Sen. Wyden Urges HHS, CMS to Increase Access to Biogen’s Alzheimer’s Therapies

May 20, 2023

Trending News ☀️

Sen. Wyden recently expressed his strong support for increased access to innovative therapies for Alzheimer’s disease developed by Biogen Inc ($NASDAQ:BIIB). In a letter to the Department of Health and Human Services (HHS) and the Centers for Medicare & Medicaid Services (CMS), Sen. Wyden urged them to ensure that Biogen’s therapies are readily available to those in need. Biogen Inc is a biotechnology company based in Cambridge, Massachusetts. Over the past few years, Biogen has invested heavily in researching and developing therapies for Alzheimer’s that could potentially help millions of people in the United States.

The company has already achieved some success with its Aducanumab drug, which has shown promise in clinical trials as a potential treatment for Alzheimer’s. With the right support from the HHS and CMS, Biogen’s therapies could have a transformative effect on people’s lives and help them lead healthier, more independent lives.

Market Price

On Thursday, Senator Ron Wyden of Oregon urged the Department of Health and Human Services (HHS) and the Centers for Medicare & Medicaid Services (CMS) to increase access to Biogen Inc.’s Alzheimer’s therapies. This came as Biogen Inc.’s stocks opened at $305.8 and closed at $305.4, representing a 0.3% decrease from the prior closing price of $306.2. Access to these treatments is an important issue for those living with Alzheimer’s and other forms of dementia, as they are often barred from receiving the care they need. In response to Senator Wyden’s statement, HHS and CMS have promised to look into ways they can make these treatments more widely available and affordable for all individuals, regardless of their diagnosis or financial situation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Biogen Inc. More…

| Total Revenues | Net Income | Net Margin |

| 10.1k | 3.13k | 21.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Biogen Inc. More…

| Operations | Investing | Financing |

| 1.38k | 1.58k | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Biogen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.6k | 10.81k | 93.04 |

Key Ratios Snapshot

Some of the financial key ratios for Biogen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.2% | -27.5% | 39.0% |

| FCF Margin | ROE | ROA |

| 11.3% | 18.4% | 10.0% |

Analysis

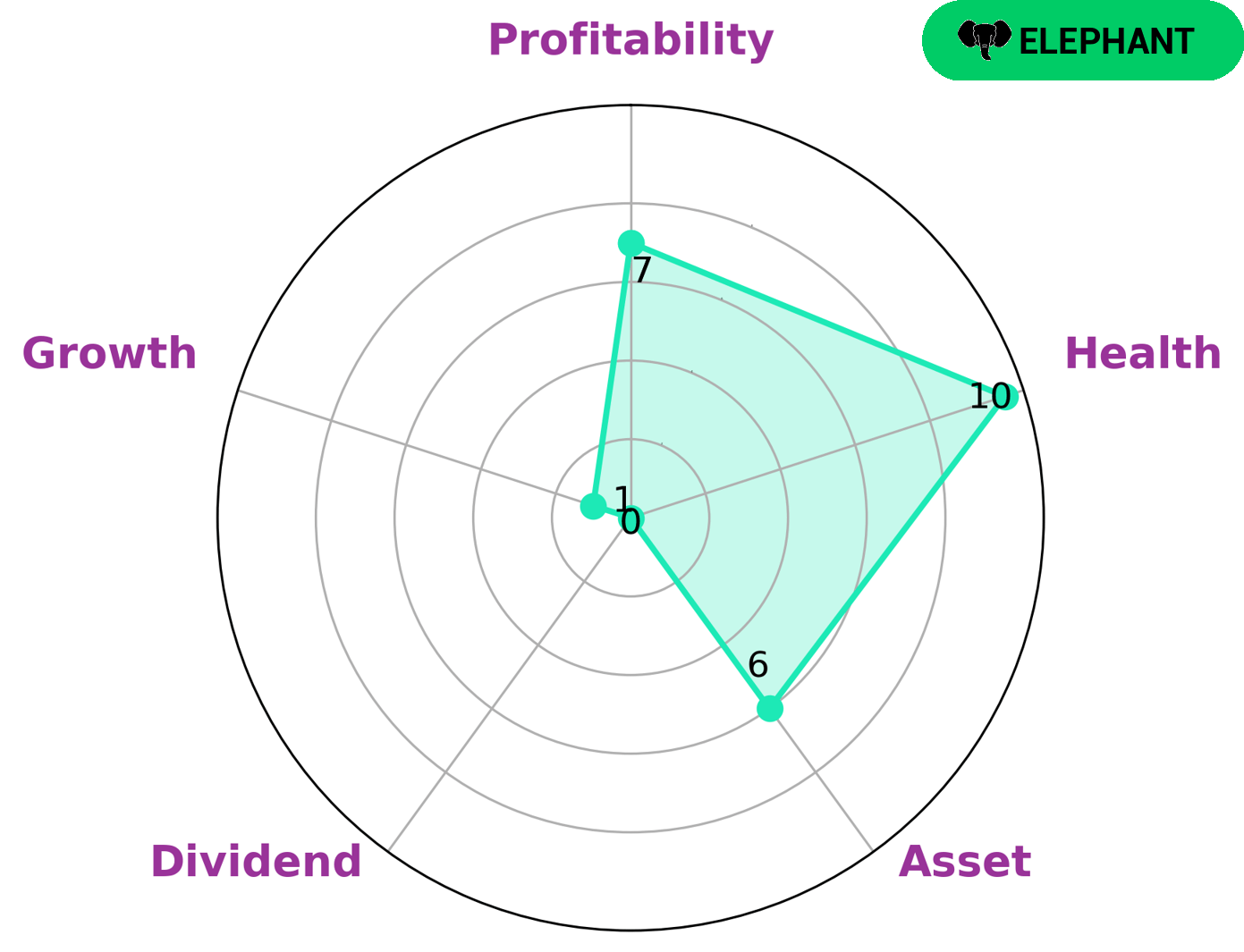

GoodWhale has conducted an analysis of the financials of BIOGEN INC and classified it as an “elephant”, which means it has a rich set of assets after deducting off liabilities. This is a type of company that would be of interest to investors who are looking for reliable and strong returns. BIOGEN INC has a high profitability rating and medium asset and weak dividend and growth. The company also boasts a high health score of 10/10 with regards to its cashflows and debt, indicating that it is capable of paying off debt and funding future operations. All of these factors make BIOGEN INC an attractive option for investors who want to invest in a stable and robust company. More…

Peers

In the biotechnology industry, Biogen Inc is up against some stiff competition from the likes of Eli Lilly and Co, Gilead Sciences Inc, and Intra-Cellular Therapies Inc. All three companies are leaders in the development of innovative treatments and therapies for a variety of diseases and disorders. Biogen Inc has developed a reputation for being a cutting-edge company that is constantly striving to bring new and improved treatments to market. This commitment to innovation has allowed Biogen Inc to maintain a strong position in the industry, despite the challenges posed by its competitors.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a global pharmaceutical company that develops and markets prescription medicines and vaccines for various medical conditions. The company’s market cap as of 2022 is 316.18B. Its return on equity (ROE) is 45.88%.

Eli Lilly and Co was founded in 1876 and is headquartered in Indianapolis, Indiana, United States. The company operates in more than 140 countries worldwide. Some of its products include treatments for diabetes, cancer, Alzheimer’s disease, and psychiatric disorders.

– Gilead Sciences Inc ($NASDAQ:GILD)

Gilead Sciences Inc is a research-based biopharmaceutical company that discovers, develops and commercialises innovative therapeutics. The company’s mission is to advance the care of patients suffering from life-threatening diseases. Gilead Sciences Inc has a market cap of 83.2B as of 2022 and a Return on Equity of 24.03%. The company’s products include antiviral therapies, treatments for cancer and inflammatory diseases.

– Intra-Cellular Therapies Inc ($NASDAQ:ITCI)

Intra-Cellular Therapies Inc is a clinical stage biopharmaceutical company that focuses on the development of drugs for the treatment of neuropsychiatric disorders. The company’s market cap as of 2022 was 4.47B, and its ROE was -42.76%. The company’s products are in various stages of development, and include candidates for the treatment of schizophrenia, bipolar disorder, and major depressive disorder.

Summary

Biogen Inc (BIIB) is an American biotechnology company that specializes in therapies for neurological and autoimmune diseases. Biogen’s research and development pipeline is focused on therapies for Alzheimer’s, Parkinson’s, multiple sclerosis, spinal muscular atrophy, among others, and is expected to continue to drive growth for the company. The company has also made significant progress in its gene therapy programs and has expanded its global reach. With a strong balance sheet and an expanding product portfolio, Biogen remains a promising investment opportunity.

Recent Posts