Biogen and Eisai’s Alzheimer’s Disease Therapy Lecanemab Receives Priority Review from China’s NMPA.

March 1, 2023

Trending News 🌥️

Biogen Inc ($NASDAQ:BIIB). and Eisai Co. recently announced that their biologics license application for their Alzheimer’s disease therapy, called lecanemab, has received a priority review from China’s National Medical Products Administration (NMPA). The application was submitted in December 2022 and successfully granted priority review status, which is likely to expedite the review process. Lecanemab is an anti-amyloid beta antibody that is meant to target and reduce amyloid beta plaques, which are believed to be a major cause of Alzheimer’s disease. By targeting these plaques, the drug could potentially help slow the progression of this devastating and debilitating condition.

If approved, lecanemab would become the first monoclonal antibody treatment for Alzheimer’s disease in China. Biogen and Eisai are hoping that this priority review will help expedite the approval process for lecanemab and make it available to patients with Alzheimer’s disease in China as soon as possible. This would be a major milestone for the companies, as well as for patients and their families who are hoping for a breakthrough treatment for this difficult condition.

Market Price

On Tuesday, the stocks of Biogen Inc opened at $267.8 and closed at $269.9, up by 0.2% from its previous closing price of $269.2. This comes after Biogen Inc, in collaboration with Eisai Co., Ltd., announced that their proposed therapy for Alzheimer’s Disease called “Lecanemab” has been accepted for Priority Review from China’s National Medical Products Administration (NMPA). This review status allows for potential expedited approval of the product in China, and is the first for any Alzheimer’s therapy reviewed by the NMPA.

If approved, Lecanemab would be the first and only anti-amyloid therapy available for the treatment of mild-to-moderate Alzheimer’s Disease in China. This news has also created optimism surrounding Biogen’s global reach as a leader in neurology innovation and care. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Biogen Inc. More…

| Total Revenues | Net Income | Net Margin |

| 10.17k | 3.05k | 23.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Biogen Inc. More…

| Operations | Investing | Financing |

| 1.38k | 1.58k | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Biogen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.55k | 11.17k | 93.04 |

Key Ratios Snapshot

Some of the financial key ratios for Biogen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.9% | -25.6% | 37.7% |

| FCF Margin | ROE | ROA |

| 11.2% | 18.3% | 9.8% |

Analysis

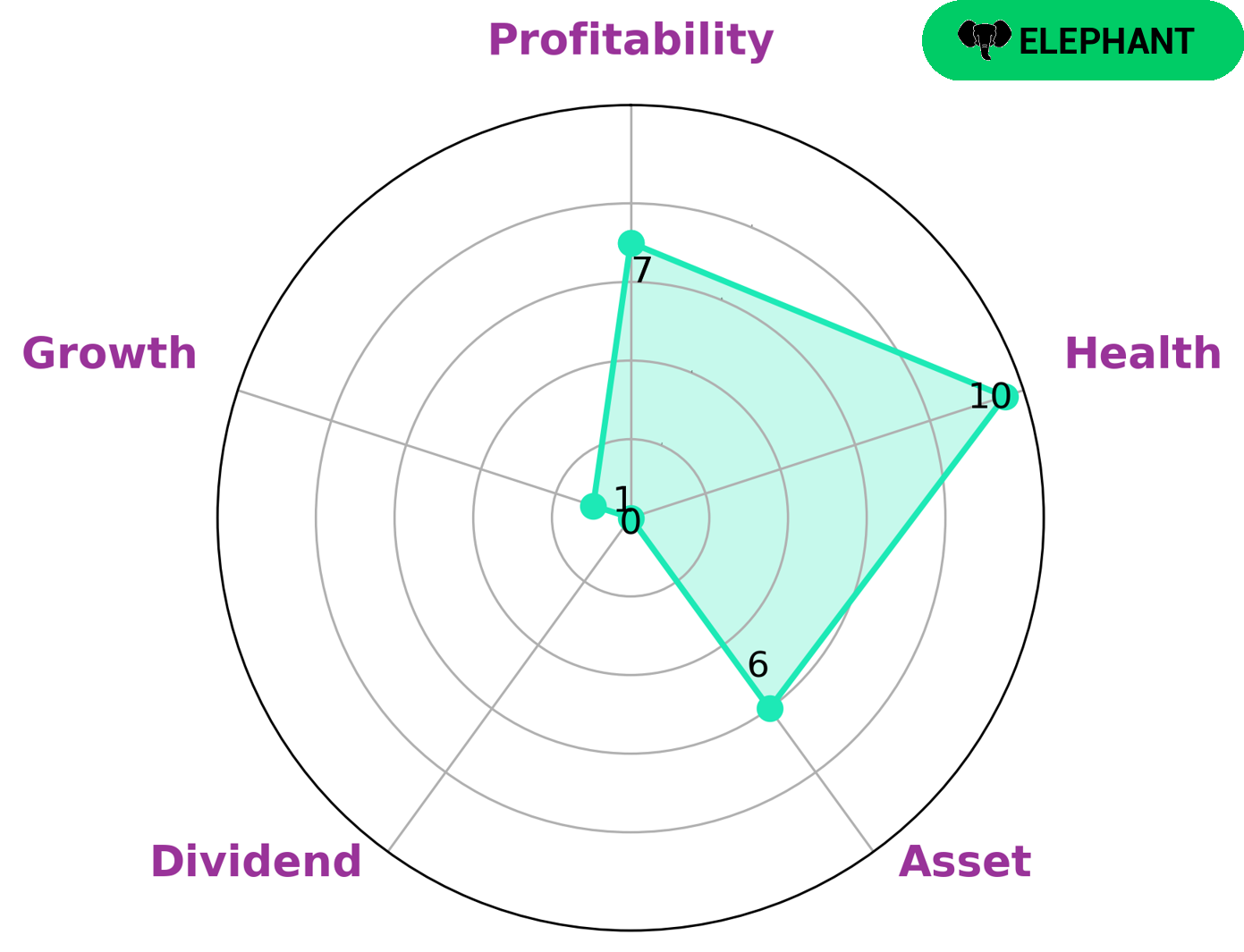

As GoodWhale, I have analysed BIOGEN INC‘s wellbeing and the results are quite interesting. To start with, the Star Chart shows that BIOGEN INC is strong in profitability, medium in asset and weak in dividend, growth. This puts BIOGEN INC in a unique category called ‘elephant’, which is a type of company that is rich in assets after deducting off liabilities. After further investigation, I was interested to find that BIOGEN INC has a high health score of 10/10 with regard to its cashflows and debt, indicating it is capable to safely ride out any crisis without the risk of bankruptcy. This should certainly pique the interest of investors seeking security and stability. On the other hand, those looking for a higher dividend or growth rate may not find what they are looking for with BIOGEN INC. More…

Peers

In the biotechnology industry, Biogen Inc is up against some stiff competition from the likes of Eli Lilly and Co, Gilead Sciences Inc, and Intra-Cellular Therapies Inc. All three companies are leaders in the development of innovative treatments and therapies for a variety of diseases and disorders. Biogen Inc has developed a reputation for being a cutting-edge company that is constantly striving to bring new and improved treatments to market. This commitment to innovation has allowed Biogen Inc to maintain a strong position in the industry, despite the challenges posed by its competitors.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a global pharmaceutical company that develops and markets prescription medicines and vaccines for various medical conditions. The company’s market cap as of 2022 is 316.18B. Its return on equity (ROE) is 45.88%.

Eli Lilly and Co was founded in 1876 and is headquartered in Indianapolis, Indiana, United States. The company operates in more than 140 countries worldwide. Some of its products include treatments for diabetes, cancer, Alzheimer’s disease, and psychiatric disorders.

– Gilead Sciences Inc ($NASDAQ:GILD)

Gilead Sciences Inc is a research-based biopharmaceutical company that discovers, develops and commercialises innovative therapeutics. The company’s mission is to advance the care of patients suffering from life-threatening diseases. Gilead Sciences Inc has a market cap of 83.2B as of 2022 and a Return on Equity of 24.03%. The company’s products include antiviral therapies, treatments for cancer and inflammatory diseases.

– Intra-Cellular Therapies Inc ($NASDAQ:ITCI)

Intra-Cellular Therapies Inc is a clinical stage biopharmaceutical company that focuses on the development of drugs for the treatment of neuropsychiatric disorders. The company’s market cap as of 2022 was 4.47B, and its ROE was -42.76%. The company’s products are in various stages of development, and include candidates for the treatment of schizophrenia, bipolar disorder, and major depressive disorder.

Summary

Biogen Inc. has seen strong investor interest due to the news that its Alzheimer’s Disease therapy, Lecanemab, has received Priority Review from China’s National Medical Products Administration (NMPA). This means that the drug’s approval process should be shorter than usual, providing investors with a potentially lucrative opportunity. Investors should consider the prospects of this drug on Biogen’s overall financial performance, as well as on its stock price. Analysts who track the stock expect the approval of Lecanemab to have a positive effect, although there are still some uncertainties surrounding its regulatory pathway.

Investors should also keep an eye on Biogen’s other products, such as Spinraza for treating spinal muscular atrophy and its multiple sclerosis portfolio. All these factors can help potential investors evaluate the potential returns that could be expected from Biogen, as well as deciding whether it is worth investing in the company.

Recent Posts