ORGANON Reports Strong Q4 Earnings for FY2022 as of December 31, 2022

March 4, 2023

Earnings report

ORGANON & ($NYSE:OGN) Company announced their FY2022 Q4 earnings results on February 16 2023, which were based on the financials as of December 31 2022. The company reported total revenue for the fourth quarter of USD 108.0 million, representing a 46.5% decrease year-over-year. Despite the decrease in revenue, ORGANON still earned a net income of USD 1485.0 million, which represented a decline of 7.4% compared to the same period in the previous year. The company attributed the decline in revenue to decreased demand for their products and services due to the pandemic.

However, they were pleased with the overall profitability of their investments and strategic initiatives during the quarter. ORGANON’s management announced that they will continue to focus on investing in emerging technologies and expanding their global reach in order to ensure long-term growth and stability for the company. The company also plans to continue to develop their existing portfolio of products and services in order to remain competitive in the market. Overall, ORGANON’s strong Q4 FY2022 earnings report showcases their continued commitment to delivering value for their stakeholders, customers, and partners.

Market Price

ORGANON reported strong earnings for the fourth quarter of fiscal year 2022, as of December 31, 2022. On Thursday, ORGANON’s stock opened at $27.8 and closed at $24.9, plunging by 15.0% from its prior closing price of 29.3. This was despite a positive outlook for the company’s future growth prospects due to the launch of several new products this quarter. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Organon &. More…

| Total Revenues | Net Income | Net Margin |

| 6.17k | 917 | 16.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Organon &. More…

| Operations | Investing | Financing |

| 638 | -481 | -1.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Organon &. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.44k | 11.5k | -4.19 |

Key Ratios Snapshot

Some of the financial key ratios for Organon & are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.4% | -23.7% | 25.0% |

| FCF Margin | ROE | ROA |

| 2.2% | -90.5% | 9.2% |

Analysis

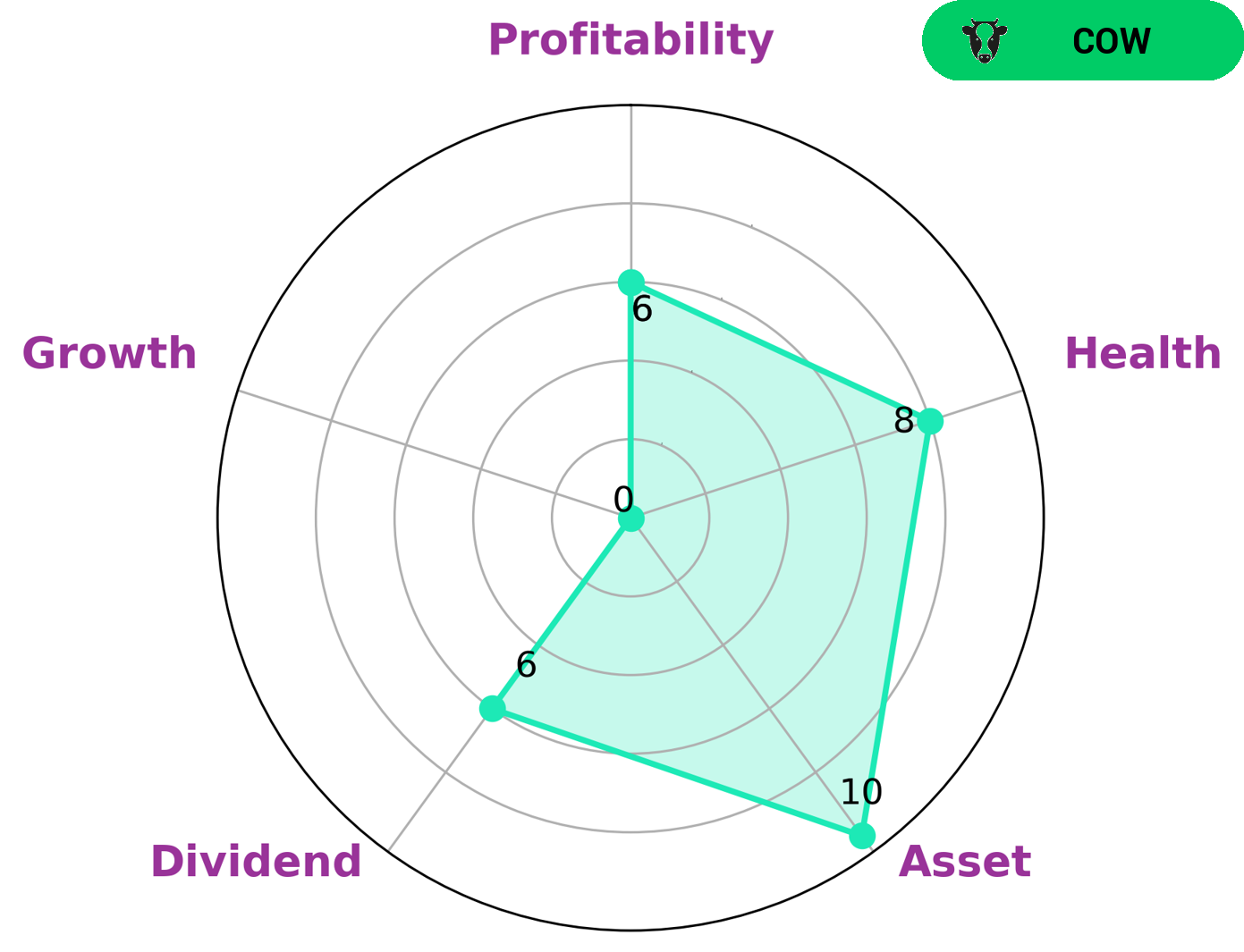

GoodWhale conducted an analysis of ORGANON &‘s wellbeing to determine its financial health. Based on our Star Chart assessment, ORGANON & is strong in asset, medium in dividend and profitability and weak in growth. This places ORGANON & in the ‘cow’ category of companies, which are those that have a track record of paying out consistent and sustainable dividends. This type of company may be attractive to investors looking for a steady income, especially those with an appetite for lower risk investments. In addition, ORGANON & has a high health score of 8/10 considering its cashflows and debt, which suggests it is in good financial health and capable of sustaining future operations in times of crisis. More…

Peers

Its competitors include Creso Pharma Ltd, NGL Fine-Chem Ltd, Willow Biosciences Inc, and other similar companies.

– Creso Pharma Ltd ($ASX:CPH)

Creso Pharma Ltd is a clinical stage pharmaceutical and nutraceutical company. The company focuses on the development, registration and commercialization of cannabis and hemp derived products. Creso Pharma Ltd has a market cap of 41.48M as of 2022, a Return on Equity of -38.64%. The company has a portfolio of products in various stages of development, including a CBD-based nutraceutical, a CBD-based animal health product, and a CBD-based topical cream.

– NGL Fine-Chem Ltd ($BSE:524774)

NGL Fine-Chem Ltd is a publicly traded company with a market capitalization of 8.71 billion as of 2022. The company’s return on equity is 13.3%. NGL Fine-Chem Ltd is engaged in the business of manufacturing and marketing of specialty chemicals. The company’s products are used in a variety of industries, including the automotive, aerospace, and construction industries.

– Willow Biosciences Inc ($TSX:WLLW)

Willow Biosciences Inc is a biotechnology company that develops and manufactures pharmaceutical ingredients. The company has a market capitalization of $14.85 million and a return on equity of -12.05%. Willow Biosciences is focused on providing sustainable, plant-based alternatives to traditional chemical manufacturing processes. The company’s products are used in a variety of industries, including pharmaceuticals, cosmetics, and food and beverage.

Summary

Organon & Co. reported total revenue for the fourth quarter of USD 108.0 million, a decrease of 46.5% year-over-year. Net income declined by 7.4% year-over-year to USD 1485 million. Following the announcement, the stock price declined. Investors may be evaluating the company’s performance along with their competitors in the industry and assessing their future outlook.

In addition, they may need to take into account other factors such as the macroeconomic climate, changes in the market, and the company’s risk profile.

Recent Posts