Eagle Pharmaceuticals Intrinsic Value Calculator – Texas Permanent School Fund Reduces Stake in Eagle Pharmaceuticals by 9.6%

May 25, 2023

Trending News 🌥️

Eagle Pharmaceuticals ($NASDAQ:EGRX), Inc. is a specialty pharmaceutical company dedicated to developing and commercializing injectable products that address the shortcomings, as identified by physicians, pharmacists, and other stakeholders, of existing commercially successful injectable products. Recently, the Texas Permanent School Fund has reduced its ownership of Eagle Pharmaceuticals, Inc. shares by 9.6% in the fourth quarter. The Texas Permanent School Fund is one of the largest public education endowments in the United States, and is dedicated to providing financial support for public school students in the state of Texas. It is managed by the State Board of Education, and is primarily funded through the sale of bonds and land grants from the Texas General Land Office. Eagle Pharmaceuticals has been performing well in recent quarters due to its strong portfolio of approved products.

Its products are sold through several distribution partners including AmerisourceBergen Corporation, Cardinal Health, McKesson Corporation, and Walgreens Boots Alliance. Despite the Texas Permanent School Fund’s reduced stake in the company, it has held on to its remaining shares. Eagle Pharmaceuticals will continue to benefit from its leading position in the specialty pharmaceutical market and is well-positioned for future growth.

Analysis – Eagle Pharmaceuticals Intrinsic Value Calculator

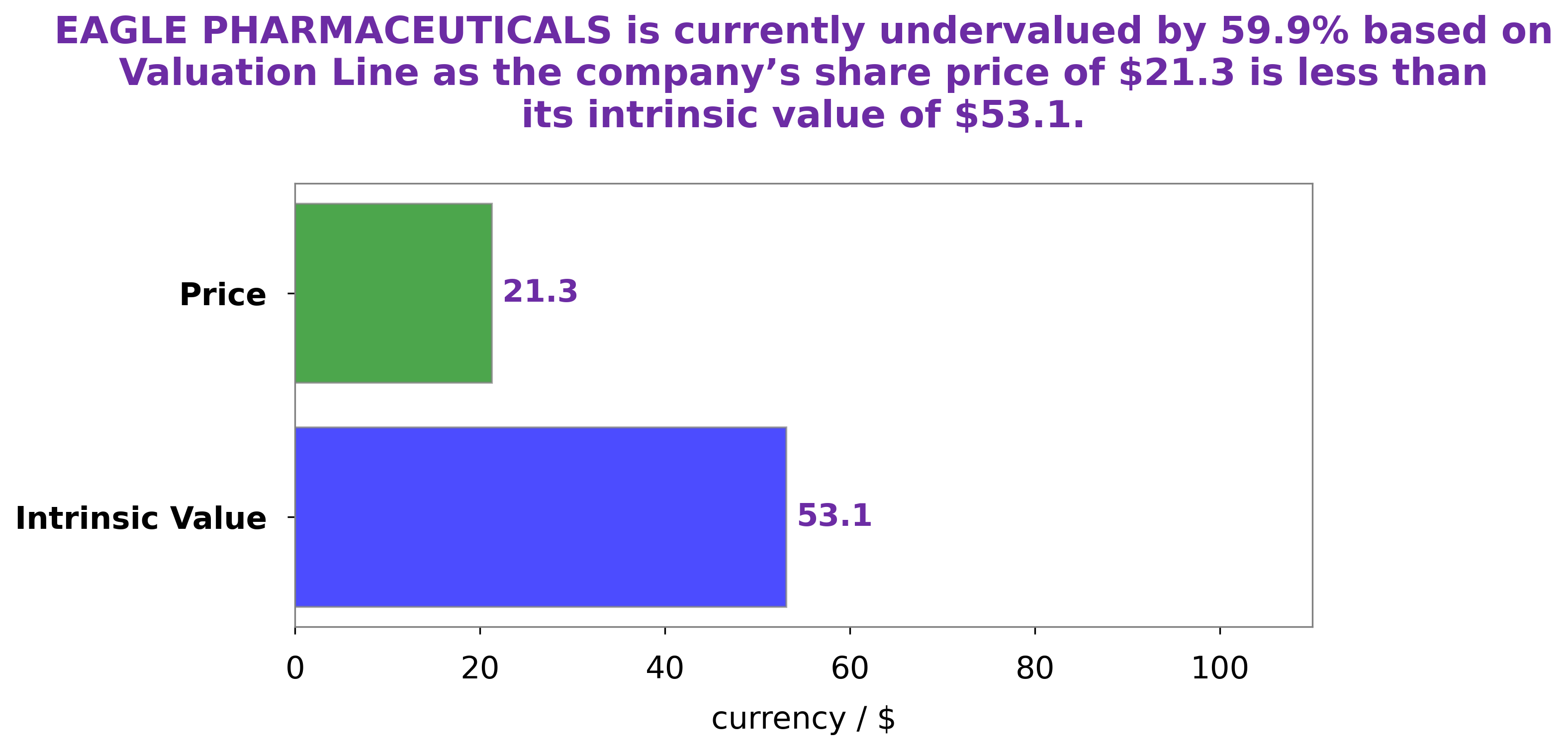

At GoodWhale, we have conducted an analysis on the wellbeing of EAGLE PHARMACEUTICALS. Our proprietary Valuation Line has calculated that the intrinsic value of the EAGLE PHARMACEUTICALS share is around $53.1. However, EAGLE PHARMACEUTICALS stock is currently being traded at $21.3, meaning it is undervalued by 59.9%. This presents a great opportunity for investors to purchase shares in EAGLE PHARMACEUTICALS, as it offers them a guaranteed return on investment that is well above the current market rate. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eagle Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 267.04 | -2.67 | -1.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eagle Pharmaceuticals. More…

| Operations | Investing | Financing |

| 33.8 | -99.22 | 17.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eagle Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 414.18 | 171.33 | 18.56 |

Key Ratios Snapshot

Some of the financial key ratios for Eagle Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 34.0% | 7.2% |

| FCF Margin | ROE | ROA |

| 12.6% | 5.0% | 2.9% |

Peers

Eagle Pharmaceuticals Inc is a pharmaceutical company that manufactures and sells prescription drugs. The company competes with other pharmaceutical companies, such as Evoke Pharma Inc, Easton Pharmaceuticals Inc, and Innopharmax Inc.

– Evoke Pharma Inc ($NASDAQ:EVOK)

Evoke Pharma Inc is a pharmaceutical company that focuses on the development of drugs for the treatment of gastrointestinal disorders. The company has a market cap of 6.54 million as of 2022 and a return on equity of -103.41%. The company’s products include treatments for conditions such as irritable bowel syndrome and gastroesophageal reflux disease.

– Easton Pharmaceuticals Inc ($OTCPK:EAPH)

Easton Pharmaceuticals Inc is a specialty pharmaceutical company that focuses on developing, acquiring, and commercializing products in the areas of drug delivery, dermatology, and cancer. The company’s market cap as of 2022 is 134.49k, and its ROE is -2.69%. Easton’s products include topical gels, creams, lotions, and solutions for the treatment of conditions such as acne, cold sores, and psoriasis. The company also develops products for the prevention and treatment of skin cancer.

– Innopharmax Inc ($TPEX:4172)

Innopharmax Inc is a pharmaceutical company with a market cap of 985.59M as of 2022 and a Return on Equity of -12.34%. The company focuses on the development and commercialization of novel therapeutics to treat serious and life-threatening illnesses. Some of the company’s products include treatments for cancer, cardiovascular diseases, and infectious diseases.

Summary

Investors should consider the factors that may have contributed to this decline, such as the company’s financial performance or changes in the global market. Careful analysis of the company’s balance sheet, income statement, and cash flow statement can provide insight into whether the company is on a positive trajectory or if there are other underlying concerns that may lead to further declines in its stock price. Moreover, monitoring changes in the industry landscape can help investors to identify potential opportunities or threats for the company going forward.

Recent Posts