Bristol-myers Squibb dividend calculator – Invest in Quality Dividend Growth with Bristol-Myers Squibb at 52-Week Lows!

May 31, 2023

☀️Trending News

BRISTOL-MYERS ($NYSE:BMY): Bristol-Myers Squibb, one of the world’s leading biopharmaceutical companies, is currently trading at near its 52-week low. With a long history of delivering high-quality dividend growth and a strong portfolio of innovative medicines, it’s an attractive proposition to savvy investors. Bristol-Myers Squibb is dedicated to discovering, developing and delivering innovative medicines to treat serious diseases and improve patients’ lives. This impressive performance has made Bristol-Myers Squibb a popular dividend stock for income-seeking investors.

At its current price, Bristol-Myers Squibb offers investors the opportunity to purchase shares at a very attractive price. With a strong pipeline of drugs and a long history of quality dividend growth, it’s an excellent opportunity to invest in for the long-term.

Dividends – Bristol-myers Squibb dividend calculator

Investors looking for quality dividend growth should take a close look at Bristol-Myers Squibb at its 52-week lows. Over the last three years, Bristol-Myers Squibb has issued annual dividends per share of $2.22, $2.19, and $2.01 USD. Going into 2021, its dividend yields are estimated to be 2.22%, followed by 3.13% in 2022 and 2.32% in 2023, giving an average dividend yield of 2.56%.

For investors who seek out dividend stocks, Bristol-Myers Squibb could be a great choice. With its consistent dividend payments and increasing yields, it can be a valuable addition to any portfolio.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bristol-myers Squibb. More…

| Total Revenues | Net Income | Net Margin |

| 45.85k | 7.31k | 17.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bristol-myers Squibb. More…

| Operations | Investing | Financing |

| 12.22k | -1.37k | -14.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bristol-myers Squibb. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 94.28k | 62.4k | 15.15 |

Key Ratios Snapshot

Some of the financial key ratios for Bristol-myers Squibb are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | 21.2% | 21.8% |

| FCF Margin | ROE | ROA |

| 24.2% | 19.9% | 6.6% |

Price History

Bristol-Myers Squibb (NYSE: BMY) has recently hit new 52-week lows on Tuesday, with its stock opening at $63.4 and closing at $63.7, down by 0.2% from its previous closing price of $63.8. This presents a great opportunity for investors looking to capitalize on the company’s strong reputation for quality dividend growth. Bristol-Myers Squibb has continued to perform consistently over the past few years, and is well-positioned to continue to do so in the future.

The company has a strong portfolio of drugs and treatments, as well as a robust pipeline of new products in development, which provides a sustainable source of revenue and growth. Furthermore, the company has a long history of returning capital to shareholders through regular dividends, making it a great choice for those seeking long-term income. Live Quote…

Analysis – Bristol-myers Squibb Intrinsic Value Calculation

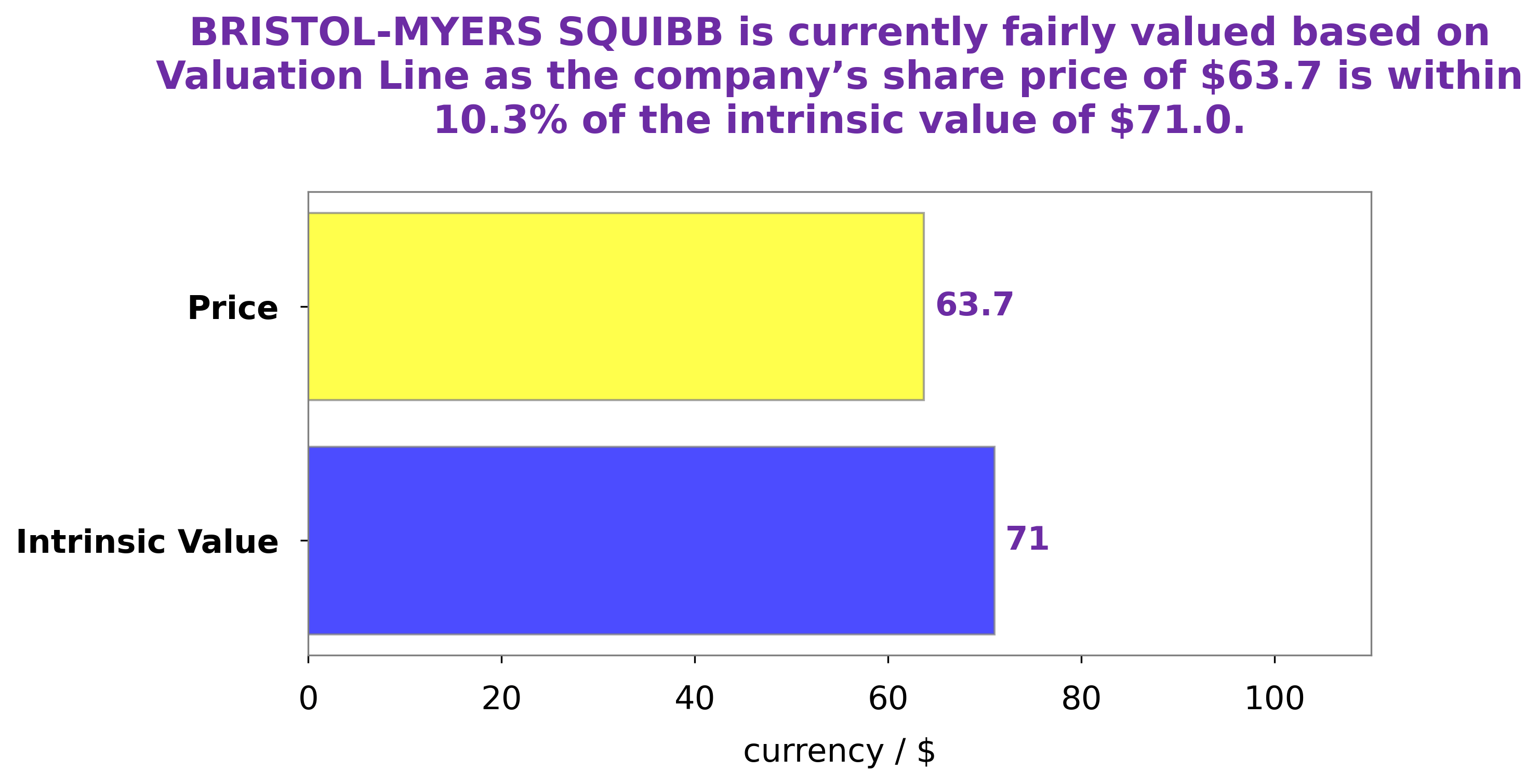

At GoodWhale, we’ve conducted a careful analysis of BRISTOL-MYERS SQUIBB‘s fundamental performance. According to our proprietary Valuation Line, the intrinsic value of BRISTOL-MYERS SQUIBB stock is around $71.0. At the moment, BRISTOL-MYERS SQUIBB shares are trading at $63.7, indicating that it is undervalued by 10.3%. We believe that this is a fair price for the stock and present an opportunity for investors to enter a position in the company. More…

Peers

The company was founded in 1887 and is headquartered in New York City. The company’s products are sold in over 100 countries. Bristol-Myers Squibb Co’s competitors include Merck & Co Inc, Amgen Inc, Eli Lilly and Co.

– Merck & Co Inc ($NYSE:MRK)

Merck & Co Inc is a global health care company that offers a wide range of products and services to customers in more than 140 countries. The company has a market cap of 236.25B as of 2022 and a Return on Equity of 28.84%. Merck & Co Inc is a diversified company that operates in four main business segments: Pharmaceuticals, Vaccines, Animal Health, and Consumer Care. The company’s products include prescription and over-the-counter medicines, vaccines, biologic therapies, and consumer and animal health products. Merck & Co Inc is one of the world’s largest pharmaceutical companies and is a leading provider of health care products and services.

– Amgen Inc ($NASDAQ:AMGN)

Amgen Inc is a large biotechnology company with a market cap of 132.76B as of 2022. The company has a strong return on equity of 460.37%. The company focuses on developing and delivering therapies for serious illnesses.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a pharmaceutical company with a market cap of 312.88B as of 2022. Its return on equity is 45.88%. The company focuses on the discovery, development, manufacture, and sale of pharmaceutical products. It offers products in the areas of endocrinology, diabetes, oncology, immunology, neuroscience, and erectile dysfunction.

Summary

Bristol-Myers Squibb (BMS) is a long-term dividend growth investment that is currently trading near its 52-week low. The company has a record of consistently increasing dividends, and has maintained a healthy dividend yield of around 3%.

In addition, BMS has a good management team, ample liquidity, and promising growth prospects for the future. The company also has a solid balance sheet and a low debt-to-equity ratio. Analysts expect BMS to continue delivering strong earnings and cash flows in the future. Therefore, investors looking for a dividend income should consider investing in BMS.

Recent Posts