ELAN Intrinsic Value – Signaturefd LLC Cashes Out of Elanco Animal Health Incorporated Stock

July 30, 2023

🌥️Trending News

Signaturefd LLC, a minority investor, recently announced that it had sold 1116 Shares of Elanco Animal Health ($NYSE:ELAN) Incorporated to Defense World. Elanco Animal Health Incorporated (ELANCO) is an animal health company that focuses on providing products and services to the global animal health industry. With its innovative portfolio, ELANCO helps animals lead healthier lives through preventive care, diagnostics, medicines, and vaccines for livestock, companion animals, and horses. The sale of 1116 Shares represents a significant portion of Signaturefd LLC’s holdings in ELANCO. This move by Signaturefd LLC signals that they believe the stock has reached its peak and are now cashing out of its shares.

Defense World, on the other hand, is showing confidence in the long-term prospects of ELANCO by investing in the company. Overall, the sale of 1116 Shares by Signaturefd LLC indicates that the investor no longer believes that ELANCO is a sound investment. On the flip side, Defense World’s purchase of the same number of shares signals that they remain confident in the future of ELANCO stock.

Market Price

Thursday proved to be a tough day for ELANCO ANIMAL HEALTH Incorporated, as Signaturefd LLC cashed out of its stake in the company. The stock opened at $12.3 and closed at $12.1, down 0.4% from its last closing price of $12.2. This marks the end of an era for the animal health giant, as Signaturefd LLC had been one of their largest investors up until now. The company’s stock has seen a considerable dip in the past few weeks, but it remains to be seen if it will be able to recover in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ELAN. More…

| Total Revenues | Net Income | Net Margin |

| 4.44k | -23 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ELAN. More…

| Operations | Investing | Financing |

| 452 | -179 | -549 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ELAN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.49k | 8.2k | 14.81 |

Key Ratios Snapshot

Some of the financial key ratios for ELAN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 12.3% | 4.9% |

| FCF Margin | ROE | ROA |

| 6.0% | 1.9% | 0.9% |

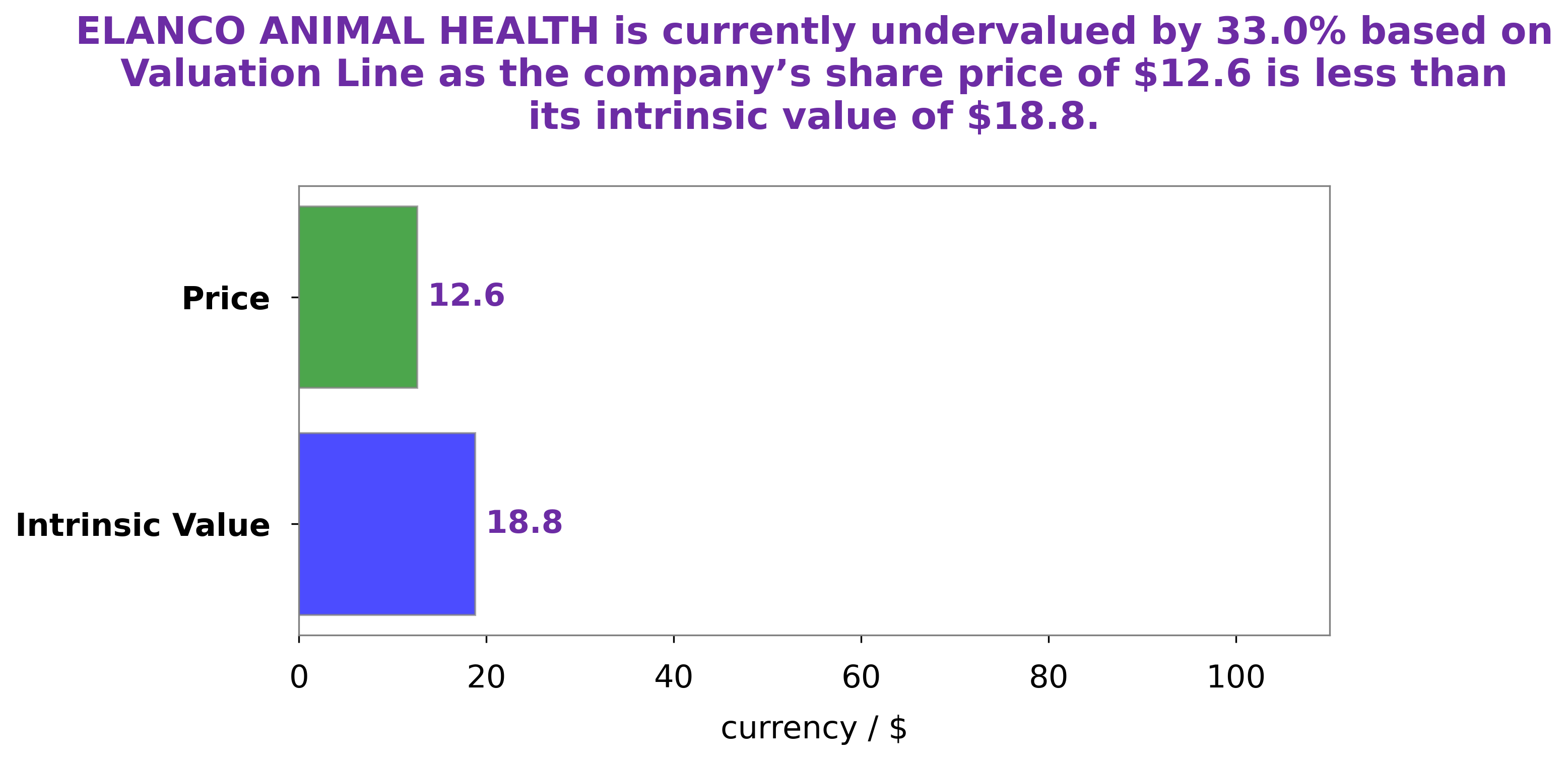

Analysis – ELAN Intrinsic Value

At GoodWhale, we conducted an analysis of ELANCO ANIMAL HEALTH’s fundamentals and our proprietary Valuation Line revealed that the fair value of ELANCO ANIMAL HEALTH share is around $23.7. Currently, ELANCO ANIMAL HEALTH stock is traded at $12.1, which means it is undervalued by 49.0%. This presents a great buying opportunity for investors. More…

Peers

The company’s competitors include GeneFerm Biotechnology Co Ltd, Rhone Ma Holdings Bhd, and Phibro Animal Health Corp.

– GeneFerm Biotechnology Co Ltd ($TPEX:1796)

Ferm Biotechnology Co Ltd is a company that manufactures and sells biotechnology products. The company has a market cap of 2.34B as of 2022 and a return on equity of 9.05%. The company’s products are used in the healthcare, food and beverage, and industrial markets.

– Rhone Ma Holdings Bhd ($KLSE:5278)

Rhone Ma Holdings Bhd is a Malaysia-based investment holding company. The Company, through its subsidiaries, is engaged in the provision of management services, banking and financial services, and investment holding. The Company’s segments include Commercial Banking, which is engaged in the provision of banking products and services to small and medium enterprises (SMEs) and individuals; Treasury, which is engaged in the provision of foreign exchange and money market services; and Corporate Banking, which is engaged in the provision of financing solutions to SMEs and large corporations.

– Phibro Animal Health Corp ($NASDAQ:PAHC)

Phibro Animal Health Corp is a publicly traded company that focuses on animal health and nutrition. As of 2022, the company had a market capitalization of 505.49 million and a return on equity of 19.25%. Phibro Animal Health Corp was founded in 1947 and is headquartered in Teaneck, New Jersey. The company’s products include pharmaceuticals, vaccines, and nutritional supplements for livestock, poultry, and aquaculture.

Summary

This indicates that Signaturefd LLC has reduced their position in the company, likely due to unfavorable market conditions or personal financial considerations. Investors considering Elanco Animal Health should note that the company has grown rapidly in recent years and has a strong product portfolio. Elanco Animal Health is also well-positioned to benefit from the growing global demand for animal health products.

Further, the company is well-supported by experienced management and has a strong balance sheet. As such, Elanco Animal Health may be a good long-term investment for investors looking for growth opportunities in the animal health industry.

Recent Posts