LLY Stock Intrinsic Value – EU Accepts Eli Lilly’s Omvoh for Ulcerative Colitis Treatment

April 1, 2023

Trending News ☀️

Eli ($NYSE:LLY) Lilly and Company, a leading pharmaceuticals corporation, has recently seen their medication Omvoh take a step closer to European Union (EU) approval. The European Medicines Agency has endorsed the biologic drug, which can be used to treat ulcerative colitis. This news has been welcomed by many, as the drug provides a new, safe, and effective therapy for sufferers of this potentially debilitating condition. Omvoh has already been approved for use in Japan, Australia and Canada, and it is hoped that the EU approval will allow more patients to benefit from its use. The drug works by reducing inflammation in the lining of the colon and reducing the body’s immune response. Eli Lilly and Company is confident that Omvoh will be approved by the EU in a timely manner, and that it will revolutionize the management of ulcerative colitis.

Eli Lilly and Company is no stranger to the biologics industry, having developed numerous medications for patients with rare and severe conditions. The company’s stock has seen a steady rise since it announced the results of Omvoh’s clinical trials earlier this year, and many believe that the drug will be a significant source of revenue for the company. The endorsement of Omvoh by the European Medicines Agency is an important step in Eli Lilly and Company’s mission to provide safe and effective treatments for those suffering from serious medical conditions.

Price History

On Friday, Eli Lilly and Co. stock opened at $342.0 and closed at $343.4, up by 0.8% from last closing price of 340.7. This was after the European Union (EU) accepted their new medicine, Omvoh, for the treatment of ulcerative colitis. The acceptance of Omvoh marks a major milestone for Eli Lilly and Co., as it will now be available to millions of people in the EU suffering from this chronic condition. It also further solidifies Eli Lilly’s position as a world leader in developing and providing innovative treatments to those in need. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LLY. More…

| Total Revenues | Net Income | Net Margin |

| 28.54k | 6.24k | 26.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LLY. More…

| Operations | Investing | Financing |

| 7.08k | -3.26k | -5.41k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LLY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.49k | 38.71k | 11.21 |

Key Ratios Snapshot

Some of the financial key ratios for LLY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 12.7% | 25.0% |

| FCF Margin | ROE | ROA |

| 16.1% | 43.1% | 9.0% |

Analysis – LLY Stock Intrinsic Value

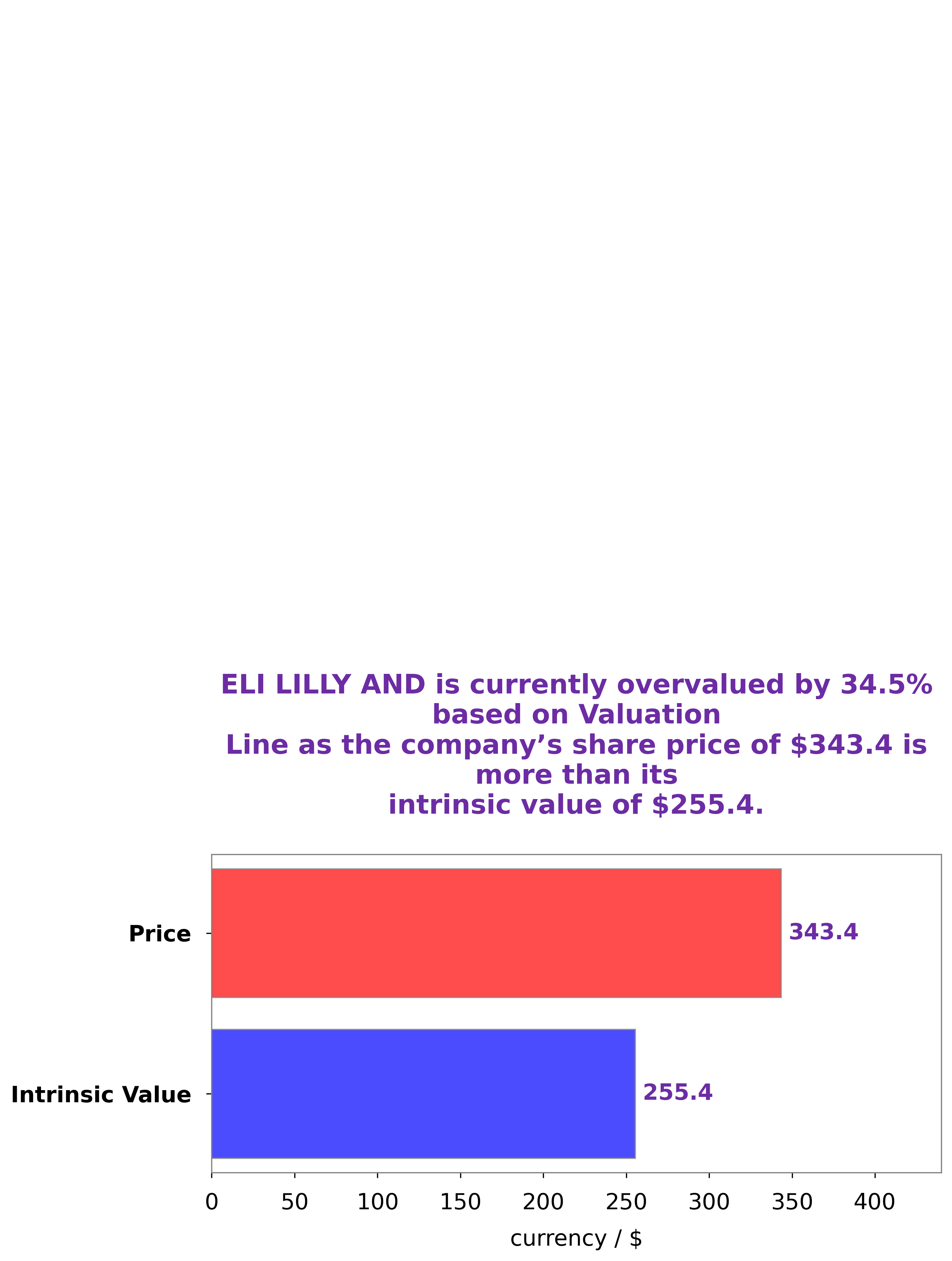

At GoodWhale, we have conducted an analysis of ELI LILLY AND based on its fundamentals. After careful consideration, we have concluded that the intrinsic value of its stock is around $255.4. This is according to our proprietary Valuation Line. Interestingly, the current market price of ELI LILLY AND stock is $343.4. This indicates that the stock is overvalued by 34.4%. This discrepancy between the intrinsic value and the market price can be explained by a variety of factors, such as investor sentiment and changes in macroeconomic conditions. More…

Peers

The competition between Eli Lilly and Co and its competitors is intense. Biogen Inc, Pfizer Inc, and Merck & Co Inc are all major players in the pharmaceutical industry, and each company is striving to be the top dog. Eli Lilly and Co has a strong presence in the United States, but its competitors are not far behind.

– Biogen Inc ($NASDAQ:BIIB)

Biogen Inc is an American multinational biotechnology company. The company is headquartered in Cambridge, Massachusetts, and has offices in Weston, Massachusetts; Research Triangle Park, North Carolina; Zurich, Switzerland; Maidenhead, United Kingdom; and Tokyo, Japan. Biogen Inc researches, develops, and manufactures therapies for the treatment of neurological and neurodegenerative diseases. The company’s products include AVONEX, TYSABRI, and FAMPYRA.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc has a market cap of 244.98B as of 2022, a Return on Equity of 24.63%. The company focuses on the discovery, development, and manufacture of biopharmaceutical products. Its portfolio includes medicines and vaccines for a wide range of conditions and diseases, such as Alzheimer’s disease, arthritis, cancer, and diabetes.

– Merck & Co Inc ($NYSE:MRK)

Merck & Co., Inc., d.b.a. Merck Sharp & Dohme (MSD) outside the United States and Canada, is an American multinational pharmaceutical company and one of the largest pharmaceutical companies in the world. The company was established in 1891 as the United States subsidiary of the German company Merck, which was founded in 1668 by the Merck family. Merck & Co. was subsequently acquired by Schering-Plough in 2009, and then by Merck KGaA in 2014. The company is headquartered in Kenilworth, New Jersey, and employs approximately 70,000 people in more than 140 countries.

Merck’s market cap is 238.43B as of 2022. The company has a Return on Equity of 28.84%. Merck & Co. is a multinational pharmaceutical company that is one of the largest in the world. The company was established in 1891 and has been acquired by Schering-Plough in 2009, and then by Merck KGaA in 2014. Merck & Co. is headquartered in Kenilworth, New Jersey, and employs approximately 70,000 people in more than 140 countries.

Summary

Eli Lilly and Co. has been given a nod of approval from the European Medicines Agency (EMA) for its drug, Omvoh, used in the treatment of ulcerative colitis. This step brings the company one step closer to getting the drug approved for use in the European Union. The drug is in phase 3 of clinical trials, and if it is approved, it will be a major boon for Eli Lilly and Co., as it would be the first approved treatment for ulcerative colitis in Europe.

The company’s stock is likely to rise as a result of this positive news. Investors may want to keep a close eye on Eli Lilly and Co. to see how this news affects the company’s stock price.

Recent Posts