Biogen Warns of Increased Risk of Intracerebral Hemorrhage with Alzheimer’s Therapy Aduhelm.

February 20, 2023

Trending News 🌧️

Biogen Inc ($NASDAQ:BIIB)., a leading biotechnology company, recently announced that the FDA has included new information in the labeling for their Alzheimer’s therapy Aduhelm, which requires healthcare providers to warn patients about the potential risk of intracerebral hemorrhage. This risk is particularly high in those with ApoE ε4 homozygotes, and a test is available to determine this genotype. Despite this new warning, Biogen does not anticipate a decrease in sales, as Medicare and private insurers do not cover Aduhelm. They are committed to providing innovative therapies to help improve the lives of patients living with these conditions. Aduhelm is their first Alzheimer’s therapy, and has been shown to reduce amyloid plaque in patients with early-onset Alzheimer’s disease. The inclusion of the new intracerebral hemorrhage warning may lead to increased caution when prescribing Aduhelm, however, this will likely have minimal impact on sales due to the fact that it is not covered by insurance.

In addition, the risk of intracerebral hemorrhage may be considered a minor risk when compared to the potential benefits of the treatment. Overall, Biogen Inc. is committed to ensuring the safety of their patients and fulfilling their mission to provide innovative therapies for neurological and neurodegenerative diseases. They continue to work with the FDA and other healthcare professionals to provide accurate information about their products as well as to ensure that their treatments are safely used by patients.

Share Price

Biogen Inc., a leading biotechnology company, recently warned of increased risk of intracerebral hemorrhage with its Alzheimer’s therapy Aduhelm. With news coverage mostly negative, on Tuesday the company’s stock opened at $289.8 and closed at $289.1, down by 0.5% from the prior closing price of 290.5. The current FDA approval process for Aduhelm is based on two clinical trials that showed it had slowed cognitive decline among patients with Alzheimer’s disease. But the clinical trials did not assess the risk of intracerebral hemorrhage, which is associated with increased mortality and morbidity, or the risk of other adverse effects of the drug. While the FDA has not yet issued an official statement on the safety of Aduhelm, the agency did note in its release that it had no evidence to suggest that intracerebral hemorrhage was directly related to Aduhelm.

Nevertheless, the FDA has requested additional information from Biogen Inc. to investigate the risk further before making a final decision on its approval. Biogen Inc.’s response to the FDA’s request is a reminder of how important it is for companies to be aware of potential risks before beginning any drug development or clinical trial process. The company is now faced with the challenge of addressing the safety concerns raised by the FDA in order to move forward with Aduhelm’s approval. Investors are closely watching to see what actions Biogen Inc. takes to address these issues and potential risks before making any decisions about investing in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Biogen Inc. More…

| Total Revenues | Net Income | Net Margin |

| 10.17k | 3.05k | 23.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Biogen Inc. More…

| Operations | Investing | Financing |

| 1.38k | 1.58k | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Biogen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.55k | 11.17k | 93.04 |

Key Ratios Snapshot

Some of the financial key ratios for Biogen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.9% | -25.6% | 37.7% |

| FCF Margin | ROE | ROA |

| 11.2% | 18.3% | 9.8% |

Analysis

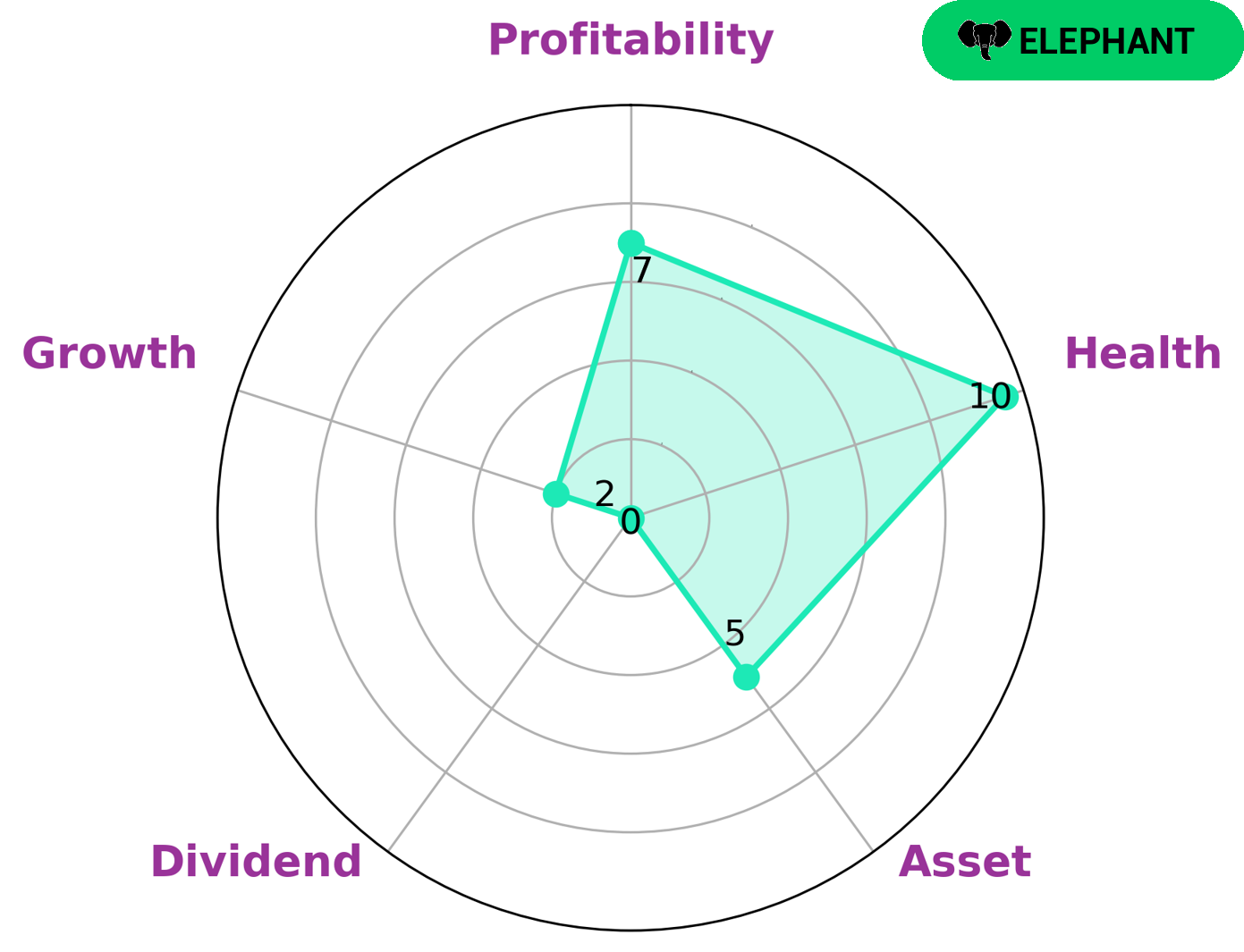

GoodWhale has performed an analysis of BIOGEN INC’s wellbeing using a Star Chart. According to the chart, BIOGEN INC is strong in profitability, medium in assets and weak in dividends and growth. The company is classified as an ‘elephant’, a type of firm that is rich in assets after deducting liabilities. This makes BIOGEN INC attractive to investors who are looking for a steady and long-term return on investments. Those investors who are looking for higher growth opportunities may not be as interested in the company. Additionally, BIOGEN INC has a very good health score of 10/10, which is based on its cashflows and debt. This implies that the company is well-positioned to sustain future operations even during times of crisis. Investors looking for the security of a relatively healthy firm will likely be interested in BIOGEN INC. Overall, based on GoodWhale’s analysis and Star Chart, BIOGEN INC is an attractive option for investors looking for long-term returns and stability. The company’s high health score and low risk profile make it an ideal choice for risk-averse investors. More…

Peers

In the biotechnology industry, Biogen Inc is up against some stiff competition from the likes of Eli Lilly and Co, Gilead Sciences Inc, and Intra-Cellular Therapies Inc. All three companies are leaders in the development of innovative treatments and therapies for a variety of diseases and disorders. Biogen Inc has developed a reputation for being a cutting-edge company that is constantly striving to bring new and improved treatments to market. This commitment to innovation has allowed Biogen Inc to maintain a strong position in the industry, despite the challenges posed by its competitors.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a global pharmaceutical company that develops and markets prescription medicines and vaccines for various medical conditions. The company’s market cap as of 2022 is 316.18B. Its return on equity (ROE) is 45.88%.

Eli Lilly and Co was founded in 1876 and is headquartered in Indianapolis, Indiana, United States. The company operates in more than 140 countries worldwide. Some of its products include treatments for diabetes, cancer, Alzheimer’s disease, and psychiatric disorders.

– Gilead Sciences Inc ($NASDAQ:GILD)

Gilead Sciences Inc is a research-based biopharmaceutical company that discovers, develops and commercialises innovative therapeutics. The company’s mission is to advance the care of patients suffering from life-threatening diseases. Gilead Sciences Inc has a market cap of 83.2B as of 2022 and a Return on Equity of 24.03%. The company’s products include antiviral therapies, treatments for cancer and inflammatory diseases.

– Intra-Cellular Therapies Inc ($NASDAQ:ITCI)

Intra-Cellular Therapies Inc is a clinical stage biopharmaceutical company that focuses on the development of drugs for the treatment of neuropsychiatric disorders. The company’s market cap as of 2022 was 4.47B, and its ROE was -42.76%. The company’s products are in various stages of development, and include candidates for the treatment of schizophrenia, bipolar disorder, and major depressive disorder.

Summary

Biogen Inc. (BIIB) is a biotechnology company that specializes in the development and commercialization of innovative therapies for neurological and neurodegenerative diseases. Recently, there has been increasing concern about the potential risk of intracerebral hemorrhage with the company’s Alzheimer’s therapy, Aduhelm. From an investing perspective, this news has caused the stock to decline and could be a cause of concern for investors.

Despite this, Biogen Inc. still has a robust pipeline of therapies, a strong financial position, and experienced management team. Investors should do their due diligence and decide if Biogen Inc. is still worth investing in or if the risk of the drug outweighs the potential reward.

Recent Posts