Los Angeles Capital Management LLC Reduces Holdings in Organon & Co.

May 3, 2023

Trending News 🌥️

Los Angeles Capital Management LLC recently reported that they have reduced their holdings of Organon & ($NYSE:OGN) Co. stock. This news was reported at Defense World. Organon & Co. is a global biopharmaceutical company focused on developing treatments for diseases and conditions in the areas of fertility, contraception, and women’s health. Organon & Co. is committed to their mission to provide patients with the highest quality of care and medicines to bring hope and healing to people’s lives. Through their network of research and development, manufacturing, and marketing capabilities, they strive to bring life-changing treatments to those who need them.

The company’s stock is traded on the New York Stock Exchange under the symbol “ORA”. Los Angeles Capital Management LLC’s recent decision to reduce their holdings of Organon & Co. stock highlights a desire among some investors to seek out other investment opportunities. While the effects of this move remain to be seen, it is sure to have an impact on the company’s future growth and profitability.

Price History

Shares of Organon & Co. opened at $24.7 and closed at $24.5, down 0.5% from the previous closing price of 24.6. The transaction was disclosed in a document filed with the Securities & Exchange Commission. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Organon &. More…

| Total Revenues | Net Income | Net Margin |

| 6.17k | 917 | 16.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Organon &. More…

| Operations | Investing | Financing |

| 858 | -420 | -433 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Organon &. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.96k | 11.85k | -3.51 |

Key Ratios Snapshot

Some of the financial key ratios for Organon & are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.4% | -23.7% | 25.0% |

| FCF Margin | ROE | ROA |

| 7.0% | -98.6% | 8.8% |

Analysis

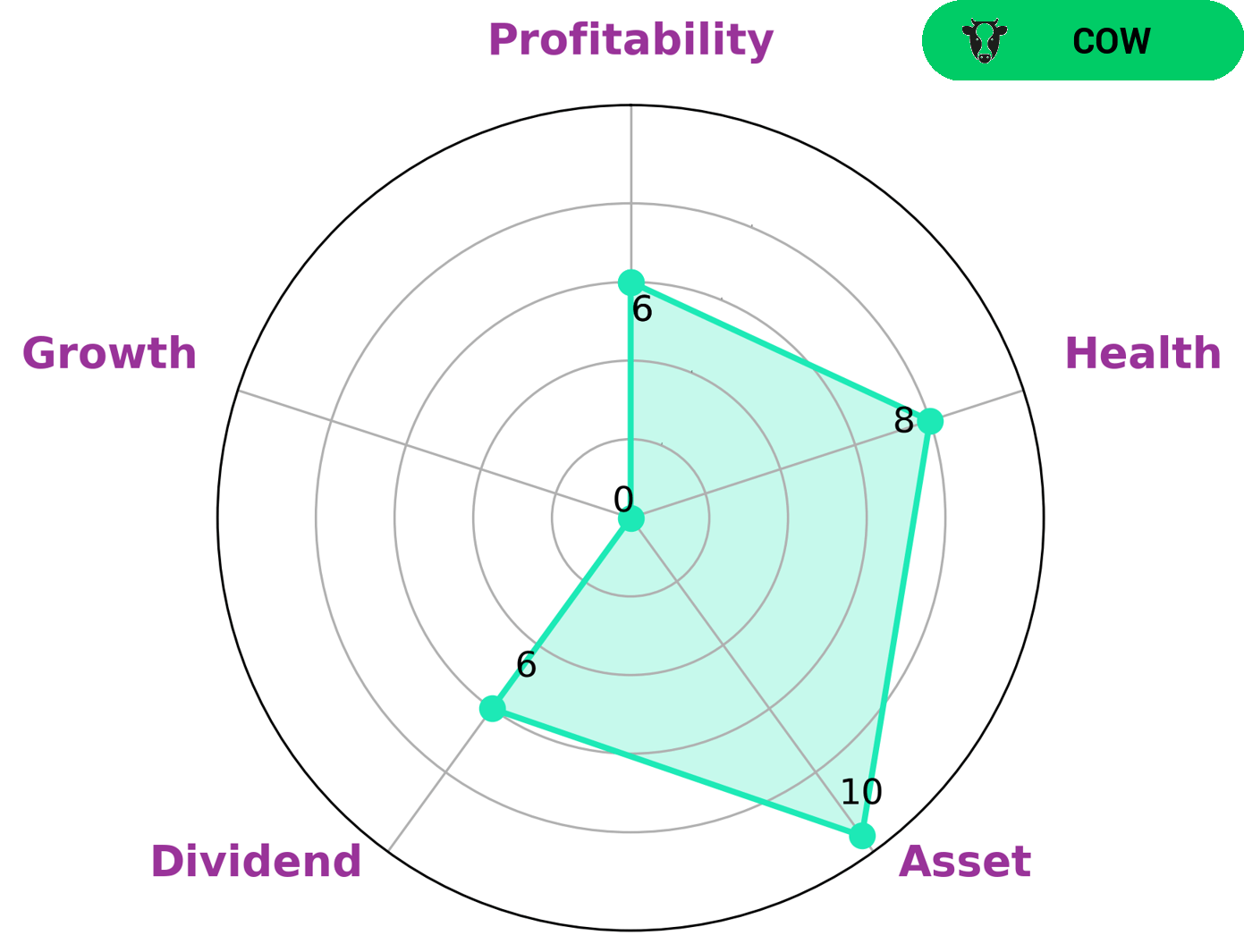

As an analysis provided by GoodWhale, ORGANON & has been classified as a ‘cow’ – a type of company that pays out consistent and sustainable dividends. This type of company may be of particular interest to investors looking for low-risk investments that still provide a steady return. When gauging ORGANON &’s overall wellbeing, our Star Chart gives it a rating of 8/10. It scored particularly well in terms of its cashflow and debt, indicating that it is capable of paying off its debt and funding future operations. In terms of asset, dividend, and profitability, ORGANON & scored medium in each category. The only area in which the company scored weakly was growth. Overall, ORGANON & has proven itself to be a strong business with reliable returns. It may be of interest to those seeking low-risk investments that still yield a good return. More…

Peers

Its competitors include Creso Pharma Ltd, NGL Fine-Chem Ltd, Willow Biosciences Inc, and other similar companies.

– Creso Pharma Ltd ($ASX:CPH)

Creso Pharma Ltd is a clinical stage pharmaceutical and nutraceutical company. The company focuses on the development, registration and commercialization of cannabis and hemp derived products. Creso Pharma Ltd has a market cap of 41.48M as of 2022, a Return on Equity of -38.64%. The company has a portfolio of products in various stages of development, including a CBD-based nutraceutical, a CBD-based animal health product, and a CBD-based topical cream.

– NGL Fine-Chem Ltd ($BSE:524774)

NGL Fine-Chem Ltd is a publicly traded company with a market capitalization of 8.71 billion as of 2022. The company’s return on equity is 13.3%. NGL Fine-Chem Ltd is engaged in the business of manufacturing and marketing of specialty chemicals. The company’s products are used in a variety of industries, including the automotive, aerospace, and construction industries.

– Willow Biosciences Inc ($TSX:WLLW)

Willow Biosciences Inc is a biotechnology company that develops and manufactures pharmaceutical ingredients. The company has a market capitalization of $14.85 million and a return on equity of -12.05%. Willow Biosciences is focused on providing sustainable, plant-based alternatives to traditional chemical manufacturing processes. The company’s products are used in a variety of industries, including pharmaceuticals, cosmetics, and food and beverage.

Summary

Organon & Co. is a global bioscience company that develops innovative solutions in the health care sector. A recent investment analysis of Organon & Co. reveals that Los Angeles Capital Management LLC has reduced its position in the company’s stocks. The investment analysis suggests that investors should be cautious when investing in Organon & Co., as the stock may not be performing as well as initially expected. The analysis also shows that the company’s sales and earnings have decreased in recent quarters, while its debt level has increased significantly.

Moreover, Organon & Co. has recently been facing a number of lawsuits, which could further impact its stock price. Therefore, investors should consider carefully before investing in Organon & Co. stocks in light of its current financial situation and potential legal risks.

Recent Posts