Gilead Sciences Stock Fair Value Calculator – Gilead Sciences’ Outlook Dimmed Following Rating Downgrade

April 13, 2023

Trending News 🌥️

Gilead Sciences ($NASDAQ:GILD), a leading biopharmaceutical company, has seen its outlook dimmed following a recent rating downgrade. The stock, which had been previously rated a buy, was downgraded to only a marginal hold by analysts. This has caused the market to become unenthusiastic about the stock, citing concerns about its future prospects. Gilead Sciences is best known for its pioneering work in the development and commercialization of innovative antiviral drugs, such as its flagship product Sovaldi. The company is also involved in research and development of other therapies and treatments, such as oncology, inflammation and respiratory diseases. This has enabled the company to maintain a strong presence in the biopharmaceutical industry.

However, the recent downgrade has caused the stock to suffer, with investors uncertain about the future outlook of Gilead Sciences. This has put a damper on the stock’s prospects in the near and mid-term, leading to many analysts downgrading their ratings of the stock. Investors are now advised to exercise caution when investing in Gilead Sciences’ stock until the company provides more information regarding its long-term outlook.

Market Price

On Wednesday, Gilead Sciences‘ stock opened at $83.0 and closed at $82.2, representing a 0.5% decrease from its previous closing price of 82.5. This downturn follows a recent rating downgrade from Wall Street analysts, who had previously given the company a ‘buy’ rating. The bleak outlook for Gilead Sciences was further compounded by news reports indicating that the company’s sales of hepatitis C drugs were slowing down, as well as a decline in their marketed products’ operating margins. As a result, investors’ outlook for Gilead Sciences has been dimmed for the foreseeable future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gilead Sciences. More…

| Total Revenues | Net Income | Net Margin |

| 27.28k | 4.59k | 27.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gilead Sciences. More…

| Operations | Investing | Financing |

| 9.07k | -2.47k | -6.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gilead Sciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 63.17k | 41.96k | 17.03 |

Key Ratios Snapshot

Some of the financial key ratios for Gilead Sciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 36.8% | 24.7% |

| FCF Margin | ROE | ROA |

| 30.6% | 19.9% | 6.7% |

Analysis – Gilead Sciences Stock Fair Value Calculator

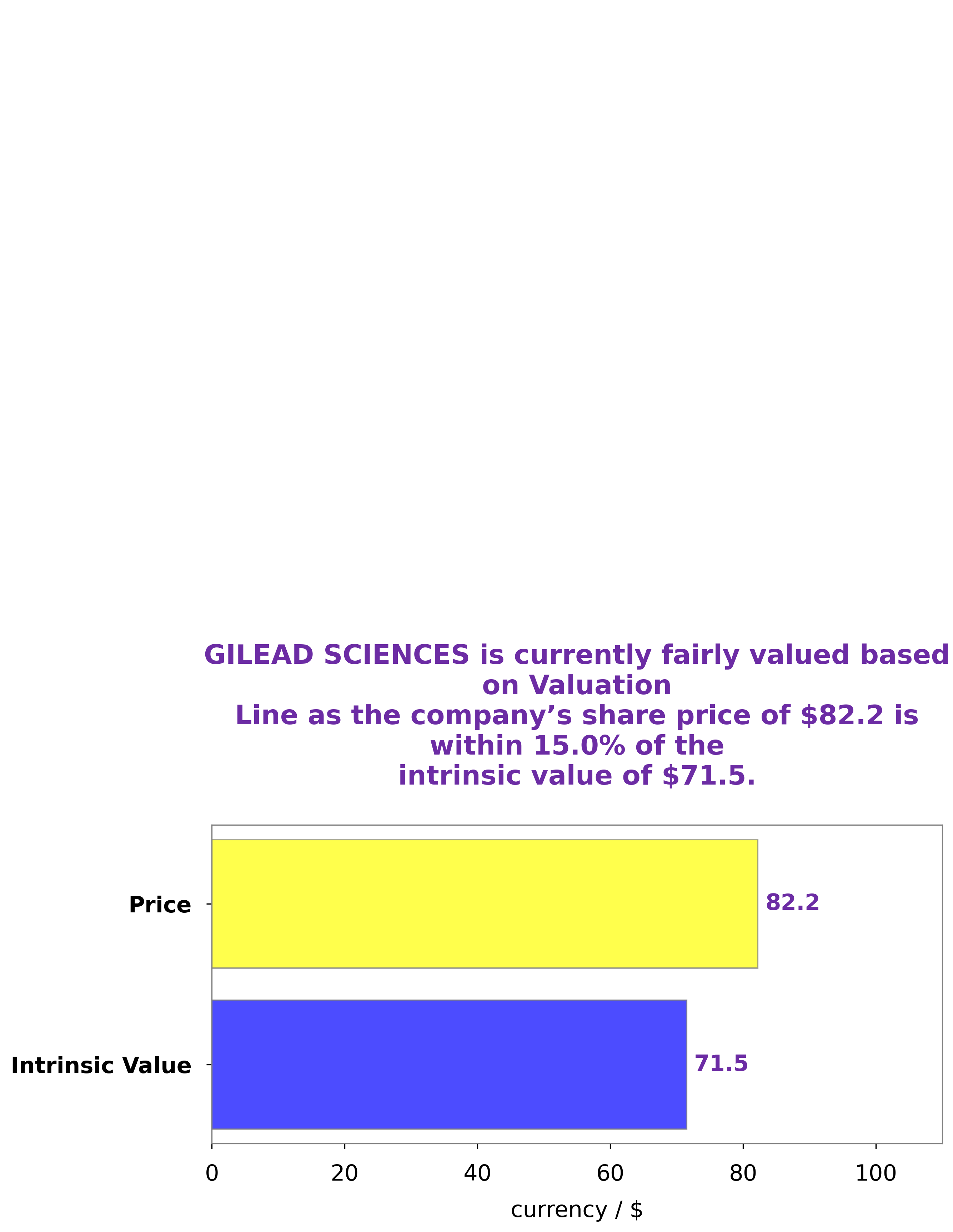

At GoodWhale, we have conducted an analysis of GILEAD SCIENCES‘s wellbeing. Through our proprietary Valuation Line, we have calculated the intrinsic value of GILEAD SCIENCES’s share to be around $71.5. More…

Peers

In the biopharmaceutical industry, competition is fierce. Among the companies vying for market share are Gilead Sciences Inc, Eli Lilly and Co, Amgen Inc, and SCYNEXIS Inc. All of these companies are working to develop new and innovative treatments for a variety of diseases.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a pharmaceutical company with a market cap of 316.8 billion as of May 2021. The company has a return on equity of 45.88% and is headquartered in Indianapolis, Indiana. Eli Lilly and Co develops and markets prescription medications and over-the-counter products. The company’s products are available in approximately 120 countries.

– Amgen Inc ($NASDAQ:AMGN)

Amgen Inc is a biopharmaceutical company with a market cap of 135.3B as of 2022. The company has a return on equity of 460.37%. Amgen Inc is a biopharmaceutical company that discovers, develops, manufactures, and delivers human therapeutics worldwide. The company offers products for the treatment of oncology/hematology, cardiovascular, inflammation, bone health, and nephrology.

– SCYNEXIS Inc ($NASDAQ:SCYX)

SCYNEXIS Inc. is a biopharmaceutical company, which focuses on the development and commercialization of novel anti-infectives to address unmet therapeutic needs. The company’s lead product, SCY-078, is an oral and intravenous antifungal agent in Phase 3 clinical development for the treatment of serious and life-threatening invasive fungal infections. SCYNEXIS Inc. was founded by Peter R. Lupton, David P. Lupton and George W. Schmidt in December 1997 and is headquartered in Durham, NC.

Summary

Gilead Sciences, a biopharmaceutical company, has seen a downgrade of its stock rating from a ‘buy’ to a ‘hold’. Market sentiment is uninspiring and the stock appears to be struggling. Investors should consider the current market conditions and the potential for the stock to turn around before investing. Analysts have suggested that Gilead Sciences may be facing pressure due to slowing sales and weak pricing power.

Additionally, with the uncertainty of the coronavirus pandemic, investors need to be cautious of any further volatility in the market. It is important to investigate all relevant data and analyze future prospects before making any investment decision.

Recent Posts