Lantheus Holdings Intrinsic Stock Value – EU Recommends Lantheus Prostate Cancer Diagnostics for Approval

May 27, 2023

Trending News 🌧️

Lantheus Holdings ($NASDAQ:LNTH), Inc. is a global leader in the development, production, and commercialization of innovative diagnostic imaging agents and products. Recently, the European Union has recommended approval for Lantheus’ prostate cancer diagnostics. The diagnostic imaging agent, which enables a detailed visualization of a variety of prostate cancer types, is expected to provide doctors with more accurate information to help them make better decisions about patient care.

Additionally, it will also improve the accuracy of diagnosis for prostate cancer and deliver improved outcomes for patients. Lantheus is committed to providing quality products and services to its customers and is passionate about improving patient care and outcomes. With the EU recommendation, Lantheus will be able to further its mission to provide high-quality diagnostics and imaging solutions that can help enhance patient care. This news is an exciting development for the company and its investors as it will bolster the company’s standing as a leader in the medical imaging space.

Price History

On Friday, LANTHEUS HOLDINGS experienced a significant drop in stock price following an announcement from the European Union (EU) that it recommends their prostate cancer diagnostics for approval. The stock opened at $98.1 and closed at $91.0, representing a 6.9% drop from its prior closing price of $97.8. This decision brings them one step closer to providing their medical imaging solutions to markets across Europe. While the ultimate decision of any approval lies with the European Commission, the EU’s recommendation provides a favorable outlook for LANTHEUS HOLDINGS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lantheus Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.03k | -17.7 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lantheus Holdings. More…

| Operations | Investing | Financing |

| 380.02 | -319.67 | 305.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lantheus Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.35k | 903.77 | 6.53 |

Key Ratios Snapshot

Some of the financial key ratios for Lantheus Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 43.0% | -11.2% | -3.1% |

| FCF Margin | ROE | ROA |

| 34.6% | -4.4% | -1.5% |

Analysis – Lantheus Holdings Intrinsic Stock Value

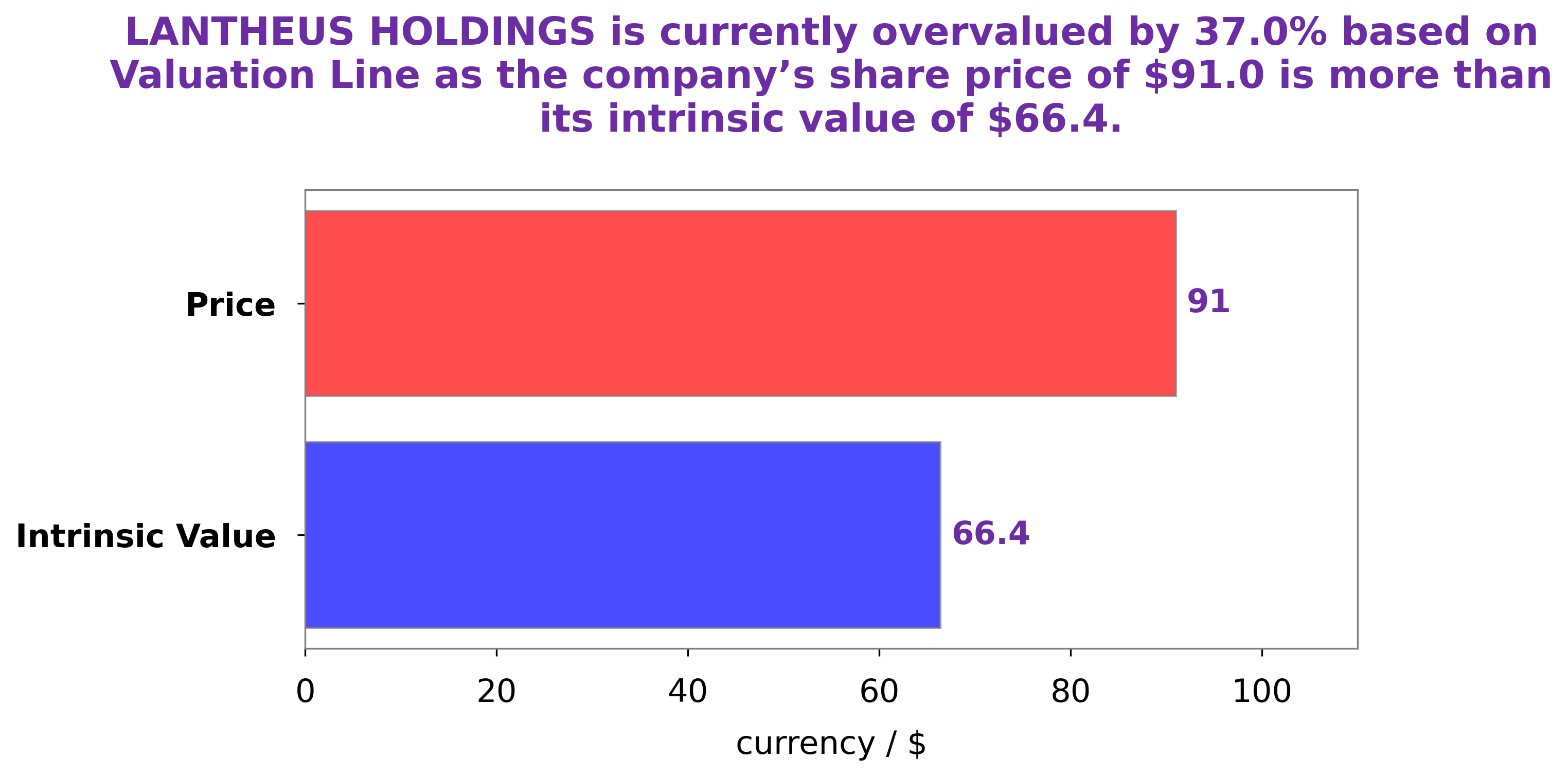

At GoodWhale, we’ve conducted an in-depth analysis of LANTHEUS HOLDINGS‘ fundamentals. We have used our proprietary Valuation Line to calculate the fair value of LANTHEUS HOLDINGS’ stock and it comes out to around $66.4. However, the stock is currently trading at $91.0, which means it is overvalued by 37.0%. We believe that this may be an opportunity for investors to take advantage of the current market and buy the stock at a discounted price. More…

Peers

The company operates through two segments, Diagnostic Imaging and Therapeutic Imaging. The Diagnostic Imaging segment provides contrast media products and related services used in diagnostic imaging procedures. The Therapeutic Imaging segment provides nuclear imaging products and services used in molecular and nuclear medicine procedures. Lantheus Holdings Inc’s competitors include RadNet Inc, Akumin Inc, and Todos Medical Ltd. RadNet Inc is a provider of outpatient diagnostic imaging services in the United States. Akumin Inc is a provider of diagnostic imaging services in the United States and Canada. Todos Medical Ltd is a biotechnology company that develops and commercializes blood tests for the early detection of cancer.

– RadNet Inc ($NASDAQ:RDNT)

RadNet, Inc. is a national provider of freestanding, fixed-site outpatient diagnostic imaging services in the United States. As of December 31, 2020, RadNet operated a network of 284 outpatient imaging centers located in California, Delaware, Maryland, Massachusetts, New Jersey, New York and Virginia. RadNet’s core business is providing high-quality diagnostic imaging services, including magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), nuclear medicine, mammography, ultrasound, digital x-ray, diagnostic radiology and fluoroscopy, at its outpatient imaging centers.

– Akumin Inc ($NASDAQ:AKU)

Akumin Inc is a holding company that, through its subsidiaries, provides outpatient diagnostic imaging services in the United States. It operates through the following segments: Imaging Centers and Mobile Imaging. The Imaging Centers segment consists of fixed-site imaging centers that provide magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, general x-ray, and diagnostic cardiology services. The Mobile Imaging segment acquires, leases, and operates mobile imaging equipment that provides magnetic resonance imaging, computed tomography, ultrasound, and general x-ray services. The company was founded on December 12, 2005 and is headquartered in Dallas, TX.

– Todos Medical Ltd ($OTCPK:TOMDF)

Todos Medical Ltd has a market cap of 19.09M as of 2022, a Return on Equity of 43.06%. The company is engaged in the business of providing diagnostic products and services for the early detection, diagnosis and prognosis of cancer and other diseases. The company’s products and services include blood tests, tissue tests and imaging services. The company’s blood tests are used to detect the presence of cancer cells in the blood, while its tissue tests are used to detect the presence of cancer cells in the tissue. The company’s imaging services are used to detect the presence of cancer cells in the body.

Summary

Lantheus Holdings is an imaging technology company that was recently recommended for EU approval for its prostate cancer diagnostic. This has been seen as a positive step for the company, as it will expand its ability to provide earlier and more accurate diagnosis of prostate cancer. For investors, this news has had an immediate effect on the stock price, causing it to move down on the day of the approval announcement. Analysts suggest that this may be due to uncertainty about how much of an impact the approval will have on the company’s long-term outlook, but overall the news appears to be positive with analysts projecting increased profits over the next few years.

In addition, the company recently launched a new imaging system which could improve accuracy even further. Investors should consider this approval and new technology when deciding whether or not to invest in Lantheus Holdings.

Recent Posts