JNJ Stock Fair Value Calculation – Johnson & Johnson Loses Top Spot to Eli Lilly, Shares Undervalued Despite Technical Risks

June 12, 2023

☀️Trending News

This shift in power has led to Johnson & Johnson ($NYSE:JNJ)’s shares being undervalued by investors due to technical risks that have emerged. Johnson & Johnson is a multinational healthcare corporation that manufactures and distributes a variety of products including pharmaceuticals, medical devices, and consumer health products. In recent years, the company has been subject to a series of lawsuits involving their baby powder product which is suspected to contain carcinogenic ingredients. These lawsuits have put a dent in Johnson & Johnson’s reputation and have caused investors to question the safety of their products, leading to a drop in stock prices.

Although there are technical risks associated with Johnson & Johnson’s products, many investors are confident that the company will eventually recover from its current slump. Despite their current market position, Johnson & Johnson shares remain undervalued and could prove to be a great investment opportunity in the near future.

Market Price

On Thursday, Johnson & Johnson (J&J) lost the top spot as the world’s most valuable healthcare company to Eli Lilly, as its stock opened at $158.5 and closed at $160.3, up by 1.1% from last closing price of 158.5. Despite this technical risk, analysts suggest that J&J’s shares are undervalued and could see an upturn in the near future. This opinion is further bolstered by the company’s strong fundamentals and long-term growth plans. However, it remains to be seen how the market responds to potential changes in J&J’s stock price in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JNJ. More…

| Total Revenues | Net Income | Net Margin |

| 96.26k | 12.72k | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JNJ. More…

| Operations | Investing | Financing |

| 23.42k | -6.19k | -18.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JNJ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 179.23k | 108.96k | 27.04 |

Key Ratios Snapshot

Some of the financial key ratios for JNJ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 4.0% | 23.6% |

| FCF Margin | ROE | ROA |

| 24.3% | 20.2% | 7.9% |

Analysis – JNJ Stock Fair Value Calculation

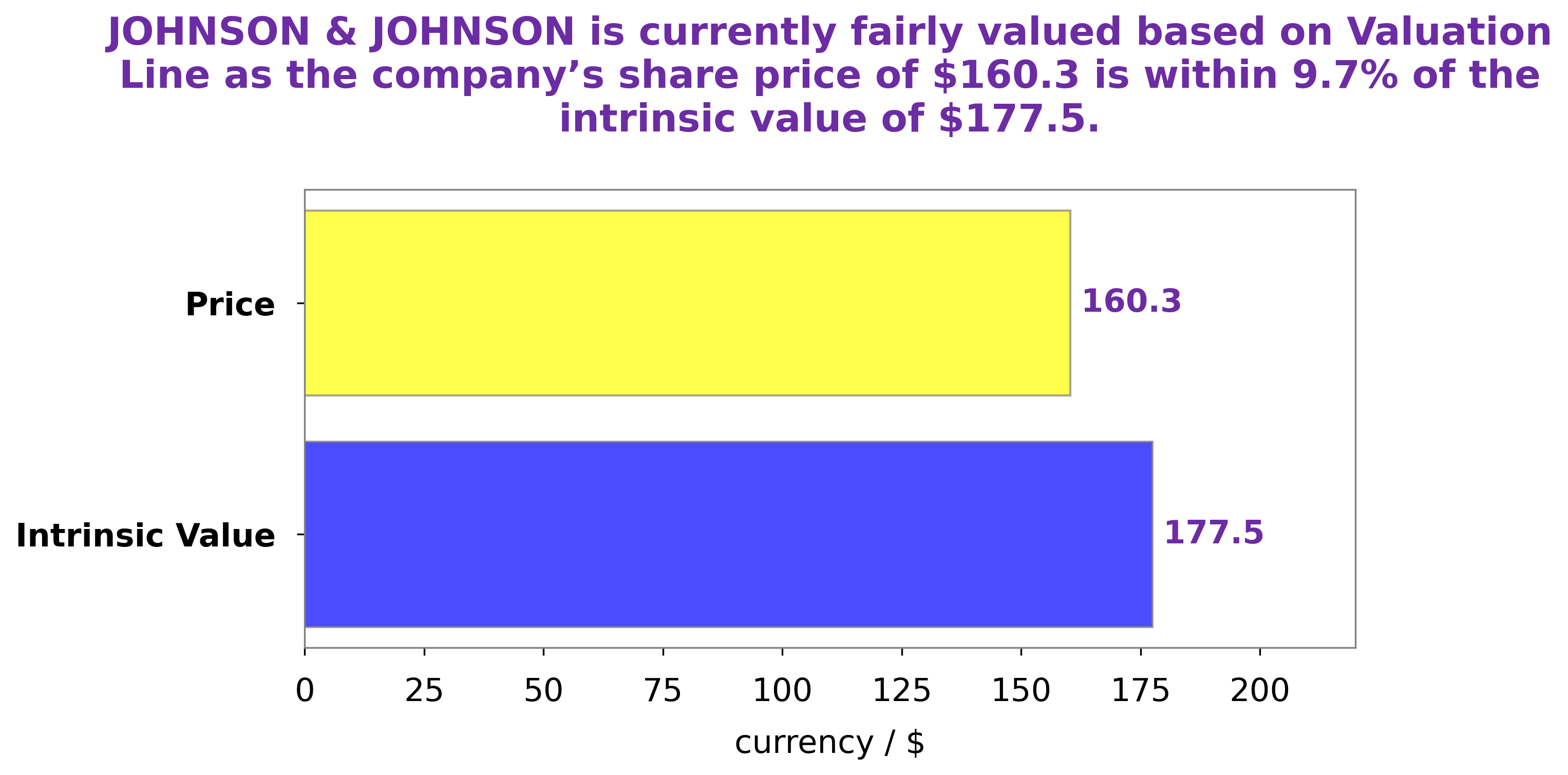

At GoodWhale, we have carefully analyzed the fundamentals of JOHNSON & JOHNSON. After taking into account its market conditions, operations data and financial ratios, we have arrived at an intrinsic value of around $177.5 for the company’s share. This suggests that the current price of $160.3, is trading below its true value by 9.7%. More…

Peers

The competition between Johnson & Johnson and its competitors is fierce. AstraZeneca PLC, Pfizer Inc, and BioNTech SE are all major players in the pharmaceutical industry, and they are all vying for a piece of the pie. Johnson & Johnson is a well-established company with a long history of success, but its competitors are not to be underestimated. They are all large, well-funded companies with a lot to lose if they don’t win the competition.

– AstraZeneca PLC ($LSE:AZN)

AstraZeneca PLC is a biopharmaceutical company with a market cap of 152.13B as of 2022. The company focuses on the discovery, development, and commercialization of small molecule drugs in the areas of oncology, cardiovascular, and renal & metabolism. The company’s ROE for the year ended December 31, 2020 was -0.94%.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a pharmaceutical company with a market cap of 240.55B as of 2022. The company has a return on equity of 24.63%. Pfizer Inc is a research-based, global pharmaceutical company that discovers, develops, manufactures, and markets medicines for humans and animals. The company’s products include prescription and over-the-counter medicines, vaccines, and biologic therapies.

– BioNTech SE ($NASDAQ:BNTX)

BioNTech SE is a German biotech company founded in 2008 that focuses on the development of Innovation therapies against cancer and other serious diseases. The company has a market cap of 32.91B as of 2022 and a Return on Equity of 71.82%. BioNTech’s mission is to revolutionize the treatment of cancer and other serious diseases by leveraging the power of the immune system. The company is developing a portfolio of immunotherapy products based on its proprietary mRNA technology platform.

Summary

Johnson & Johnson (JNJ) recently relinquished its top spot in the Dow Jones Industrial Average to Eli Lilly, a move that has caused investors to take a closer look at JNJ. Despite the technical risks associated with this shift, analysts suggest JNJ’s shares remain undervalued and a solid long-term investment. JNJ boasts a strong portfolio of innovative products, a wide global presence, and a solid dividend history. Its cash flows are well-protected with diversified revenue streams that are expected to grow in the next few years.

Additionally, its strong balance sheet provides financial flexibility to pursue strategic acquisitions and partnerships. With a large cash reserve and low debt, JNJ is well-positioned to capitalize on future opportunities in the healthcare sector. Analysts consider JNJ to be a relatively safe option for investors looking for steady returns.

Recent Posts