Eli Lilly Reports Q4 Revenue Beat, Misses on Non-GAAP EPS

April 28, 2023

Trending News 🌧️

Eli ($NYSE:LLY) Lilly and Company is a pharmaceutical company headquartered in Indianapolis, Indiana. The company develops and manufactures innovative medications and biotechnology products for humans and animals, and is currently one of the world’s largest pharmaceutical companies. On the other hand, Eli Lilly’s revenue of $6.96 billion exceeded analysts’ expectations by $90 million. The company saw growth in its two largest markets, the United States and Japan, as well as in other international markets.

Share Price

Eli Lilly reported its fourth-quarter financial results Thursday, with revenue beating expectations but non-GAAP earnings per share missing estimates. Stock opened at $391.3 and closed at $390.4, up 3.7 percent from prior closing price of $376.3. Despite the miss on EPS, Eli Lilly’s stock price moved higher as investors were encouraged by the better-than-expected revenue numbers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LLY. More…

| Total Revenues | Net Income | Net Margin |

| 28.54k | 6.24k | 26.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LLY. More…

| Operations | Investing | Financing |

| 7.08k | -3.26k | -5.41k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LLY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.49k | 38.71k | 11.21 |

Key Ratios Snapshot

Some of the financial key ratios for LLY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 12.7% | 25.0% |

| FCF Margin | ROE | ROA |

| 16.1% | 43.1% | 9.0% |

Analysis

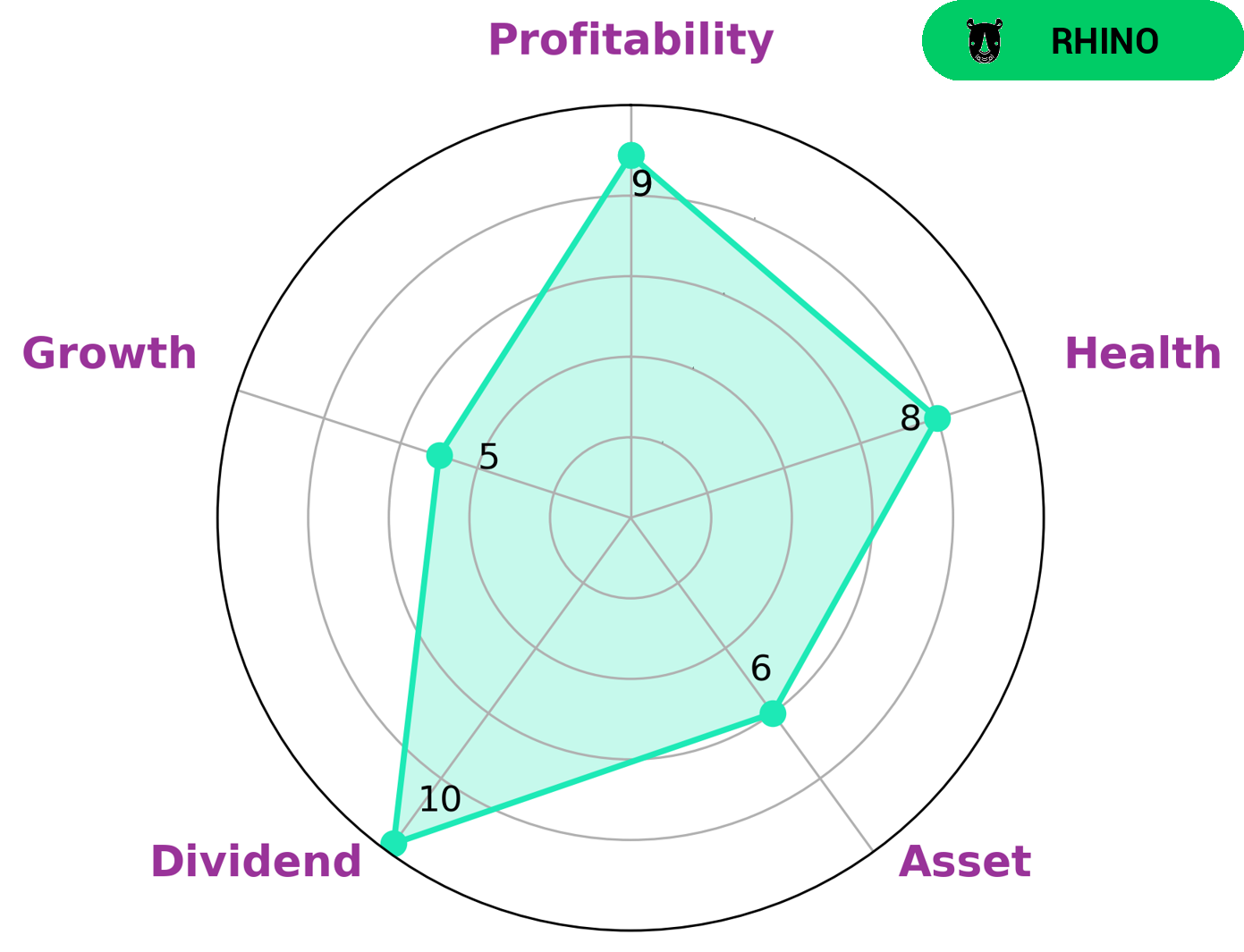

GoodWhale conducted an analysis of ELI LILLY AND’s wellbeing, and the results were very encouraging. According to our Star Chart, ELI LILLY AND has strong dividend and profitability, and medium asset and growth. This means ELI LILLY AND has been able to achieve moderate revenue or earnings growth, and is classified as a ‘rhino’ company. We believe that ELI LILLY AND’s high health score of 8/10, considering its cashflows and debt, is an indication of its capability to pay off debt and fund future operations. As such, ELI LILLY AND may be of interest to investors who are looking for a company with a good track record in dividend yields, profitability, and debt management. More…

Peers

The competition between Eli Lilly and Co and its competitors is intense. Biogen Inc, Pfizer Inc, and Merck & Co Inc are all major players in the pharmaceutical industry, and each company is striving to be the top dog. Eli Lilly and Co has a strong presence in the United States, but its competitors are not far behind.

– Biogen Inc ($NASDAQ:BIIB)

Biogen Inc is an American multinational biotechnology company. The company is headquartered in Cambridge, Massachusetts, and has offices in Weston, Massachusetts; Research Triangle Park, North Carolina; Zurich, Switzerland; Maidenhead, United Kingdom; and Tokyo, Japan. Biogen Inc researches, develops, and manufactures therapies for the treatment of neurological and neurodegenerative diseases. The company’s products include AVONEX, TYSABRI, and FAMPYRA.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc has a market cap of 244.98B as of 2022, a Return on Equity of 24.63%. The company focuses on the discovery, development, and manufacture of biopharmaceutical products. Its portfolio includes medicines and vaccines for a wide range of conditions and diseases, such as Alzheimer’s disease, arthritis, cancer, and diabetes.

– Merck & Co Inc ($NYSE:MRK)

Merck & Co., Inc., d.b.a. Merck Sharp & Dohme (MSD) outside the United States and Canada, is an American multinational pharmaceutical company and one of the largest pharmaceutical companies in the world. The company was established in 1891 as the United States subsidiary of the German company Merck, which was founded in 1668 by the Merck family. Merck & Co. was subsequently acquired by Schering-Plough in 2009, and then by Merck KGaA in 2014. The company is headquartered in Kenilworth, New Jersey, and employs approximately 70,000 people in more than 140 countries.

Merck’s market cap is 238.43B as of 2022. The company has a Return on Equity of 28.84%. Merck & Co. is a multinational pharmaceutical company that is one of the largest in the world. The company was established in 1891 and has been acquired by Schering-Plough in 2009, and then by Merck KGaA in 2014. Merck & Co. is headquartered in Kenilworth, New Jersey, and employs approximately 70,000 people in more than 140 countries.

Summary

Eli Lilly and Co reported their third quarter earnings and revenue results. Despite the EPS miss, the stock price moved up on the same day, suggesting investors were pleased with the overall results and may be expecting better performance in the future. This positive sentiment may be supported by Eli Lilly’s strong pipeline, with many potential blockbuster drugs in the works and the announcement of several new clinical trials in the past few months. Investors will be looking for even more promising news from the company in the coming quarters.

Recent Posts