Pfizer Stock Soars in 2023, Outperforming Market on Strong Trading Day.

March 26, 2023

Trending News ☀️

On a strong trading day, the stock of Pfizer Inc ($NYSE:PFE). soared well above the market, outperforming its rivals and making strong gains. The stock was the biggest gainer on the day, rising significantly to close at an all-time high. It was a remarkable performance, considering that the rest of the market was relatively flat. Investors were clearly impressed with Pfizer’s performance, pointing to their strong product lineup and a promising pipeline of potential drugs in the works. The company has been at the forefront of innovative treatments, and their progress in developing new treatments has been remarkable. Furthermore, they have recently made significant investments in research and development to ensure their products remain competitive and cutting-edge.

The stock’s impressive performance also reflects the confidence investors have in the company’s financials. Pfizer has seen consistent growth in its quarterly earnings, and their balance sheet remains strong. As a result, investors are willing to pay a higher price for the stock and are confident that it will continue to appreciate in value over time. Investors were clearly impressed with the company’s performance and remain confident about its future prospects.

Market Price

The stock opened at $40.1 and closed at $40.4, up 0.5% from its last closing price of $40.2. With its stock continuing to climb higher and news mostly being positive for the company, the outlook for Pfizer Inc. continues to look promising. The company’s stock has seen steady growth since the beginning of this year, and the outlook for the future remains bright. Investors are cautiously optimistic about the potential of Pfizer Inc., as its strong performance has been consistent throughout the year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pfizer Inc. More…

| Total Revenues | Net Income | Net Margin |

| 100.33k | 31.37k | 34.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pfizer Inc. More…

| Operations | Investing | Financing |

| 29.27k | -15.78k | -14.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pfizer Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 197.21k | 101.29k | 17.03 |

Key Ratios Snapshot

Some of the financial key ratios for Pfizer Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.7% | 38.9% | 35.8% |

| FCF Margin | ROE | ROA |

| 25.9% | 26.0% | 11.4% |

Analysis

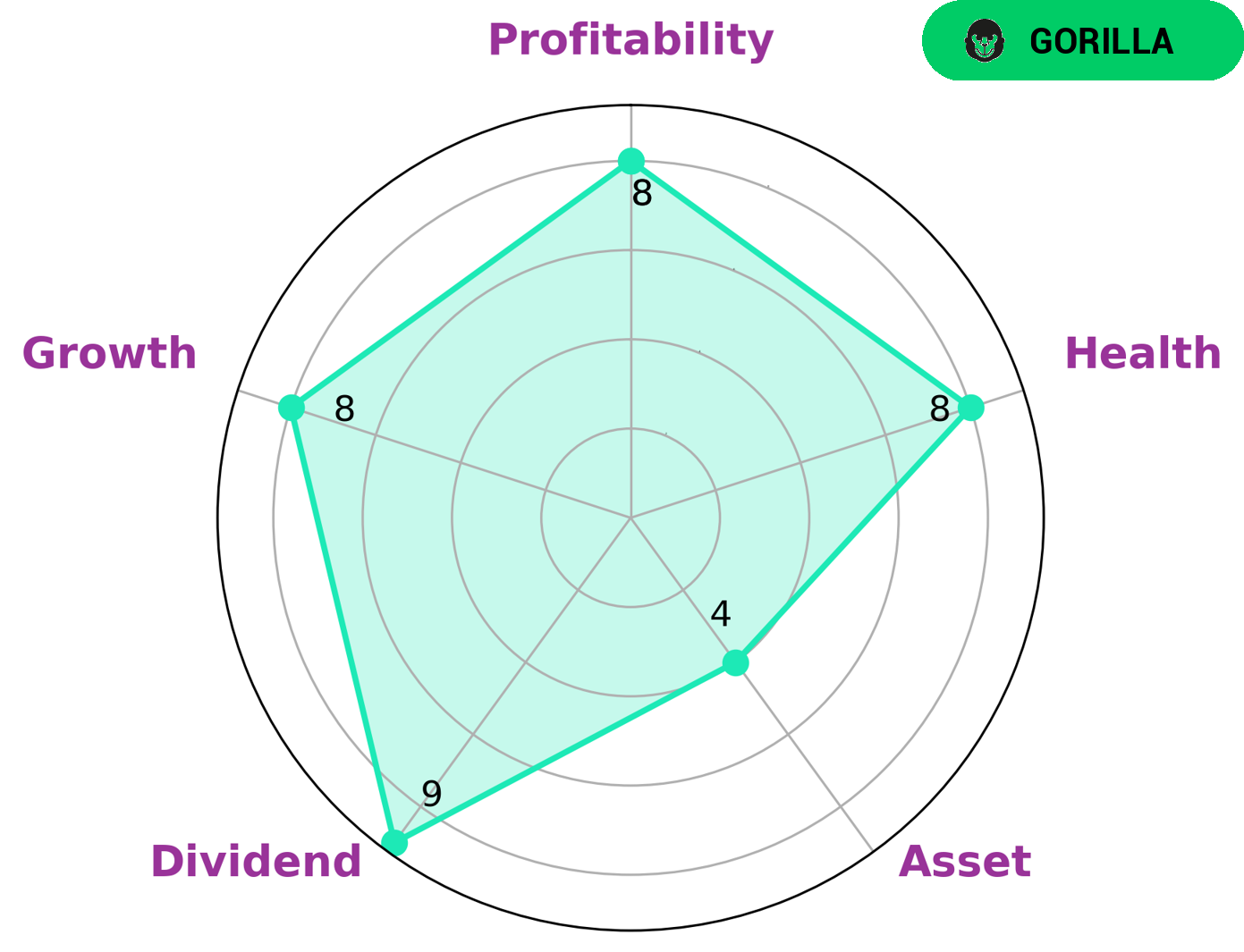

GoodWhale has conducted an analysis of PFIZER INC‘s financials, and based on our Star Chart, PFIZER INC is strong in dividend, growth, profitability, and medium in asset. PFIZER INC is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This type of company is attractive to investors who are looking for long-term, stable returns. Furthermore, PFIZER INC has a high health score of 8/10 with regard to its cashflows and debt, which indicates that the company is capable of riding out any crisis without the risk of bankruptcy. Therefore, PFIZER INC could be a very attractive investment for those looking for a safe option with good returns. More…

Peers

In the pharmaceutical industry, competition is fierce between companies striving to bring innovative new drugs to market. Among the leaders in this industry are Pfizer Inc and its competitors Astellas Pharma Inc, Roche Holding AG, and AstraZeneca PLC. While each company has its own strengths and weaknesses, they all share a commitment to research and development in an effort to stay ahead of the competition.

– Astellas Pharma Inc ($TSE:4503)

Astellas Pharma Inc is a Japanese pharmaceutical company with a market cap of 3.61T as of 2022. The company’s ROE is 6.6%. Astellas Pharma is engaged in the research, development, manufacture, and marketing of pharmaceutical products. The company’s products include ethical drugs, over-the-counter drugs, and generic drugs. Astellas Pharma also has a clinical research division that conducts clinical trials of new drugs.

– Roche Holding AG ($OTCPK:RHHBY)

Roche Holding AG is a multinational pharmaceutical company headquartered in Basel, Switzerland. The company was founded in 1896 by Fritz Hoffmann-La Roche. Roche is the world’s largest biotech company, with products in the areas of pharmaceuticals, diagnostics, and consumer health. The company’s mission is to “improve lives by enabling people to do more, feel better, and live longer.”

Roche Holding AG has a market cap of 270.34B as of 2022, a Return on Equity of 47.83%. The company’s strong market position and financial performance are due to its innovative products and services, which address a broad range of medical needs. Roche is committed to research and development, and has a strong pipeline of new products in development. The company’s focus on customer needs and its ability to bring new products to market quickly have resulted in strong financial performance and shareholder value.

– AstraZeneca PLC ($LSE:AZN)

AstraZeneca PLC is a pharmaceutical company with a market cap of 152.81 billion as of 2022. The company has a return on equity of -0.94%. AstraZeneca PLC is engaged in the research, development, manufacture, and marketing of prescription pharmaceuticals and biologic products for the treatment of cardiovascular, gastrointestinal, infection, neuroscience, oncology, and respiratory diseases.

Summary

Pfizer Inc. has been performing exceptionally well in the stock market in 2023, significantly outperforming its competitors. Investors have seen a tremendous return on their investments, with Pfizer stocks soaring since the beginning of the year. Analysts point to strong trading activity as the main factor in this surge, as the company is benefitting from a bullish environment.

Additionally, the market sentiment for Pfizer appears to remain positive, with analysts expecting further growth in the coming quarters. As such, Pfizer Inc. is seen as a good option for long-term investors looking for a safe bet.

Recent Posts