Amgen Inc Intrinsic Value – FTC Suit Against Horizon Deal Could Freeze Biotech M&A, Warns AMGEN

May 17, 2023

Trending News 🌧️

AMGEN ($NASDAQ:AMGN) Inc., a biopharmaceutical company based in Thousand Oaks, California, has warned that the potential for an FTC suit to be brought against the Horizon deal could have a chilling effect on the M&A activity within the biotechnology sector. The FTC has expressed concern that the merger of Cigna and Express Scripts could increase healthcare costs for consumers and restrict competition in the marketplace. Similarly, the potential for the same type of legal action against the Horizon deal has caused industry experts to worry about a possible slowdown in M&A activity within the biotechnology sector.

The fear is that if an FTC suit is brought against this proposed merger, then the legal action could have a ripple effect throughout the biotechnology industry where larger companies are seeking to acquire smaller firms in order to gain a competitive edge and strengthen their portfolios. This could have a negative impact on investment and growth in the sector, which would be detrimental to AMGEN Inc. and other biotechnology companies.

Market Price

On Tuesday, AMGEN Inc. saw a significant drop in stock prices, with its stock opening at $234.2 and closing at $227.9, down by 2.4% from prior closing price of 233.5. This was in response to US Federal Trade Commission’s lawsuit against Horizon Therapeutics’ proposed buyout of ailing biotech firm, Element Therapeutics, which has raised alarm within the biotech sector. AMGEN Inc. has warned that this lawsuit could potentially freeze biotech mergers and acquisitions (M&A) activity, as companies will be wary of potential legal issues. Companies may also be more cautious in evaluating potential targets for acquisitions, and scrutinizing the terms and conditions of any proposed deals more closely.

The lawsuit has also caused investors to reassess the value of biotech companies, leading to more volatility in stock prices. Overall, AMGEN Inc. has expressed concern that the FTC’s lawsuit could have a significant impact on the biotech M&A landscape, leading to a potential slowdown in the industry and further volatility in stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amgen Inc. More…

| Total Revenues | Net Income | Net Margin |

| 26.19k | 7.92k | 30.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amgen Inc. More…

| Operations | Investing | Financing |

| 8.62k | -4.58k | 20.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amgen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 88.72k | 83.37k | 10.01 |

Key Ratios Snapshot

Some of the financial key ratios for Amgen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | -2.0% | 41.1% |

| FCF Margin | ROE | ROA |

| 28.8% | 149.4% | 7.6% |

Analysis – Amgen Inc Intrinsic Value

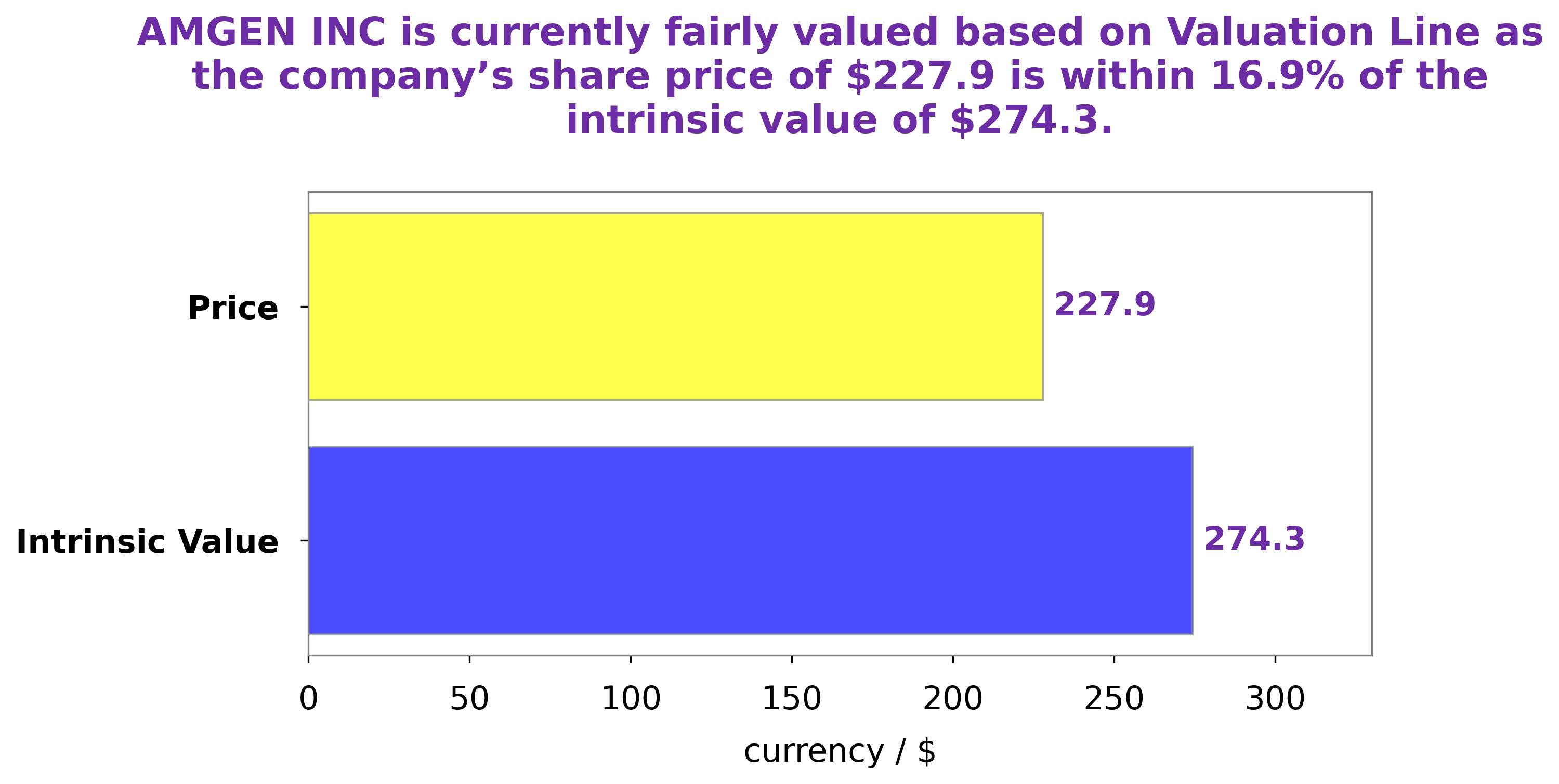

At GoodWhale, we recently conducted a financial analysis of AMGEN Inc. Our proprietary Valuation Line calculated the intrinsic value of an AMGEN Inc share to be around $274.3. Currently, AMGEN Inc shares are trading at $227.9. This price is fair, yet undervalued by 16.9%, making the stock an attractive option for those looking to enter this market. The Valuation Line offers a unique approach to assessing stock prices by combining fundamentals and technicals in a single graph. It is this combination that provides investors with a better picture of the stock’s overall performance and the true value of their investment. Investors looking for insight into the stock market should take a closer look at GoodWhale’s Valuation Line and the analysis of AMGEN Inc as it provides an accurate reflection of the company’s potential. More…

Peers

The competition between Amgen Inc and its competitors is fierce. Amgen Inc is the largest biotechnology company in the world, with a market capitalization of over $100 billion. Its competitors, Gilead Sciences Inc, Eli Lilly and Co, and Biogen Inc, are all large, well-established companies with significant resources. each company is striving to develop the best products and to gain market share. The competition is intense, and each company is working hard to win.

– Gilead Sciences Inc ($NASDAQ:GILD)

Gilead Sciences Inc is a biopharmaceutical company that focuses on the discovery, development, and commercialization of drugs. The company was founded in 1987 and is headquartered in Foster City, California. Gilead Sciences Inc has a market cap of 83.2B as of 2022, a Return on Equity of 24.03%. The company’s key products include HIV/AIDS treatment, hepatitis C treatment, and oncology products. Gilead Sciences Inc also has a pipeline of products in development for various indications, including HIV, hepatitis B, non-alcoholic steatohepatitis, and respiratory syncytial virus.

– Eli Lilly and Co ($NYSE:LLY)

Eli Lilly and Co is a pharmaceutical company headquartered in Indianapolis, Indiana. The company was founded in 1876 by Colonel Eli Lilly. The company develops and markets products in the areas of diabetes, oncology, immunology, neuroscience, and other areas. Lilly has operations in more than 60 countries and sells products in more than 125 countries. Lilly has been one of the world’s leading innovators in the pharmaceutical industry, with products such as Prozac, Zyprexa, and Cialis. The company has a market cap of 316.18B as of 2022 and a Return on Equity of 45.88%.

– Biogen Inc ($NASDAQ:BIIB)

Biogen Inc. is a global biotechnology company. The company is engaged in the discovery, development, manufacturing and commercialization of therapies for the treatment of neurodegenerative diseases, hematologic conditions and autoimmune diseases. Biogen has a market cap of $39.12B as of 2022 and a return on equity of 14.98%. The company’s products include aducanumab, a monoclonal antibody for the treatment of Alzheimer’s disease; SPINRAZA, a therapeutic agent for the treatment of spinal muscular atrophy; and TYSABRI, a monoclonal antibody for the treatment of multiple sclerosis.

Summary

AMGEN Inc. (NASDAQ: AMGN) is a biotechnology company focused on discovering, developing, manufacturing, and delivering innovative human therapeutics. It has a strong track record of providing strong returns for investors through a combination of stock appreciation, steady dividend increases, and share buybacks. AMGEN’s pipeline is packed with potential game-changing products, and its current product lineup continues to power the company’s growth and will likely lead to further increases in shareholder value in the years to come.

Recent Posts