FDA Rejects Viatris’s Biosimilar Marketing Application for Cancer Therapy Bevacizumab.

February 15, 2023

Trending News 🌧️

On Friday, Biocon, the Indian partner of Viatris Inc ($NASDAQ:VTRS)., a global healthcare company with a mission to provide access to high-quality medicines, announced that the U.S. Food and Drug Administration (FDA) had rejected the marketing application for a biosimilar form of the cancer therapy bevacizumab which they had submitted. This news comes as a major setback for Viatris Inc., as the approval of this drug would have enabled them to launch a new product in the U.S. market for cancer treatment – one of the fastest-growing areas of therapeutic medicine. Viatris Inc. is the result of a merger between Mylan N.V. and Upjohn, two leading companies in generic and specialty medicines. Viatris Inc. aims to make high-quality medicines accessible and affordable to patients around the world by expanding its portfolio with innovative treatments, partnering with governments and other healthcare organizations, and leveraging its global reach to increase access to healthcare. The FDA rejection of the biosimilar form of bevacizumab is a major blow to Viatris Inc.’s plans to expand its product portfolio in the U.S., as well as its mission to provide access to high-quality medicines worldwide.

This setback reaffirms the need for increased scrutiny from regulatory authorities when evaluating new treatments and highlights the importance of comprehensive clinical studies in order to prove a drug’s safety and efficacy. Despite this setback, Viatris Inc. remains committed to its mission of providing access to high-quality medicines and is hopeful that other applications will be approved in the future. The company is working hard to meet the needs of patients and is continuously striving to develop innovative treatments that will revolutionize healthcare across the globe.

Market Price

On Tuesday, Viatris Inc. received news from the U.S. Food and Drug Administration that their biosimilar marketing application for a cancer therapy drug bevacizumab was rejected. The news has had mostly negative media exposure, causing their stock to open at $12.0 and close at $11.8, down 1.4% from the prior closing price of 12.0. The rejection of Viatris Inc’s application resulted in a setback for the company, as their drug was intended to be an alternative to current treatments. Viatris Inc. was aiming to provide a more affordable version of the same drug to patients with cancer, however this goal is now delayed by the FDA’s refusal. Viatris Inc. responded to the news by stating they are “thoroughly reviewing the complete response letter” and that they “look forward to continued dialogue with the FDA regarding our Bevacizumab Biosimilar.”

The company is hoping to address the FDA’s concerns and get their drug approved in the near future. Although the news of this rejection is disappointing for Viatris Inc., it is not the end of the road for them and their effort to bring an effective, affordable drug treatment to cancer patients. They are now moving forward to work with the FDA to address their concerns and hopefully resubmit their application in a timely manner. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Viatris Inc. More…

| Total Revenues | Net Income | Net Margin |

| 16.73k | 803.6 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Viatris Inc. More…

| Operations | Investing | Financing |

| 3.33k | -483.1 | -2.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Viatris Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.66k | 29.48k | 15.82 |

Key Ratios Snapshot

Some of the financial key ratios for Viatris Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.7% | 46.3% | 10.4% |

| FCF Margin | ROE | ROA |

| 16.9% | 5.6% | 2.2% |

Analysis

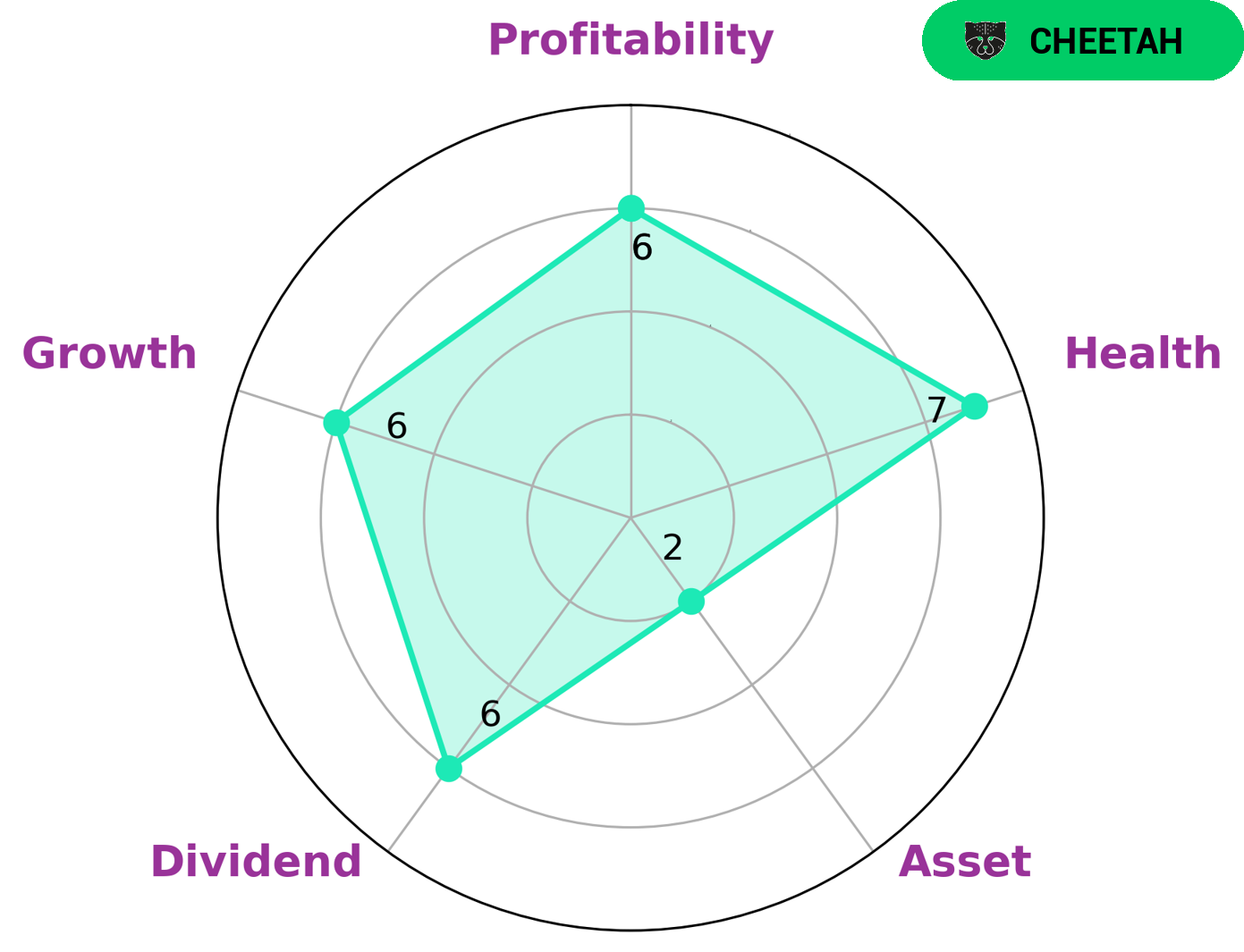

GoodWhale conducted an analysis of VIATRIS INC‘s wellbeing and discovered that it is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but it is considered less stable due to lower profitability. This means that investors interested in companies with potentially high returns and high risk may be attracted to VIATRIS INC. The Star Chart also reveals that VIATRIS INC is strong in dividend, medium in growth, profitability and weak in asset. These ratings suggest that the company may be more of a short-term investment, as it could provide good returns, but may not generate consistent returns over long periods of time. The health score of 7/10 indicates that despite its potential risks, VIATRIS INC is capable to safely ride out any crisis without the risk of bankruptcy. This score takes into account the company’s cashflows and debt, and is an indication of the company’s financial strength. Overall, VIATRIS INC has potential for investors who seek high returns and are willing to accept higher risks. However, investors should carefully study all aspects of the company before deciding to invest in it. More…

Peers

The company has a rich history of more than 150 years, dating back to the founding of its predecessor companies, which include some of the world’s most well-known brands. Today, Viatris is a leading provider of essential medicines and solutions, with a presence in more than 150 countries and a workforce of over 30,000 people. The company’s mission is to provide access to high-quality medicines and solutions for patients and customers around the world. Viatris is committed to being a trusted partner for patients, customers, employees, shareholders, and society. The company’s products are available in a wide range of therapeutic areas, including cardiovascular, diabetes, oncology, respiratory, and other conditions. Viatris has a portfolio of more than 1,000 products, including many that are essential medicines. The company also offers a range of services, including manufacturing, distribution, and logistics, to support its customers and patients. Viatris’s competitors include Pfizer Inc, Teva Pharmaceutical Industries Ltd, GSK PLC, and other global pharmaceutical companies.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is an American multinational pharmaceutical corporation. It is one of the world’s largest pharmaceutical companies. The company was founded in 1849 by Charles Pfizer and Charles Erhart in Brooklyn, New York. The company’s headquarters are in New York City. The company’s products include medicines and vaccines for a wide range of medical conditions and diseases.

– Teva Pharmaceutical Industries Ltd ($NYSE:TEVA)

Teva Pharmaceutical Industries Ltd is a pharmaceutical company with a market cap of 9.07B as of 2022 and a Return on Equity of -9.35%. The company focuses on producing generic drugs and active pharmaceutical ingredients. Teva is the world’s largest manufacturer of generic drugs and one of the world’s largest pharmaceutical companies.

– GSK PLC ($LSE:GSK)

GlaxoSmithKline PLC is a British pharmaceutical company with a market capitalization of 58.8 billion pounds as of 2022. The company has a return on equity of 34.04%. GlaxoSmithKline is a global healthcare company that researches, develops, and manufactures pharmaceuticals, vaccines, and consumer healthcare products.

Summary

Viatris Inc. is a pharmaceutical company that recently submitted a marketing application for a cancer therapy biosimilar called Bevacizumab. Unfortunately, the U.S. Food and Drug Administration (FDA) has rejected the application. This has resulted in mostly negative media exposure for the company. Analysts suggest that investors should consider the company’s fundamentals and take a closer look at the current market trends before investing in the stock.

Recent Posts