Abbvie Inc Stock Fair Value Calculation – Abbvie Receives US Approval for Rinvoq to Treat Crohn’s Disease

May 20, 2023

Trending News ☀️

Abbvie Inc ($NYSE:ABBV). is a biopharmaceutical company headquartered in North Chicago, Illinois that specializes in developing and manufacturing drugs intended to combat complex and difficult-to-treat diseases. Recently, Abbvie has received US approval for Rinvoq, a new drug meant to treat Crohn’s Disease. Rinvoq, a Janus Kinase (JAK) inhibitor, is a pill taken once daily used to alleviate the symptoms of Crohn’s disease, an inflammatory bowel disorder. The medication helps reduce the inflammation in the digestive tract caused by the disease.

It will also provide a new treatment option for those living with Crohn’s disease who have not found relief with existing medications. Abbvie is optimistic about the potential of Rinvoq and has stated that the drug is expected to be available shortly.

Share Price

The news saw ABBVIE’s stock open at $142.6 and close at $143.4, up 0.1% from its prior closing price of $143.4. This is a positive development for the company as it continues to expand its portfolio of drugs and treatments. This approval expands the use of Rinvoq, which is already approved to treat moderate to severe rheumatoid arthritis, to include Crohn’s disease. This will be a new option for those suffering from this debilitating gastrointestinal disorder. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Abbvie Inc. More…

| Total Revenues | Net Income | Net Margin |

| 56.74k | 7.55k | 14.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Abbvie Inc. More…

| Operations | Investing | Financing |

| 24.94k | -623 | -24.8k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Abbvie Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 138.81k | 121.52k | 9.78 |

Key Ratios Snapshot

Some of the financial key ratios for Abbvie Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.5% | 6.9% | 23.2% |

| FCF Margin | ROE | ROA |

| 42.7% | 47.6% | 5.9% |

Analysis – Abbvie Inc Stock Fair Value Calculation

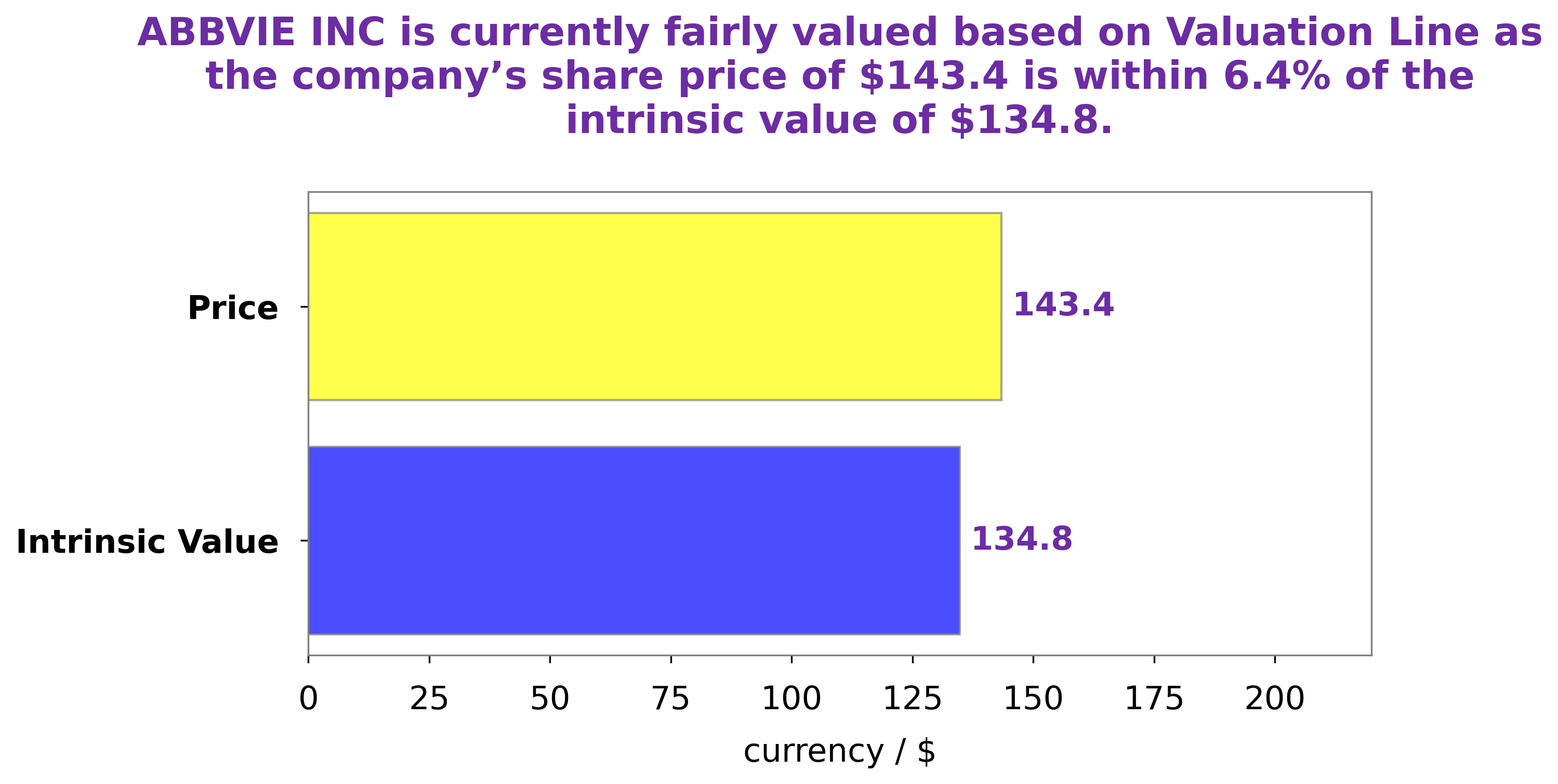

At GoodWhale, we have analyzed ABBVIE INC‘s financials to assess its value in the stock market. Our proprietary valuation line puts the fair value of ABBVIE INC share at around $134.8. Currently, ABBVIE INC’s stock is traded at $143.4, which is a fair price but overvalued by 6.4%. Therefore, investors should be aware that the current stock price may not be the best time to buy ABBVIE INC’s stock. More…

Peers

AbbVie Inc is a global, research-based biopharmaceutical company formed in 2013. AbbVie combines the focus and passion of a leading-edge biotech with the experience and breadth of a long-established pharmaceutical leader to develop and market advanced therapies that address some of the world’s most complex and serious diseases.

Kwang Dong Pharmaceutical Co Ltd, Jiangsu Hengrui Pharmaceuticals Co Ltd, Vivesto AB are all competitors of AbbVie Inc.

– Kwang Dong Pharmaceutical Co Ltd ($KOSE:009290)

Kwang Dong Pharmaceutical Co Ltd is a South Korean company that manufactures and sells pharmaceutical products. The company has a market cap of 233.75 billion as of 2022 and a return on equity of 19.33%. Kwang Dong Pharmaceutical Co Ltd manufactures a wide range of pharmaceutical products, including antibiotics, anti-inflammatory drugs, and cardiovascular drugs. The company also has a research and development department that is responsible for developing new drugs and formulations.

– Jiangsu Hengrui Pharmaceuticals Co Ltd ($SHSE:600276)

Jiangsu Hengrui Pharmaceutical Co., Ltd. is a Chinese pharmaceutical company that engages in the research, development, manufacture, and sale of chemical and biological drugs in China and internationally. The company has a market cap of 248.78 billion as of 2022 and a return on equity of 6.72%. Jiangsu Hengrui Pharmaceutical Co., Ltd. is headquartered in Lianyungang, China.

– Vivesto AB ($OTCPK:OASMY)

Vivesto AB is a Swedish company that provides financial technology solutions. The company has a market capitalization of 32.61 million as of 2022 and a return on equity of -9.39%. Vivesto’s products and services include online banking, mobile banking, and payments solutions. The company serves retail, corporate, and institutional clients.

Summary

ABBVIE Inc is a global pharmaceutical company with a focus on developing and commercializing innovative pharmaceutical products. In recent developments, the company has gained FDA approval for the use of its drug, Rinvoq, to treat Crohn’s Disease in the United States. For investors, ABBVIE is a potentially attractive stock to consider buying as the company has strong financials and a solid pipeline of products in development.

In addition, ABBVIE offers a dividend yield of approximately 4%. Furthermore, analysts rate ABBVIE as a buy due to its strong balance sheet and potential for further growth. With the Rinvoq approval, ABBVIE now has the opportunity to increase its share of the Crohn’s Disease market, which could drive further revenue growth for the company.

Recent Posts