Investors Overlooked Opportunity: Organon Offers Big Potential Despite 12% Price Drop in Past Year

February 8, 2023

Trending News ☀️

Organon ($NYSE:OGN) is a Belgium-based pharmaceutical company that develops and manufactures various drugs and treatments for a range of diseases, including cancer, diabetes, and heart disease. Despite its strong track record of success, the company’s stock has dropped 12% in the past year, making it an attractive opportunity for investors. This suggests that the company is trading at a significant discount compared to its peers, making it a great investment opportunity. Furthermore, despite the recent drop in its stock price, the company has posted steady growth over the last five years, indicating that the stock may be undervalued. The company has also recently launched several new products which are expected to drive its future growth.

These include treatments for cancer and diabetes as well as new drugs for treating heart disease and neurological disorders. The launch of these products is likely to attract more investors, leading to higher demand for Organon’s stock. Overall, Organon offers investors a unique opportunity to capitalize on a company that has been overlooked by the market despite its strong track record of success and innovative products. With its low PE ratio and steady growth over the last five years, Organon is an attractive investment opportunity that should not be overlooked.

Price History

Organon is an overlooked opportunity that offers big potential despite its 12% price drop in the past year. Till now, media sentiment has been mostly neutral, with most investors unaware of the potential of the company.

However, recent events have been positive, with their share price rising 0.9% on Tuesday. The stock opened at $29.5 and closed at $29.8, up from the previous closing price of $29.6. The company has consistently posted impressive earnings reports, which have given investors confidence in their future prospects.

Additionally, Organon has continued to invest in research and development, which has resulted in new products and services that have enabled the company to remain competitive in a rapidly changing market. Organon has also been making strategic acquisitions to expand its reach, as well as investing in its existing business lines. This has enabled the company to tap into new markets and strengthen its overall financial position. As a result, Organon has been able to increase its revenue and profits, while also providing investors with an attractive return on investment. Its strong fundamentals, combined with its expanding product portfolio, make it a sound investment for those looking for steady returns over time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Organon &. More…

| Total Revenues | Net Income | Net Margin |

| 6.29k | 1.01k | 17.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Organon &. More…

| Operations | Investing | Financing |

| 638 | -492 | -538 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Organon &. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.44k | 11.5k | -4.19 |

Key Ratios Snapshot

Some of the financial key ratios for Organon & are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -13.6% | -12.5% | 26.2% |

| FCF Margin | ROE | ROA |

| 2.2% | -93.5% | 9.9% |

Analysis

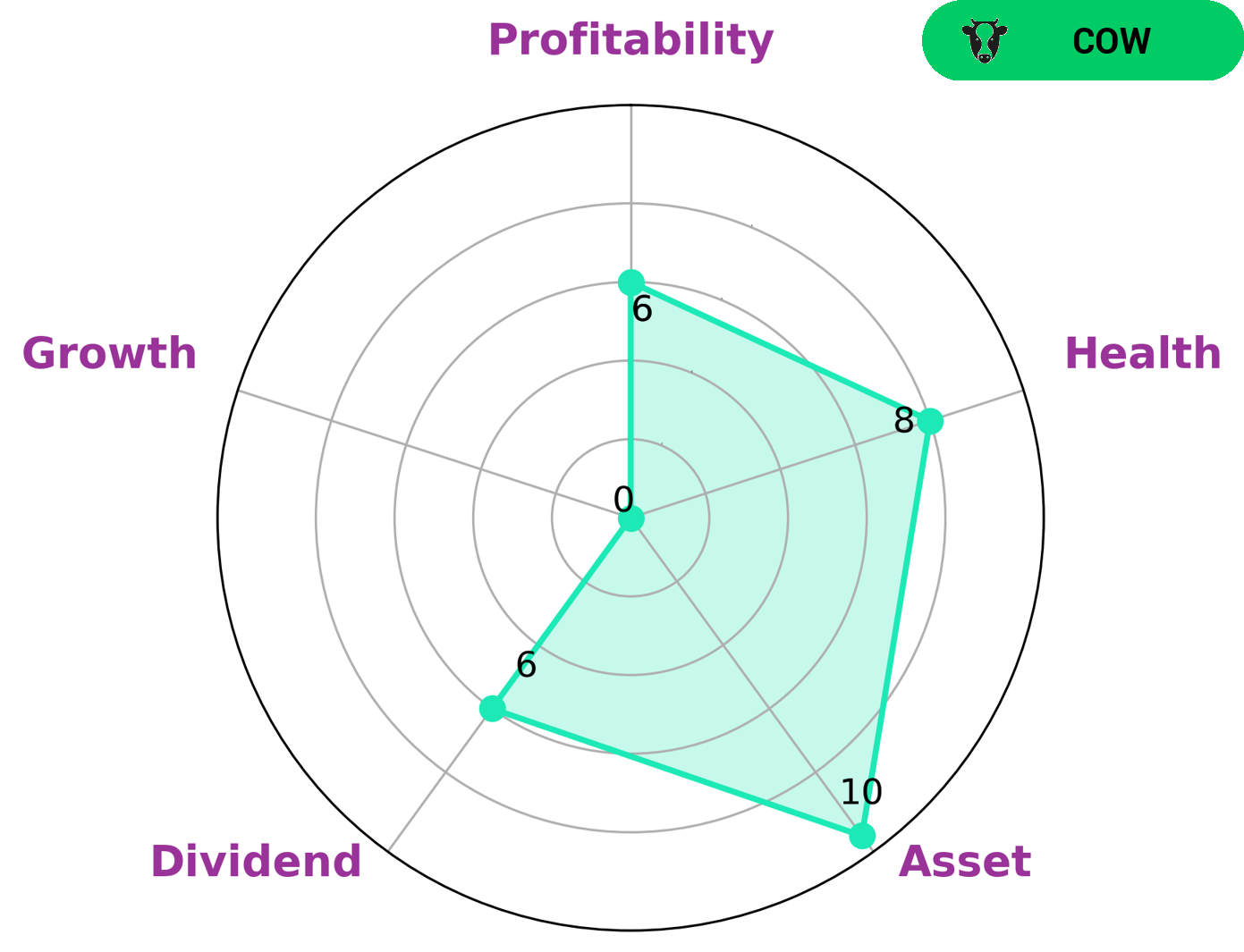

GoodWhale analyzed the fundamentals of ORGANON & and the results of the analysis were revealed in a Star Chart. The Star Chart showed that ORGANON & had a strong asset, medium dividend, profitability, and weak growth. ORGANON & had a very high health score of 8/10 with regards to its cashflows and debt, showing that it was in a very good position to weather any crisis without the risk of bankruptcy. Furthermore, ORGANON & was classified as a ‘cow’, a type of company that has consistently paid out sustainable dividends in the past. This type of company would be attractive to investors who are looking for steady and consistent income from their investments, such as retirees and those who require a regular income from their investments. Furthermore, investors who are looking for low-risk investments with the potential for capital appreciation would also find ORGANON & to be appealing. In addition, those looking for long-term investments would also find value in ORGANON & as it has regularly paid out dividends over time and is in a position to do so in the future. More…

Peers

Its competitors include Creso Pharma Ltd, NGL Fine-Chem Ltd, Willow Biosciences Inc, and other similar companies.

– Creso Pharma Ltd ($ASX:CPH)

Creso Pharma Ltd is a clinical stage pharmaceutical and nutraceutical company. The company focuses on the development, registration and commercialization of cannabis and hemp derived products. Creso Pharma Ltd has a market cap of 41.48M as of 2022, a Return on Equity of -38.64%. The company has a portfolio of products in various stages of development, including a CBD-based nutraceutical, a CBD-based animal health product, and a CBD-based topical cream.

– NGL Fine-Chem Ltd ($BSE:524774)

NGL Fine-Chem Ltd is a publicly traded company with a market capitalization of 8.71 billion as of 2022. The company’s return on equity is 13.3%. NGL Fine-Chem Ltd is engaged in the business of manufacturing and marketing of specialty chemicals. The company’s products are used in a variety of industries, including the automotive, aerospace, and construction industries.

– Willow Biosciences Inc ($TSX:WLLW)

Willow Biosciences Inc is a biotechnology company that develops and manufactures pharmaceutical ingredients. The company has a market capitalization of $14.85 million and a return on equity of -12.05%. Willow Biosciences is focused on providing sustainable, plant-based alternatives to traditional chemical manufacturing processes. The company’s products are used in a variety of industries, including pharmaceuticals, cosmetics, and food and beverage.

Summary

Organon is a pharmaceuticals company that has experienced a 12% drop in price over the past year, yet may still offer investors a lucrative opportunity. Despite the decrease in stock price, investors should be aware that Organon’s underlying fundamentals remain strong, with a solid balance sheet and a healthy cash flow. They also have a well-established product portfolio, which includes several blockbuster drugs and a diverse range of treatments in the pipeline. These factors could potentially make Organon a good investment for those looking for long-term growth.

Furthermore, investors should also consider the current media sentiment towards the company, which is mostly neutral at the moment. As such, investors may want to consider doing their own research and taking into account their own financial goals before making any investment decisions regarding Organon.

Recent Posts