Intra-Cellular Therapies Q4 2023 GAAP EPS Beats Expectations by $0.15.

March 5, 2023

Trending News 🌥️

INTRA-CELLULAR ($NASDAQ:ITCI): Intra-Cellular Therapies ended the fourth quarter of 2023 with a GAAP earnings per share (EPS) of -$0.45, beating estimates by $0.15 per share. Overall, Intra-Cellular Therapies has delivered a strong performance with its Q4 earnings, despite the challenging circumstances it faced during the reporting period. The company’s management has attributed its success to its focus on streamlining operations, reducing expenses and mitigating risks. They have also noted that their products continue to perform well, demonstrating that their solutions are comprehensive and effective.

The company’s strategy for the coming quarters will involve continuing to pursue cost containment initiatives, diversifying its product portfolio, and seeking out new markets for growth. With these measures in place, Intra-Cellular Therapies is well-positioned to capitalize on the opportunities in its industry and to deliver even better results in the future.

Market Price

On Wednesday, INTRA-CELLULAR THERAPIES stock opened at $50.0 and closed at $49.3, up by 0.6% from previous closing price of 49.0. This was due to their Q4 2023 GAAP EPS beating expectations by $0.15. As news of the impressive performance spread through the markets, investors were encouraged and their confidence in the company was strengthened, leading to the 0.6% increase in stock prices. Such strong financial performance was just another indication of the success of INTRA-CELLULAR THERAPIES’ innovative intra-cellular therapies that have been revolutionizing the medical industry for several years now. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Intra-cellular Therapies. More…

| Total Revenues | Net Income | Net Margin |

| 249.13 | -256.26 | -102.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Intra-cellular Therapies. More…

| Operations | Investing | Financing |

| -270.19 | -128.37 | 455.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Intra-cellular Therapies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 754.78 | 98.71 | 6.92 |

Key Ratios Snapshot

Some of the financial key ratios for Intra-cellular Therapies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1501.8% | – | -105.8% |

| FCF Margin | ROE | ROA |

| -108.8% | -24.6% | -21.8% |

Analysis

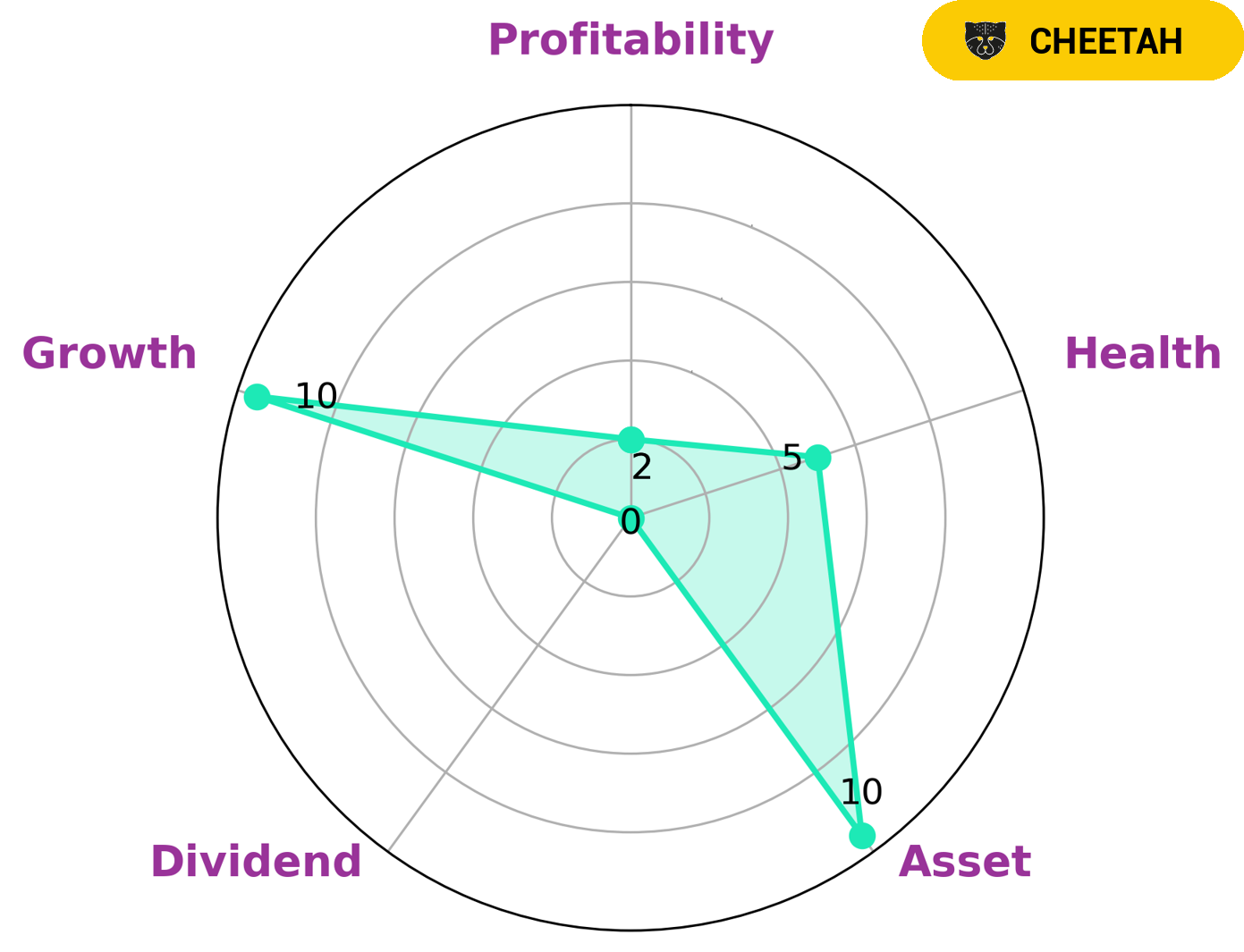

At GoodWhale, we have been analyzing the financials of INTRA-CELLULAR THERAPIES and assessing its performance using our Star Chart rating system. The results indicate that INTRA-CELLULAR THERAPIES is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but has lower profitability and therefore is seen as less stable. Based on this analysis, INTRA-CELLULAR THERAPIES is strong in asset, growth and weak in dividend payouts and profitability. Additionally, INTRA-CELLULAR THERAPIES has an intermediate health score of 5/10 with regard to its cashflows and debt, which indicates that it is likely to safely ride out any crisis without the risk of bankruptcy. Given this assessment and the potential for growth, INTRA-CELLULAR THERAPIES may be an attractive investment opportunity for investors who are comfortable with higher risk investments. Additionally, it may also be an ideal fit for day traders or active investors as there is potential for short-term reward. More…

Peers

The company’s lead product candidate, lumateperone, is in Phase III clinical trials for the treatment of schizophrenia. SCYNEXIS Inc, Invion Ltd, and Shuttle Pharmaceuticals Holdings Inc are all clinical stage biopharmaceutical companies that focus on the development of small molecule drugs for the treatment of neuropsychiatric disorders.

– SCYNEXIS Inc ($NASDAQ:SCYX)

SCYNEXIS Inc is a biopharmaceutical company that focuses on the development and commercialization of oral and intravenous anti-infective agents to treat patients with serious and life-threatening infections. The company’s lead product, SCY-078, is a novel, first-in-class oral and intravenous agent in clinical development for the treatment of serious fungal infections. The company’s second product, SCY-123, is an oral agent in clinical development for the treatment of bacterial infections, including Clostridium difficile infection.

– Invion Ltd ($ASX:IVX)

Invion Ltd is a development stage biopharmaceutical company, which focuses on the treatment of cancer and inflammatory disease. The company was founded in 2003 and is headquartered in Brisbane, Australia.

– Shuttle Pharmaceuticals Holdings Inc ($NASDAQ:SHPH)

Shuttle Pharmaceuticals Holdings Inc is a pharmaceutical company with a market cap of 25.81M as of 2022. The company has a Return on Equity of 47.66%. Shuttle Pharmaceuticals Holdings Inc is engaged in the research, development, manufacture, and sale of pharmaceutical products. The company’s products include prescription and over-the-counter drugs, as well as nutritional supplements and other health-related products.

Summary

Intra-Cellular Therapies has delivered positive results in their recent Q4 2023 GAAP earnings, beating analyst expectations by $0.15 per share. This marks a great step forward for the company, as it demonstrates their potential to be a profitable investment. This indicates that the company is managing their costs efficiently and improving their operating margin.

Additionally, their share price has also increased as a result of the earnings release, which could be an indication that investors have become more confident in Intra-Cellular Therapies. Overall, these results suggest that the company is making progress in the right direction and may be a lucrative investment for those looking to diversify their portfolio.

Recent Posts