Harrow Health to Present at B. Riley Securities 23rd Annual Institutional Investor Conference on May 24, 2023.

May 25, 2023

Trending News ☀️

Harrow Health ($NASDAQ:HROW), a leading U.S. eyecare pharmaceutical company, will present at the B. Riley Securities 23rd Annual Institutional Investor Conference on May 24, 2023. The company has achieved success since its founding, becoming a major player in the industry with its innovative products and services. Harrow Health’s commitment to its customers drives the company’s expanding portfolio of eye care solutions and treatments. The company is dedicated to providing comprehensive, quality products and consumer support, while delivering long-term value to its stakeholders. At the conference, Harrow Health will present its latest financial results and provide an update on the company’s achievements over the past year.

Representatives from the company will also be on hand to answer questions from investors, giving them a better understanding of the direction of the company and its growth prospects. Attendees of the conference can expect to gain insight into the company’s operations, including product launches, pricing strategies, customer acquisition, and other key business initiatives. It is also a chance for the company to build relationships with potential investors and increase its visibility in the market. Harrow Health looks forward to connecting with investors and engaging in meaningful dialogue at the conference.

Market Price

On Thursday, the stock opened at $21.6 and closed at $21.0, representing a 3.1% decrease from its previous closing price of $21.6. This announcement is likely to increase investor interest in the company and its products, with the anticipation of an increase in stock prices in the near future. It is expected that HARROW HEALTH will use this opportunity to showcase its advances in technology and products and give investors an insight into the company’s vision for the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Harrow Health. More…

| Total Revenues | Net Income | Net Margin |

| 92.58 | -18.29 | -18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Harrow Health. More…

| Operations | Investing | Financing |

| -7.48 | -132.3 | 117.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Harrow Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 217.5 | 195.97 | 0.73 |

Key Ratios Snapshot

Some of the financial key ratios for Harrow Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.2% | – | 0.4% |

| FCF Margin | ROE | ROA |

| -157.5% | 1.0% | 0.1% |

Analysis

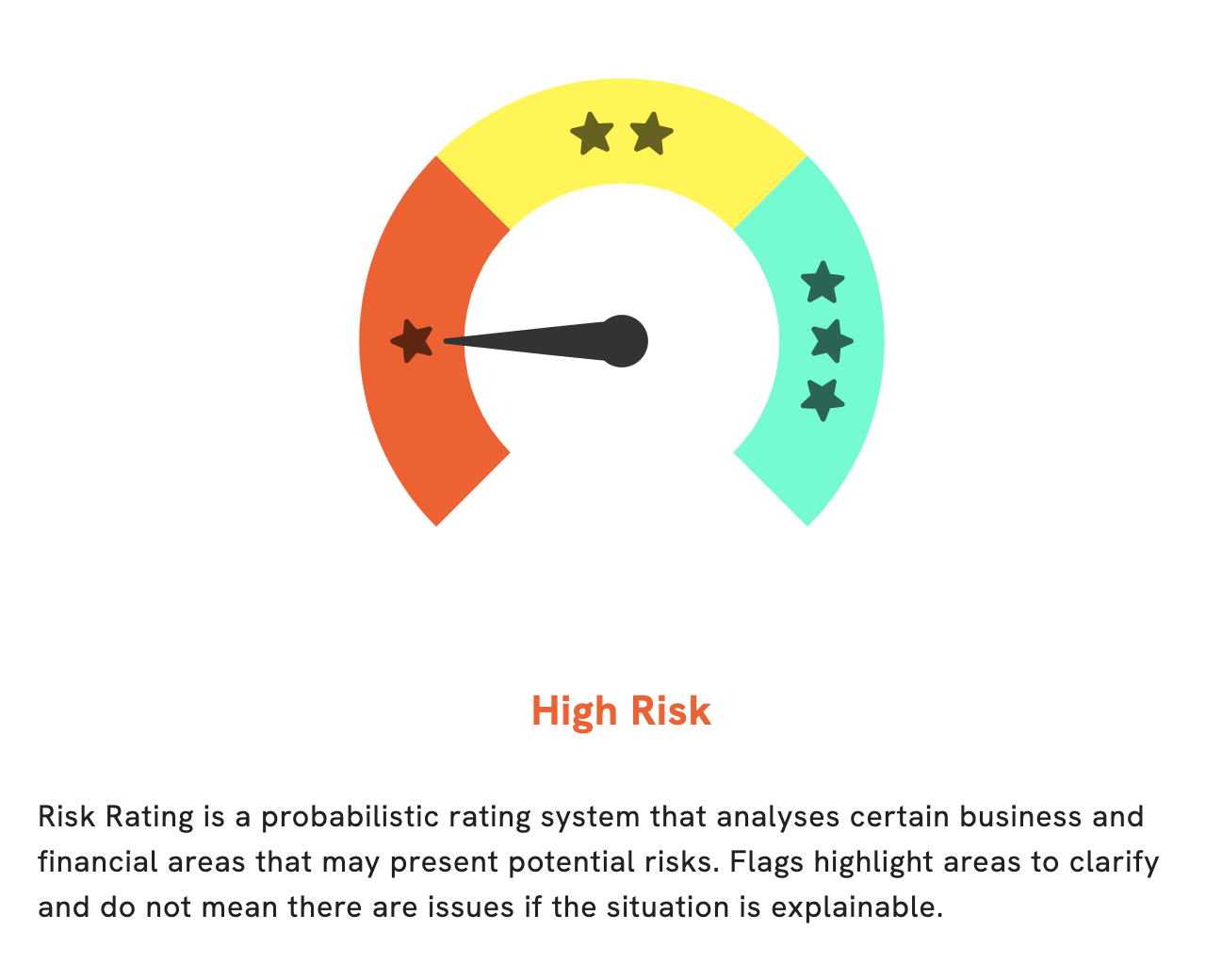

At GoodWhale, we have conducted an analysis of HARROW HEALTH‘s financials. Based on our Risk Rating, HARROW HEALTH is considered a high risk investment in terms of its financial and business aspects. We have detected three risk warnings in its income sheet, balance sheet, and cash flow statement. If you are interested in learning more about HARROW HEALTH, become a registered user and check out our detailed analysis. More…

Peers

Its competitors include Universe Pharmaceuticals Inc, CEN Biotech Inc, and Earth Science Tech Inc.

– Universe Pharmaceuticals Inc ($NASDAQ:UPC)

Universe Pharmaceuticals Inc is a pharmaceutical company with a market cap of 25.66M as of 2022. The company has a Return on Equity of 7.88%. Universe Pharmaceuticals Inc is engaged in the research, development, manufacture and sale of pharmaceutical and health products. The company’s products include prescription drugs, over-the-counter drugs, herbal remedies and dietary supplements. Universe Pharmaceuticals Inc is headquartered in New York, New York.

– CEN Biotech Inc ($OTCPK:CENBF)

CEN Biotech is a biotech company that focuses on developing and commercializing innovative therapies for the treatment of cancer and other serious diseases. The company has a market cap of 2.73M and a ROE of 97.87%. CEN Biotech is a publicly traded company on the OTCQB market under the ticker symbol “CENB”.

– Earth Science Tech Inc ($OTCPK:ETST)

With a market cap of 2.59M, Science Tech Inc is a small company with a ROE of -103.79%. The company focuses on providing innovative engineering and technical solutions to the commercial, industrial, and governmental sectors. Science Tech Inc has a long history of providing quality services and products that meet or exceed customer expectations. The company is committed to providing value to its customers through its products and services.

Summary

Harrow Health Inc. has seen its stock price move down following its announcement that it would participate in the B. Riley Securities 23rd Annual Institutional Investor Conference on May 24, 2023. While the company is yet to provide insight into the expectations for the conference, investors may be cautious given the uncertain economic environment. However, as the company remains a leader in U.S. eyecare pharmaceuticals, investors may view the conference as a potential opportunity for the company to build on its successes and drive long-term, sustainable growth.

Recent Posts