Merck Lifescience Enters Strategic Contract with LP Logiscience to Introduce Electric Vehicles in Mumbai, India.

May 4, 2023

Trending News 🌥️

Merck ($NYSE:MRK) Lifescience, a leader in the pharmaceutical industry, has entered into a strategic agreement with LP Logiscience, a leading logistics provider, to introduce electric vehicles for transportation services in Mumbai, India. The agreement between Merck Lifescience and LP Logiscience will help promote the adoption of electric vehicles as a more efficient and environmentally friendly form of transportation. With this agreement, electric vehicles will be used for driverless transportation services, providing customers with a safe and reliable way to move around Mumbai. This move will also help reduce emissions in the city and promote green energy initiatives.

Moreover, Merck Lifescience is committed to investing in sustainable solutions that are both cost-effective and support their mission of providing medical advancements that improve the lives of people around the world. By entering into this contract with LP Logiscience, Merck Lifescience is taking an important step to create a greener future for Mumbai and its citizens.

Price History

The news drove the company’s stock to a new high, opening at $115.8 and closing at $116.3, up by 0.8% from last closing price of 115.5. This initiative is part of Merck Lifescience’s commitment to reducing carbon emissions and providing cleaner and more sustainable transport solutions for its customers. The move is sure to benefit both companies involved in the venture and will open up new opportunities for the city of Mumbai.

The agreement between the two companies has been welcomed by stakeholders and the wider public, who are eager to see an increase in electric vehicles being used in the city. This latest agreement is sure to bolster Merck Lifescience’s already impressive portfolio of ecological initiatives and will be a major step forward in their mission to reduce their carbon footprint. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Merck. More…

| Total Revenues | Net Income | Net Margin |

| 57.87k | 13.03k | 24.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Merck. More…

| Operations | Investing | Financing |

| 19.09k | -4.96k | -9.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Merck. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 109.16k | 63.1k | 18.12 |

Key Ratios Snapshot

Some of the financial key ratios for Merck are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 8.7% | 27.8% |

| FCF Margin | ROE | ROA |

| 25.4% | 21.9% | 9.2% |

Analysis

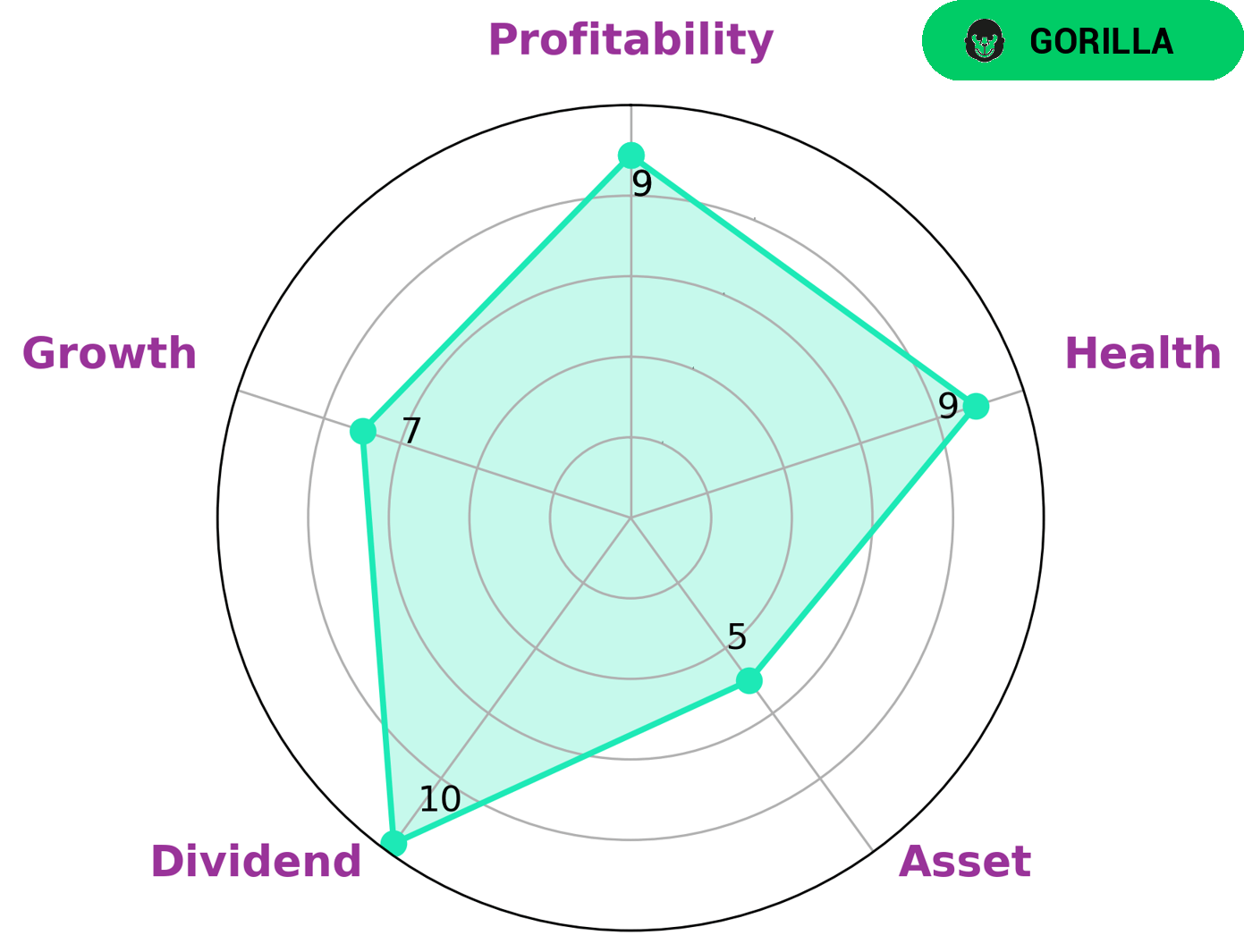

GoodWhale has analyzed MERCK‘s wellbeing and the findings are quite impressive. Our Star Chart reveals MERCK is strong in dividend, growth, profitability, and medium in asset. We have classified MERCK as a ‘gorilla’ type of company, who has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes MERCK an attractive investment opportunity for value investors as well as growth investors. In addition, MERCK also boasts a high health score of 9/10 considering its cashflows and debt, which makes it capable to sustain future operations in times of crisis. With its strong financial performance, MERCK is a prime pick for investors looking for a suitable long-term investment option. More…

Peers

In the pharmaceutical industry, Merck & Co Inc is up against some stiff competition. Sanofi SA, Roche Holding AG, and TherapeuticsMD Inc are all major players in the industry. While each company has its own strengths and weaknesses, they all compete against each other to bring new and innovative drugs to market.

– Sanofi SA ($LTS:0O59)

As of 2022, Sanofi SA has a market capitalization of 102.29 billion euros and a return on equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and is one of the world’s largest pharmaceutical companies. Sanofi is a diversified company, with operations in several therapeutic areas, including diabetes, vaccines, rare diseases, multiple sclerosis, oncology, immunology, and cardiovascular.

– Roche Holding AG ($LTS:0TDF)

Roche Holding AG, a Swiss multinational healthcare company, has a market cap of 270.34B as of 2022. The company’s Return on Equity is 47.83%. Roche is a leader in research-focused healthcare with combined strengths in pharmaceuticals and diagnostics. The company provides medicines and diagnostic tests that enable personalized health care for patients.

– TherapeuticsMD Inc ($NASDAQ:TXMD)

TherapeuticsMD Inc. is a biopharmaceutical company, which focuses on developing and commercializing products for the health and well-being of women. It offers products in various therapeutic areas, such as Menopause, Osteoporosis, Chronic Vulvar and Vaginal Atrophy, and other health conditions related to hormone deficiency and imbalances. The company was founded by Robert G. Finizio, George S. Paletta, and Douglas S. Leighton in 2010 and is headquartered in Boca Raton, FL.

Summary

Merck Lifescience has recently signed a strategic contract with LP Logiscience, in order to introduce electric vehicles into its transportation operations. This move is seen as a significant step in Merck’s strategy to move towards renewable energy and is likely to have a positive impact on their bottom line. The agreement has been highly anticipated by investors, as Merck’s stock price has risen in the days leading up to the announcement.

The contract is likely to save Merck money on both the cost of operation and maintenance of its vehicles. Analysts expect Merck’s long-term investments in this new technology will pay off in the form of increased sales, increased efficiency, and improved margins.

Recent Posts