GILEAD SCIENCES Announces Fiscal Year 2022 Fourth Quarter Earnings Results on February 2, 2023.

April 3, 2023

Earnings Overview

On February 2, 2023, GILEAD SCIENCES ($NASDAQ:GILD) reported their fourth quarter earnings results for the fiscal year 2022, which ended on December 31, 2022. In comparison with the same quarter of the previous year, total revenue rose by 331.6% to USD 1.6 billion while net income increased by 2.1% to USD 7.4 billion.

Transcripts Simplified

Gilead had a successful quarter and year, with total product sales excluding Veklury at $6.3 billion, up 9% year-over-year, or 12%, excluding the impact of FX, and the loss of exclusivity of Truvada and Atripla. HIV sales for the fourth quarter were $4.8 billion at 5% year-over-year, driven by higher demand as well as favorable pricing dynamics. Descovy sales for the fourth quarter were $537 million, up 13% year-over-year and 7% sequentially.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gilead Sciences. More…

| Total Revenues | Net Income | Net Margin |

| 27.28k | 4.59k | 27.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gilead Sciences. More…

| Operations | Investing | Financing |

| 9.07k | -2.47k | -6.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gilead Sciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 63.17k | 41.96k | 17.03 |

Key Ratios Snapshot

Some of the financial key ratios for Gilead Sciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 36.8% | 24.7% |

| FCF Margin | ROE | ROA |

| 30.6% | 19.9% | 6.7% |

Price History

Their stock opened at $82.4 and closed at $81.4, a decrease of 3.1% from the last closing price of 84.0 from the previous day. This decrease is likely related to the changing business environment and the outlook for the company in the coming quarter. GILEAD Sciences is expected to present a detailed overview of its financial performance for the fourth quarter on February 2, 2023. This report will include revenue, net income, and other financial information related to the company’s performance. Investors will be looking closely at this report to gain further insights into GILEAD Sciences’ business model and how it is positioned for success in the upcoming quarter.

The fourth quarter of 2022 has been an interesting one for GILEAD Sciences, as the company has seen its stock prices fluctuate due to several major events and announcements. Investors are hoping that this quarterly earnings report can provide a clearer picture of the company’s health and future prospects. With the results of this report, investors will be able to make more informed decisions about investing in GILEAD Sciences. Live Quote…

Analysis

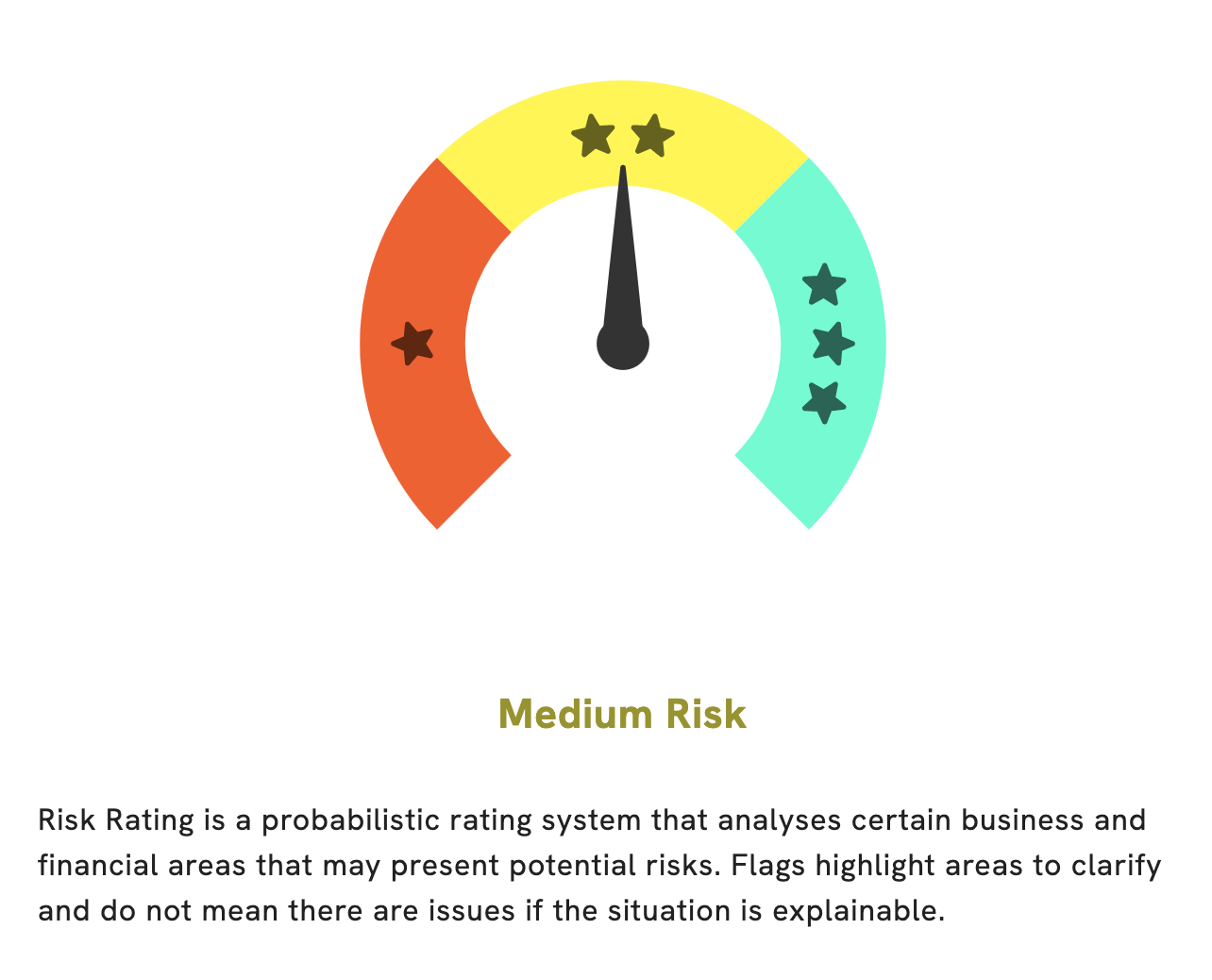

At GoodWhale, we wanted to analyze the financials of GILEAD SCIENCES so that our users can get an insight into the financial health of the company. After carefully reviewing their financials, we have determined that GILEAD SCIENCES is a medium risk investment and our Risk Rating for the company is medium. We have detected two potential risks in the income statement and balance sheet of GILEAD SCIENCES. We encourage our users to register on goodwhale.com and view more detailed analysis of GILEAD SCIENCES’s financials. We believe this information can help investors make informed decisions when selecting stocks. More…

Peers

In the biopharmaceutical industry, competition is fierce. Among the companies vying for market share are Gilead Sciences Inc, Eli Lilly and Co, Amgen Inc, and SCYNEXIS Inc. All of these companies are working to develop new and innovative treatments for a variety of diseases.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a pharmaceutical company with a market cap of 316.8 billion as of May 2021. The company has a return on equity of 45.88% and is headquartered in Indianapolis, Indiana. Eli Lilly and Co develops and markets prescription medications and over-the-counter products. The company’s products are available in approximately 120 countries.

– Amgen Inc ($NASDAQ:AMGN)

Amgen Inc is a biopharmaceutical company with a market cap of 135.3B as of 2022. The company has a return on equity of 460.37%. Amgen Inc is a biopharmaceutical company that discovers, develops, manufactures, and delivers human therapeutics worldwide. The company offers products for the treatment of oncology/hematology, cardiovascular, inflammation, bone health, and nephrology.

– SCYNEXIS Inc ($NASDAQ:SCYX)

SCYNEXIS Inc. is a biopharmaceutical company, which focuses on the development and commercialization of novel anti-infectives to address unmet therapeutic needs. The company’s lead product, SCY-078, is an oral and intravenous antifungal agent in Phase 3 clinical development for the treatment of serious and life-threatening invasive fungal infections. SCYNEXIS Inc. was founded by Peter R. Lupton, David P. Lupton and George W. Schmidt in December 1997 and is headquartered in Durham, NC.

Summary

GILEAD SCIENCES reported strong fourth quarter earnings results for the fiscal year 2022 with total revenue reaching USD 1.6 billion, indicating a 331.6% growth year-over-year. Net income also increased 2.1% year-over-year to USD 7.4 billion. Despite this positive report, the stock price of GILEAD SCIENCES decreased on the same day.

Investors should take these figures into consideration when making their investing decisions. It is important to look at the company’s long-term performance rather than short-term outcomes in order to make a wise and informed decision.

Recent Posts