ELAN Intrinsic Stock Value – Elanco Animal Health Inc’s ($ELAN) Trading Performance Analyzed in New Report

November 7, 2023

🌥️Trending News

Elanco Animal Health ($NYSE:ELAN) Inc ($ELAN) is a global leader in animal health and nutrition. It develops, manufactures and markets a wide range of animal health products including vaccines, pharmaceuticals and feed additives. Recently, a new report was published analyzing the company’s trading performance. The report considers the performance of Elanco Animal Health stocks over the past few months and provides an in-depth look at the company’s stock movement.

Additionally, the report includes detailed analysis of the company’s financial structure and recent developments. It also offers insight into the company’s long-term growth potential and provides a comprehensive overview of its competitive landscape. The report also examines Elanco Animal Health’s financial performance and examines the company’s profitability, liquidity, and solvency. Furthermore, it provides an outlook on the company’s future performance. Finally, the report provides investors with an in-depth assessment of the company’s current trading situation and offers advice on how to benefit from its long-term growth potential.

Share Price

The report revealed that the stock opened at $9.6 and closed at $9.4, which represented a decrease of 2.6% from the prior closing price of 9.6. This significant drop in share price could be attributed to various factors such as an overall decline in the stock market, weak earnings reports, and concerns regarding a potential economic downturn. It is important to note that Elanco Animal Health Inc remains an active participant in the industry and has been growing its presence globally in recent years. Despite the recent decline, the company continues to remain committed to providing innovative animal health solutions to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ELAN. More…

| Total Revenues | Net Income | Net Margin |

| 4.32k | -98 | -0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ELAN. More…

| Operations | Investing | Financing |

| 369 | -179 | -549 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ELAN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.77k | 8.29k | 15.19 |

Key Ratios Snapshot

Some of the financial key ratios for ELAN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | 17.2% | 3.8% |

| FCF Margin | ROE | ROA |

| 4.0% | 1.4% | 0.7% |

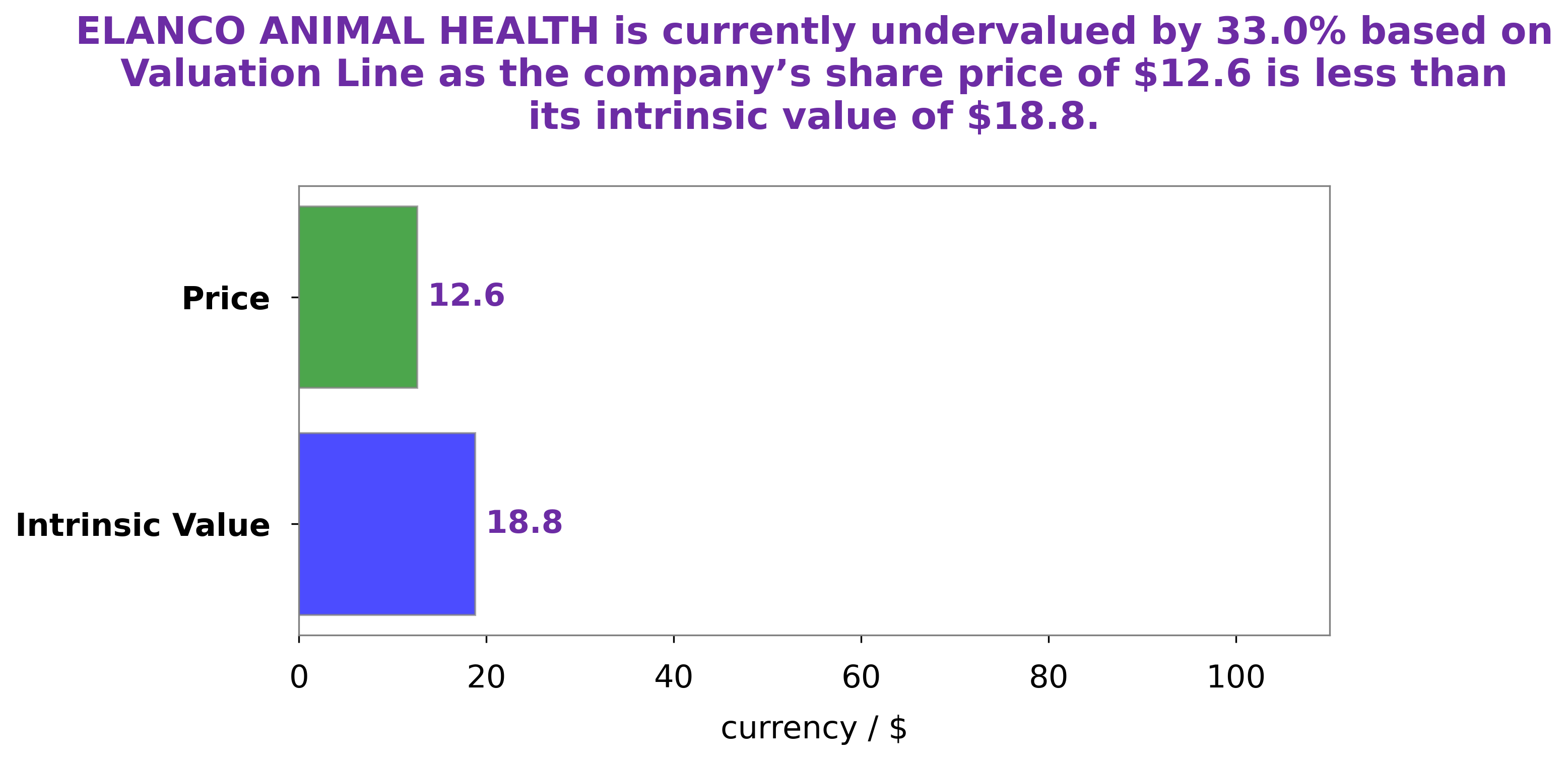

Analysis – ELAN Intrinsic Stock Value

At GoodWhale, we have conducted an analysis of ELANCO ANIMAL HEALTH’s fundamentals. After careful consideration of the company’s financial information, we have concluded that its fair value is around $20.7, calculated using our proprietary Valuation Line. The current market price of ELANCO ANIMAL HEALTH’s stock is around $9.4, which means that it is trading at a significant discount of 54.6% from its fair value. This presents an excellent opportunity for investors looking to buy and hold the stock for the long-term. More…

Peers

The company’s competitors include GeneFerm Biotechnology Co Ltd, Rhone Ma Holdings Bhd, and Phibro Animal Health Corp.

– GeneFerm Biotechnology Co Ltd ($TPEX:1796)

Ferm Biotechnology Co Ltd is a company that manufactures and sells biotechnology products. The company has a market cap of 2.34B as of 2022 and a return on equity of 9.05%. The company’s products are used in the healthcare, food and beverage, and industrial markets.

– Rhone Ma Holdings Bhd ($KLSE:5278)

Rhone Ma Holdings Bhd is a Malaysia-based investment holding company. The Company, through its subsidiaries, is engaged in the provision of management services, banking and financial services, and investment holding. The Company’s segments include Commercial Banking, which is engaged in the provision of banking products and services to small and medium enterprises (SMEs) and individuals; Treasury, which is engaged in the provision of foreign exchange and money market services; and Corporate Banking, which is engaged in the provision of financing solutions to SMEs and large corporations.

– Phibro Animal Health Corp ($NASDAQ:PAHC)

Phibro Animal Health Corp is a publicly traded company that focuses on animal health and nutrition. As of 2022, the company had a market capitalization of 505.49 million and a return on equity of 19.25%. Phibro Animal Health Corp was founded in 1947 and is headquartered in Teaneck, New Jersey. The company’s products include pharmaceuticals, vaccines, and nutritional supplements for livestock, poultry, and aquaculture.

Summary

Elanco Animal Health Inc. (ELAN) is an animal health company that specializes in developing products to prevent and treat disease in animals. Its portfolio includes pharmaceuticals, vaccines, nutritional supplements and other products. The company’s strong financial performance has been driven by a robust demand in the global animal health market, which is expected to remain strong in the future.

Additionally, ELAN has made strategic acquisitions and partnerships that have strengthened its product offerings. ELAN is expected to continue to benefit from its strong balance sheet and growing market presence, making it an attractive investment for long-term investors.

Recent Posts