ($NASDAQ:LNTH) is a leading innovator in the field of radiopharmaceuticals. With their recent acquisitions of Mevion Medical Systems and Progenics Pharmaceuticals, Lantheus Holdings is now positioned to become a leader in the radiopharmaceuticals market for 2031. This analysis of key trends in the radiopharmaceuticals market will provide insight into how Lantheus Holdings can best take advantage of the opportunities available to them. The primary trend that will affect the industry is the continued emergence and advancement of new technology. This includes the development of new diagnostic techniques, such as molecular imaging and 3D imaging, as well as advances in targeted therapy and drug delivery. As these technologies are adopted, it will become increasingly important for Lantheus Holdings to have access to cutting-edge products to remain competitive. Along with new technology, the demand for more personalized healthcare is expected to continue to rise over the next decade.

This trend will lead to an increased focus on targeted therapies that are tailored to the individual patient’s needs. This means that Lantheus Holdings will need to ensure they have access to the most advanced radiopharmaceuticals in order to meet this rising demand. Finally, regulatory changes are expected to play a major role in the radiopharmaceuticals market for 2031. As governments and healthcare organizations continue to update their policies and guidelines, Lantheus Holdings will need to remain up-to-date on the latest regulations in order to remain compliant and competitive. The company’s strategic acquisitions and access to cutting-edge technology, along with their commitment to personalized healthcare and staying abreast of regulatory changes, will ensure they remain a leader in this rapidly changing industry.

Share Price

On Thursday, LANTHEUS HOLDINGS stock opened at $86.5 and closed at $88.8, up by 2.3% from its previous closing price of 86.8. According to a recent trend analysis, the company is expected to be the leader in radiopharmaceuticals market by 2031. This is attributed to its consistent dedication to innovation and its ability to stay ahead of the competition. The company has a diverse product portfolio that includes diagnostic imaging agents, therapeutic radiopharmaceuticals, and other related products. In the last two years, the company has shown remarkable growth in its revenues, which is an indication of its strong market position. Furthermore, the company has made significant investments in research and development to bring new products to the market and increase its customer base.

This is expected to be a major factor in the company’s success in the future. The company is also investing heavily in marketing and advertising campaigns to promote its products and increase its market share. Furthermore, it has also taken measures to reduce its costs and improve efficiency in order to stay competitive in the market. The company’s strong financial position, market leadership, and consistent commitment to innovation are expected to contribute significantly to this achievement. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lantheus Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.03k | -17.7 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lantheus Holdings. More…

| Operations | Investing | Financing |

| 380.02 | -319.67 | 305.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lantheus Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.35k | 903.77 | 6.53 |

Key Ratios Snapshot

Some of the financial key ratios for Lantheus Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 43.0% | -11.2% | -3.1% |

| FCF Margin | ROE | ROA |

| 34.6% | -4.4% | -1.5% |

Analysis

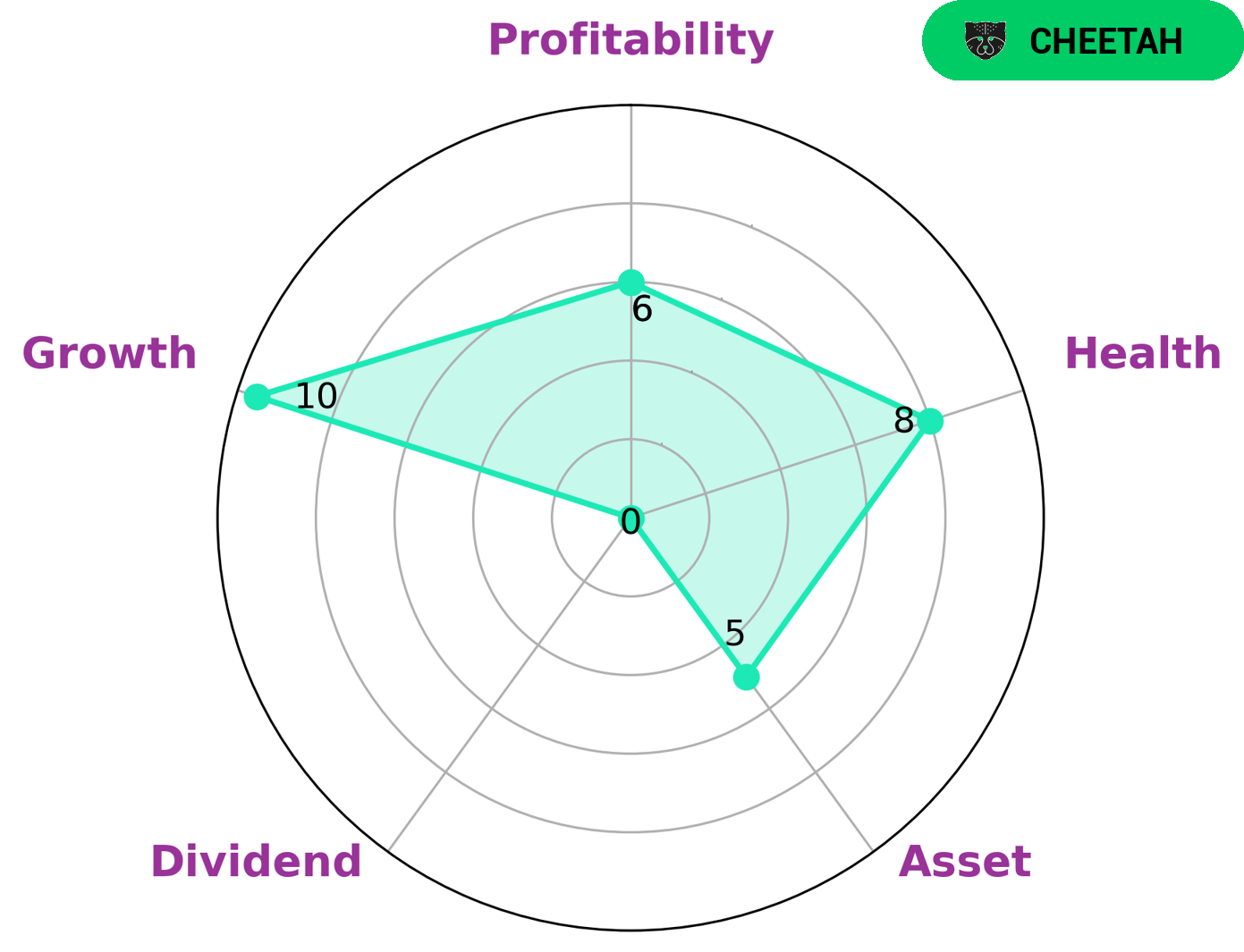

At GoodWhale, we recently conducted an analysis of LANTHEUS HOLDINGS wellbeing. We used our Star Chart to evaluate their health score, which came out as 8/10. This higher score was achieved considering the company’s cashflows and debt, which demonstrate its capability to pay off debt and fund future operations. Further, we found that LANTHEUS HOLDINGS is strong in growth, medium in asset, profitability and weak in dividend. Based on this, we classified LANTHEUS HOLDINGS as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are focused on capital appreciation and willing to take higher risk may find this company attractive. However, those who are looking for more stability and consistent dividend would not be the right fit for LANTHEUS HOLDINGS. More…

Peers

The company operates through two segments, Diagnostic Imaging and Therapeutic Imaging. The Diagnostic Imaging segment provides contrast media products and related services used in diagnostic imaging procedures. The Therapeutic Imaging segment provides nuclear imaging products and services used in molecular and nuclear medicine procedures. Lantheus Holdings Inc’s competitors include RadNet Inc, Akumin Inc, and Todos Medical Ltd. RadNet Inc is a provider of outpatient diagnostic imaging services in the United States. Akumin Inc is a provider of diagnostic imaging services in the United States and Canada. Todos Medical Ltd is a biotechnology company that develops and commercializes blood tests for the early detection of cancer.

– RadNet Inc ($NASDAQ:RDNT)

RadNet, Inc. is a national provider of freestanding, fixed-site outpatient diagnostic imaging services in the United States. As of December 31, 2020, RadNet operated a network of 284 outpatient imaging centers located in California, Delaware, Maryland, Massachusetts, New Jersey, New York and Virginia. RadNet’s core business is providing high-quality diagnostic imaging services, including magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), nuclear medicine, mammography, ultrasound, digital x-ray, diagnostic radiology and fluoroscopy, at its outpatient imaging centers.

– Akumin Inc ($NASDAQ:AKU)

Akumin Inc is a holding company that, through its subsidiaries, provides outpatient diagnostic imaging services in the United States. It operates through the following segments: Imaging Centers and Mobile Imaging. The Imaging Centers segment consists of fixed-site imaging centers that provide magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, general x-ray, and diagnostic cardiology services. The Mobile Imaging segment acquires, leases, and operates mobile imaging equipment that provides magnetic resonance imaging, computed tomography, ultrasound, and general x-ray services. The company was founded on December 12, 2005 and is headquartered in Dallas, TX.

– Todos Medical Ltd ($OTCPK:TOMDF)

Todos Medical Ltd has a market cap of 19.09M as of 2022, a Return on Equity of 43.06%. The company is engaged in the business of providing diagnostic products and services for the early detection, diagnosis and prognosis of cancer and other diseases. The company’s products and services include blood tests, tissue tests and imaging services. The company’s blood tests are used to detect the presence of cancer cells in the blood, while its tissue tests are used to detect the presence of cancer cells in the tissue. The company’s imaging services are used to detect the presence of cancer cells in the body.

Summary

Lantheus Holdings is a leading healthcare company in the diagnostic imaging and radiopharmaceuticals market. It offers key products such as Cardiolite, DEFINITY, Neurolite and Axumin, which are used for diagnosis and therapeutic treatments. Investors looking to get involved in this company need to carefully consider the market trends and dynamics associated with the diagnostic imaging and radiopharmaceuticals industry. The market is expected to grow significantly in the coming years, driven by increased demand for imaging equipment, higher utilization of nuclear medicine procedures, and increasing government support for healthcare investments. Lantheus has a strong presence in the North American and European markets and is well-positioned to take advantage of the growing global demand. Investors should also consider the company’s excellent financial performance, with a strong balance sheet and healthy cash flow.

Additionally, Lantheus is actively involved in research and development activities to develop innovative products to enter into new markets such as Asia-Pacific region. With its excellent financial standing and strong product portfolio, Lantheus Holdings looks like an attractive investment opportunity in the diagnostic imaging and radiopharmaceuticals market.

Recent Posts