Winmate Inc dividend yield calculator – Winmate Inc Announces 5.0 Cash Dividend to Shareholders

June 12, 2023

🌥️Dividends Yield

On June 2 2023, Winmate Inc ($TWSE:3416) announced that they will be offering a 5.0 cash dividend to their shareholders. This marks an increase from the previous three years, where they have declared annual dividends per share of 4.5 TWD, 4.5 TWD, and 4.0 TWD which had dividend yields of 5.79%, 5.79%, and 5.33% respectively. The average dividend yield for the past three years is 5.64%. If you are looking for a reliable stock which offers dividends, Winmate Inc could be worth considering. The ex-dividend date for the cash dividend is June 30 2023. Investors who buy the stock before that date will be eligible to receive the dividend.

However, investors should also consider that the dividend yield may change anytime, and it might not remain at 5.64% in the future. Therefore, investors should evaluate their own risk appetite before investing in the stock and make sure it aligns with their investment goals.

Market Price

The announcement sent the stock price of the company to open at NT$116.5 and close at NT$115.5, down by 0.4% from the prior closing price of 116.0. The company is optimistic that the dividend will be well received by its shareholders, given the fact that it has been steadily expanding in to new markets and increasing its market share. It is expected that this dividend will provide an additional incentive for investors to buy into WINMATE INC and help the company grow further. Live Quote…

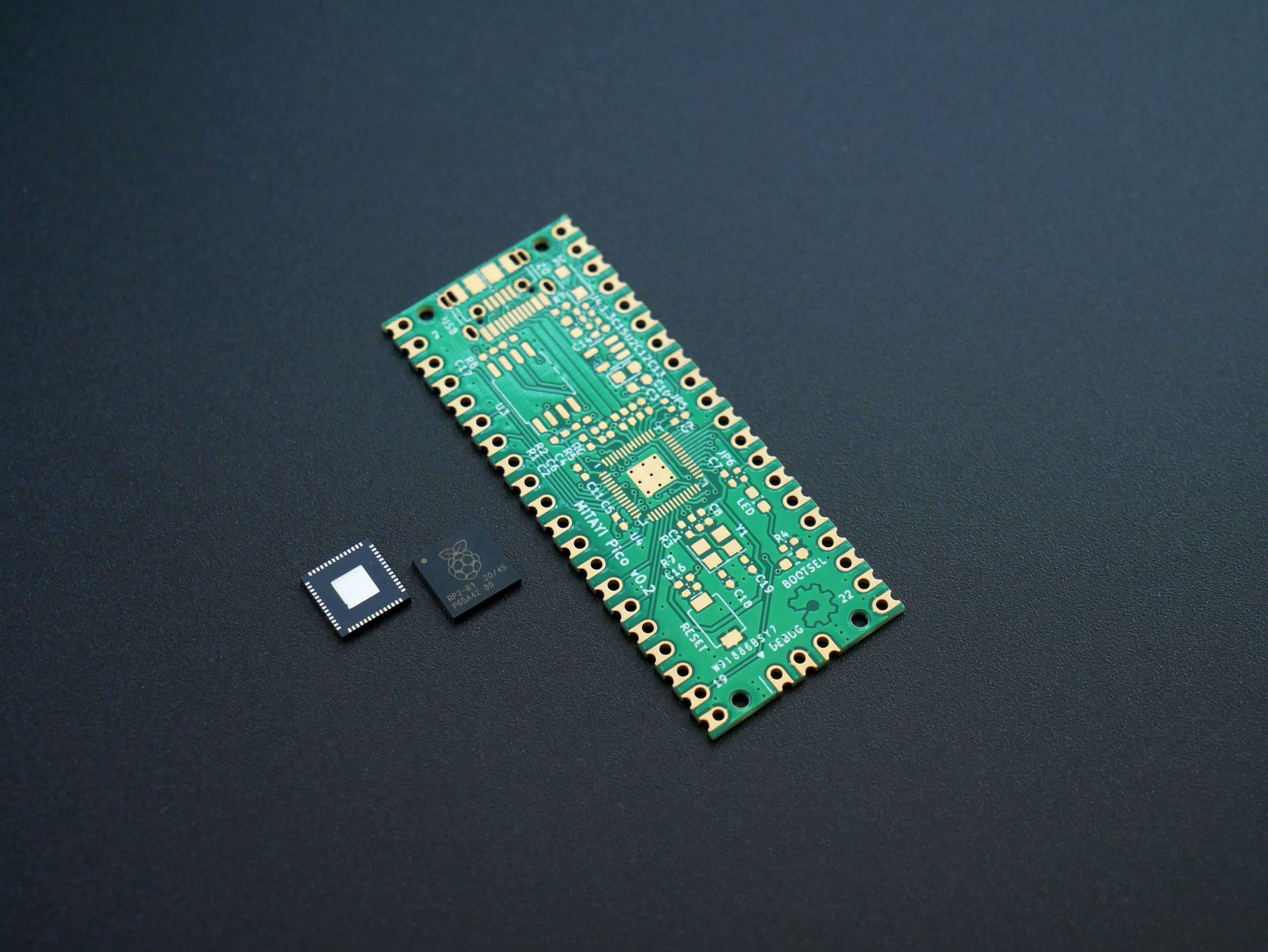

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Winmate Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.7k | 476.3 | 17.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Winmate Inc. More…

| Operations | Investing | Financing |

| 642.1 | -86.26 | -329.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Winmate Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.71k | 1.18k | 34.69 |

Key Ratios Snapshot

Some of the financial key ratios for Winmate Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.7% | 27.2% | 22.2% |

| FCF Margin | ROE | ROA |

| 17.3% | 14.8% | 10.1% |

Analysis

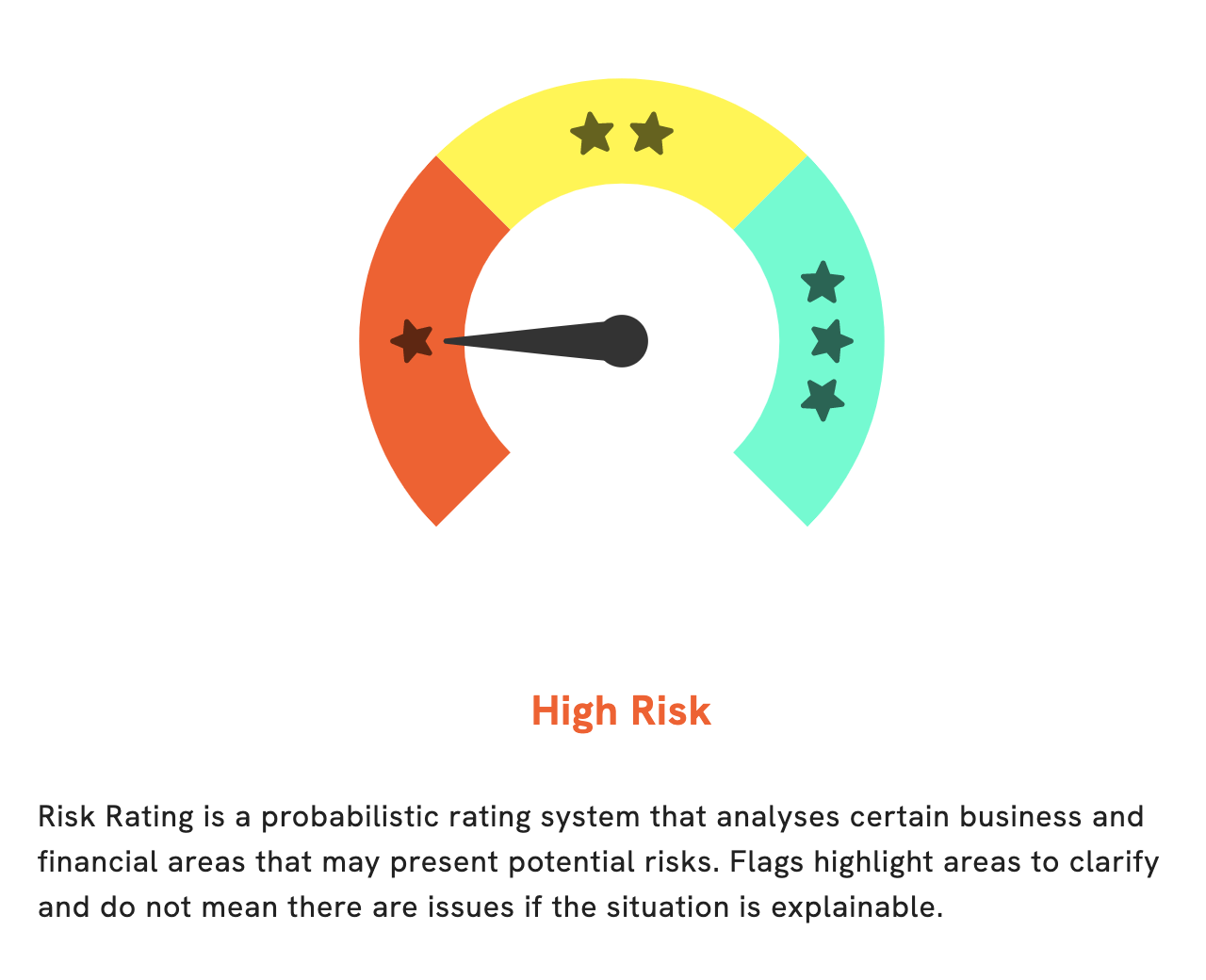

At GoodWhale, we recently conducted an analysis on the financial and business wellbeing of WINMATE INC. After taking into consideration various factors, our Risk Rating determined that WINMATE INC is a high-risk investment. We detected two risk warnings in their income and balance sheet, and if you would like to take a closer look at these warnings, you may register with us. This analysis is essential for any investor considering WINMATE INC, and it can help them make an informed decision. More…

Peers

Winmate Inc is one of the leading industrial computing solution providers in the market, offering a range of high-performance products and services. It competes closely with other major players such as TES Touch Embedded Solutions (Xiamen) Co Ltd, Advantech Co Ltd, and Gettop Acoustic Co Ltd. These companies are leading the way in terms of innovation and product quality, offering competitive solutions for businesses of all sizes.

– TES Touch Embedded Solutions (Xiamen) Co Ltd ($SZSE:003019)

Touch Embedded Solutions (Xiamen) Co Ltd, also known as TES, is a leading provider of embedded software and hardware solutions for the electronics industry. The company has a market capitalization of 3.36 billion US dollars as of 2023, making it one of the larger companies in its industry. Its Return on Equity (ROE) is 12.47%, which marks an improvement upon previous years. This suggests the company is using its shareholders’ investments wisely to generate higher returns. The company focuses on providing custom solutions to customers across various industries, such as automotive, medical, industrial control, and communications. TES’s products and services are designed to meet the needs of customers, ensuring that they are able to keep up with the pace of technological advancement.

– Advantech Co Ltd ($TWSE:2395)

Advantech Co Ltd is a global leader in providing integrated solutions in the fields of automation, embedded computing and intelligent systems. The company has a market capitalization of 315.29B as of 2023 and a Return on Equity (ROE) of 21.05%. This signifies the strong financial performance of the company, and the good returns it provides to its shareholders. Advantech’s solutions are used in a wide array of industries including medical, industrial, automotive, and retail. The company has grown significantly over the last few years and continues to be a global leader in innovative solutions for the industries it serves.

– Gettop Acoustic Co Ltd ($SZSE:002655)

Gettop Acoustic Co Ltd is a Chinese company that specializes in acoustic components and solutions. The company is publicly traded on the Chinese stock exchange and has a market cap of 4.61B as of 2023. Gettop Acoustic Co Ltd also has a Return on Equity of 4.95%. This indicates that the company is performing well in terms of generating returns on the equity invested in it. Gettop Acoustic Co Ltd offers products such as speakers, receivers, amplifiers, sound systems, and other related audio components and solutions. The company has a strong customer base, with both large corporate entities and individual consumers relying on it for their acoustic needs.

Summary

Investing in WINMATE INC can be a worthwhile venture for investors looking for a stable dividend yield. In the past three years, WINMATE INC has consistently declared a dividend per share of 4.5 TWD and 4.0 TWD, yielding 5.79% and 5.33%, respectively. Consequently, the average dividend yield is 5.64%, making it a relatively safe and consistent investment option.

Furthermore, the dividend payments remain consistent over time, providing a steady stream of income that can be used to reinvest in WINMATE INC’s stocks. Investors should be aware that investing in WINMATE INC requires careful consideration and a thorough understanding of the company’s financial situation.

Recent Posts