Whitehaven Coal dividend calculator – Whitehaven Coal Ltd to Pay Record 2023 Dividend to Shareholders Today!

March 19, 2023

Trending News 🌧️

Today is a momentous day for Whitehaven Coal ($ASX:WHC) Ltd shareholders, as the company has announced that it will pay a record 2023 dividend – known as the Whopper Whitehaven Dividend – to its shareholders. This is the largest share of profits ever paid out by the company, and is sure to be welcomed by all shareholders. Whitehaven Coal Ltd is one of the largest coal producers in Australia and has been in operation for over twenty years. The company’s focus has been on meeting the increasing demand for coal for energy production and for export. The Whopper Whitehaven Dividend will be paid out in two instalments, with the first being paid out today.

This is the highest dividend that Whitehaven Coal Ltd has ever paid out, and is sure to be well received by shareholders. The Whopper Whitehaven Dividend is a testament to the success of Whitehaven Coal Ltd and its ability to generate substantial profits for its shareholders. This is an exciting time for shareholders of Whitehaven Coal Ltd as they receive their record dividend payments today.

Dividends – Whitehaven Coal dividend calculator

Today, Whitehaven Coal Ltd announced that it will pay a record dividend of 0.48 AUD per share to its shareholders, according to its financial results for the 2022 and 2023 financial years! This is an impressive 8.88% dividend yield for the year 2022 and 2.65% for the year 2023. Therefore, the average dividend yield for the two-year period is 5.76%. If you are looking for dividend stocks, Whitehaven Coal Ltd may be worth adding to your list of considerations.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Whitehaven Coal. More…

| Total Revenues | Net Income | Net Margin |

| 7.29k | 3.39k | 46.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Whitehaven Coal. More…

| Operations | Investing | Financing |

| 4.55k | -232.86 | -1.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Whitehaven Coal. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.71k | 2.66k | 5.68 |

Key Ratios Snapshot

Some of the financial key ratios for Whitehaven Coal are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.3% | 116.2% | 66.8% |

| FCF Margin | ROE | ROA |

| 59.6% | 65.7% | 39.5% |

Stock Price

Today, WHITEHAVEN COAL Ltd announced its plan to pay out a record dividend to its shareholders. This dividend, which is set to be paid out in 2023, is expected to be the highest dividend payout ever for the company. This news saw WHITEHAVEN COAL’s stock open on Friday at AU$7.3 and close at AU$7.1, a decrease of 3.9% from last closing price of 7.4.

The dividend payout is seen as a sign of the company’s continued commitment to rewarding its shareholders and creating value for them. Investors will be keenly watching the development of WHITEHAVEN COAL in the coming years to see if it can maintain its position as a reliable dividend-payer in the future. Live Quote…

Analysis

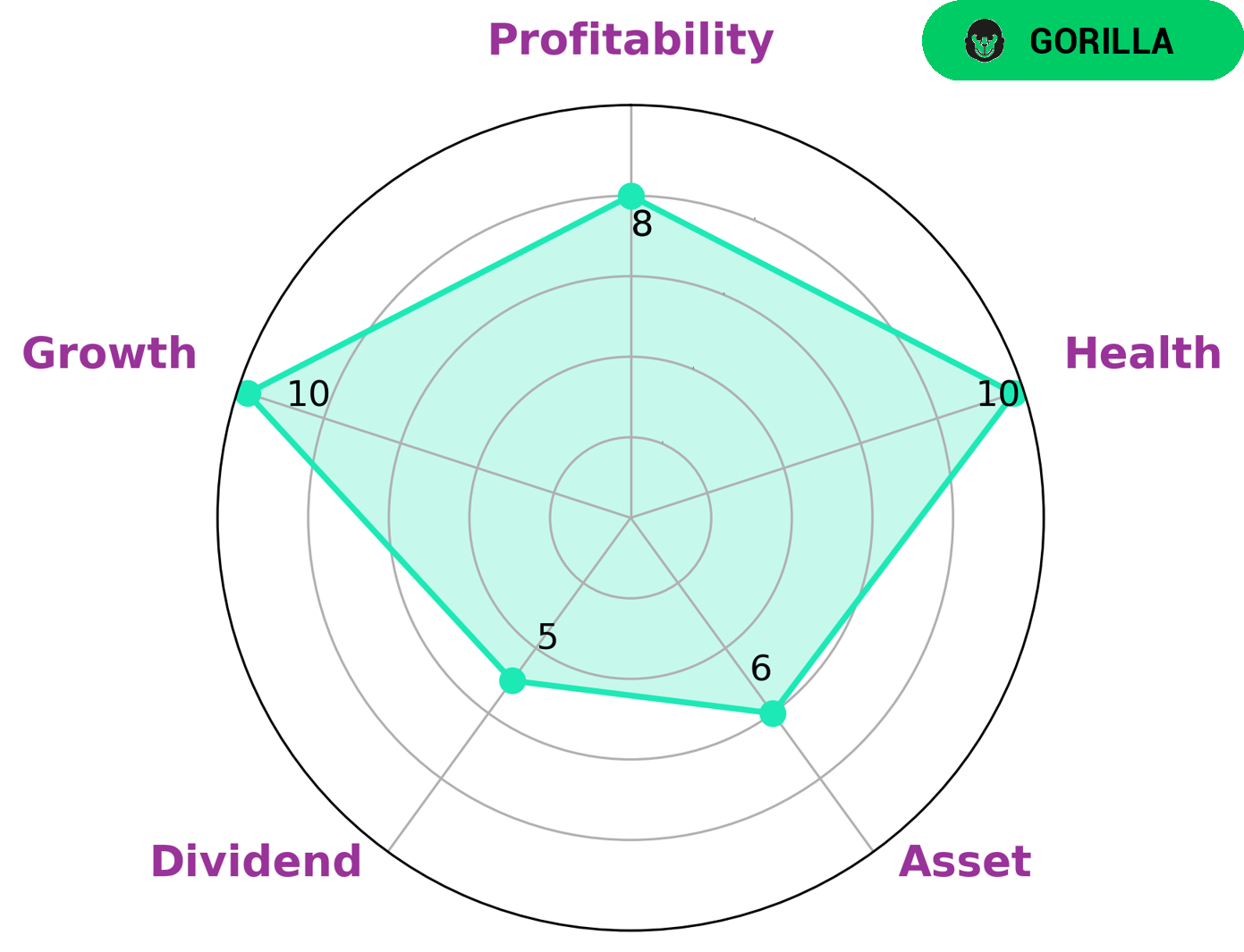

GoodWhale analyzed the financials of WHITEHAVEN COAL and based on our Star Chart, it is classified as a ‘gorilla’ – a type of company that has achieved both stable and high revenue or earning growth due to their strong competitive advantage. This is an attractive prospect for investors who are looking for a reliable, well-performing investment. Moreover, WHITEHAVEN COAL has a high health score of 10/10 with regard to its cashflows and debt – meaning it is capable of paying off debt and funding future operations with ease. This is an added bonus for potential investors as it provides assurance that their investments will be safeguarded for the long-term. Furthermore, WHITEHAVEN COAL is strong in growth and profitability; medium in asset; and low in dividend which indicates that investors may be more likely to reap more capital gains than dividends from this company. All in all, investors looking for a reliable, long-term investment should consider WHITEHAVEN COAL as it exhibits strong financial health and competitive advantages that can guarantee returns. More…

Peers

Whitehaven Coal Ltd is one of the major players in the coal industry and is fiercely competing with its competitors – New Hope Corp Ltd, China Shenhua Energy Co Ltd and Guizhou Panjiang Refined Coal Co Ltd – to gain market share. As the demand for coal continues to rise, these companies are engaged in a fierce battle to become the top supplier in the industry.

– New Hope Corp Ltd ($ASX:NHC)

New Hope Corporation Limited is an Australian-based coal mining and energy company. The company engages in the production, transport, and sale of coal and related products. As of 2022, the market capitalization of New Hope Corporation Limited is 5.76 billion dollars. The company’s returns on equity (ROE) stands at 41.11%, indicating that the company is generating a high return on its invested capital. New Hope Corporation Limited is well-positioned to benefit from the increasing demand for energy resources, as it is one of the largest coal producers in Australia.

– China Shenhua Energy Co Ltd ($SHSE:601088)

China Shenhua Energy Co Ltd is a state-owned coal-based energy company with a market cap of 525.32B as of 2022. The company operates in both the production and sale of coal, railway transportation and power generation sectors. The company boasts a Return on Equity of 16.69%, indicating a strong performance and ability to generate returns from shareholders’ investments. China Shenhua Energy Co Ltd is one of the largest coal producers in China and is the world’s largest integrated coal-based energy company.

– Guizhou Panjiang Refined Coal Co Ltd ($SHSE:600395)

Guizhou Panjiang Refined Coal Co Ltd is a China-based company that produces and sells refined coal products in Mainland China. The company has an impressive market capitalization of 14.64 billion as of 2022, which reflects investor confidence in the company’s prospects and its ability to generate returns. Additionally, the company boasts an impressive Return on Equity (ROE) of 15.96%, which is indicative of the company’s ability to generate profits from its existing assets. The company has achieved considerable success in its operations, and is well-positioned to capitalize on future growth opportunities.

Summary

Whitehaven Coal Ltd, an Australian coal mining company, announced on date that it will pay a record dividend of 2023 to shareholders. Although this news is favorable to investors, the stock price of Whitehaven Coal fell on the same day. This could possibly be due to investors selling the stock after the news was released, expecting a price drop. It is important for any investor looking to buy Whitehaven Coal stocks to do their own research and make sure they understand the company’s financial position and any risks associated with investing.

Furthermore, investors should consider factors such as the price of coal, demand and supply of coal, and the overall economy before making their investment decision. The dividend may be a sign of strong financials, but it is best to remain cautious.

Recent Posts