Welspun Corp dividend yield – Welspun Corp Ltd Declares 5.0 Cash Dividend

June 9, 2023

🌥️Dividends Yield

On June 1, 2023, Welspun Corp ($BSE:532144) Ltd declared a 5.0 cash dividend for its shareholders. This is the third year in a row that the company has issued a 5.0 INR per share dividend, giving investors an average dividend yield of 2.28%. This makes WELSPUN CORP a great option for those looking for a dividend stock as there will be an ex-dividend date of June 16, 2023. The stable dividend payments and the relatively high yield make WELSPUN CORP an attractive pick for dividend investors.

Price History

The news saw the company’s stock surged up by 3.0% from the previous closing price of 252.6, to open at 254.6 and close at 260.2. The dividend payout of 5.0% is seen as a welcome move by investors. The company is expecting a positive response to the announcement as it seeks to bolster its market position; a move that could potentially increase investor confidence and spur higher trading volumes in its stocks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Welspun Corp. More…

| Total Revenues | Net Income | Net Margin |

| 97.58k | 2.07k | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Welspun Corp. More…

| Operations | Investing | Financing |

| -1.85k | -4.17k | 9.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Welspun Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 153.39k | 104.95k | 167.15 |

Key Ratios Snapshot

Some of the financial key ratios for Welspun Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | -44.0% | 5.9% |

| FCF Margin | ROE | ROA |

| -14.1% | 7.9% | 2.4% |

Analysis

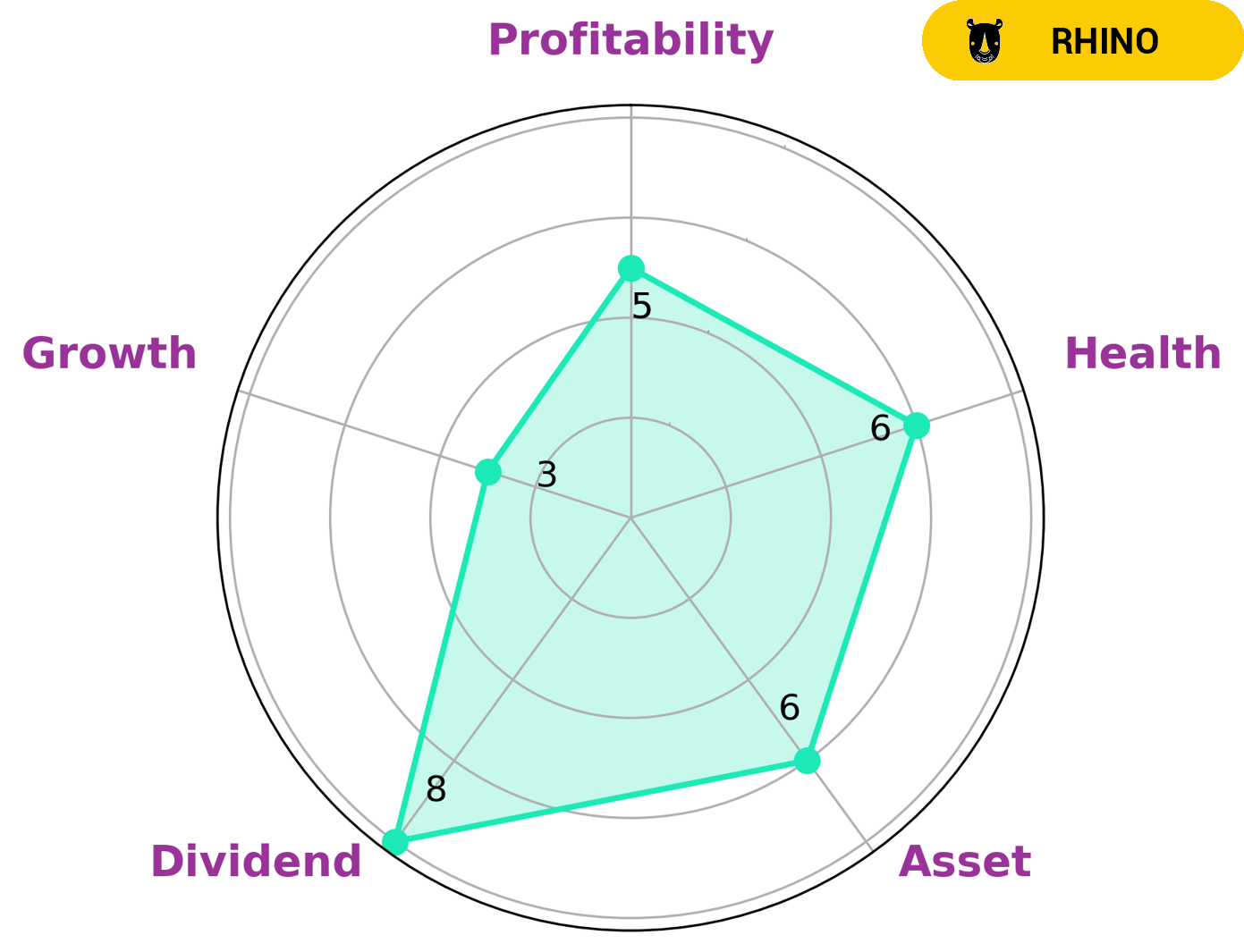

GoodWhale has conducted an in-depth analysis of WELSPUN CORP‘s fundamentals. Based on our Star Chart, WELSPUN CORP has an intermediate health score of 6/10 with regard to its cashflows and debt structure, suggesting that it is likely to remain resilient and ride out any crisis without the risk of bankruptcy. We further find that WELSPUN CORP is strong in dividend payments, medium in asset performance, and profitability, and weak in revenue and earnings growth. Based on these criteria, we classify WELSPUN CORP as a ‘rhino’ type of company, which generally have achieved moderate revenue or earnings growth. Given these characteristics, we conclude that WELSPUN CORP is likely to be attractive to investors focused on steady dividend payments in the short to medium term while maintaining a moderate-risk/moderate-return profile. Investors looking for rapid growth would be best served by looking elsewhere. More…

Peers

The competition between Welspun Corp Ltd and its competitors Suga Steel Co Ltd, Citic Pacific Special Steel Group Co Ltd, and Venus Pipes & Tubes Ltd is fierce and growing. All four companies strive to be the leader in the steel industry, offering innovative products and services to their customers. They are constantly looking to improve their processes and products, while competing on cost and quality. No matter which company emerges as the leader in the industry, one thing is for sure: the competition between these four companies will continue to be strong.

– Suga Steel Co Ltd ($TSE:3448)

Suga Steel Co Ltd is a leading producer of steel and metal products. It has a market capitalization of 4.2 billion as of 2023 and offers investors a return on equity of 26.51%. This high return on equity indicates that the company is effectively utilizing its capital and generating profits for its shareholders. The market cap of the company reflects the faith of investors in its ability to continue delivering strong returns. In addition, the company’s efficient operations and strong performance have enabled it to remain competitive in the industry and maintain its large market share.

– Citic Pacific Special Steel Group Co Ltd ($SZSE:000708)

Citic Pacific Special Steel Group Co Ltd is one of the leading steel producers in China. It has a market cap of 77.88 billion US Dollars as of 2023 and a Return on Equity of 14.17%. The company produces a diverse range of steel products including steel bars, plates, wire rods, sections, and strips. It also provides services such as hot rolling, cold rolling, and galvanizing. The company has a vast market share in the Chinese steel market, and its large market cap reflects its financial strength and stability. Its impressive ROE of 14.17% indicates its consistent financial health.

– Venus Pipes & Tubes Ltd ($BSE:543528)

Venus Pipes & Tubes Ltd is a leading manufacturer and supplier of high-quality pipes and tubes for the industrial and engineering sectors. With a market capitalization of 22.38 billion as of 2023, the company has seen significant growth since its inception in 1993. It has an impressive Return on Equity (ROE) of 14.0%, which is an indication of the company’s strong financial performance. The company’s products are renowned for their superior quality and durability, making them a preferred choice for many key industries and other users.

Summary

Welspun Corp is an attractive investment opportunity for investors looking for a steady dividend income. It has a consistent track record of paying out 5 INR per share annually for the past three years, which translates to an average dividend yield of 2.28%. The company’s strong financial performance over the years suggests that it is well-positioned to continue delivering robust returns to shareholders. Analysts expect the stock to be able to sustain its dividend payout rate in the near future, making it an ideal choice for long-term investors.

The company also has a relatively low debt-equity ratio, suggesting that it is well-equipped to manage any financial challenges it may face in the future. With its consistent dividend payouts and strong fundamentals, Welspun Corp is an ideal investment prospect.

Recent Posts